Market Turns Attention to Jobs, Looking for Clues to Fed Policy

Stocks are under pressure this morning on news of a major shake-up in Portugal's government, escalating turmoil in Egypt, and more softness in Chinese manufacturing data. On the homefront, encouraging jobs data is helping to lift the tide. Weekly jobless claims fell 5,000 to 343,000 and the ADP employment report showed better-than-expected 188,000 private sector payrolls added last month, versus an expected gain of 160,000.

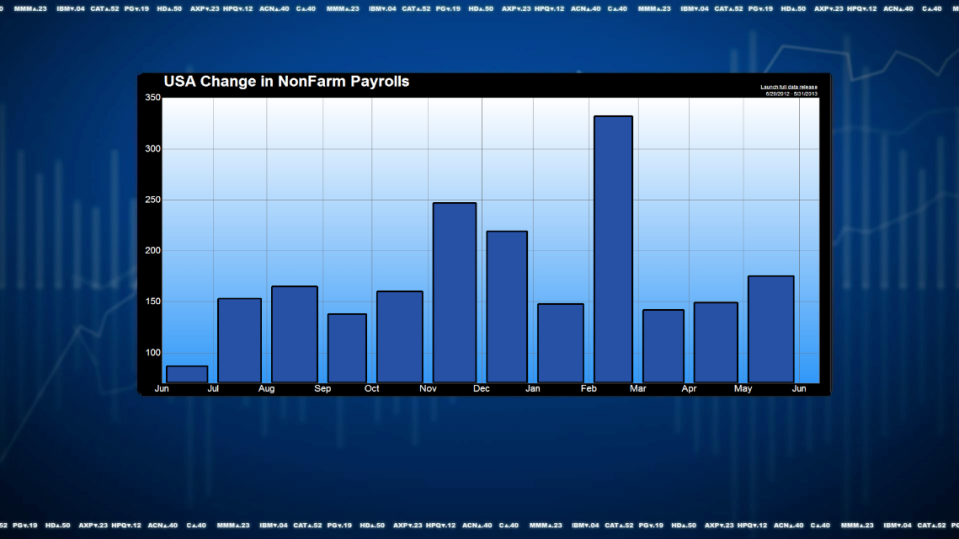

The data comes ahead of the critical Labor Department jobs report to be released at the end of the week. Consensus estimates are for 155,000 non-farm payrolls added in June versus 175,000 in May. The unemployment rate is projected to tick down to 7.5% from 7.6%.

“One of my biggest fears is that we’re going to get a four percent print on GDP and a 300,000 non-farm payroll number, which would cause the Federal Reserve to take the punch bowl away,” says Jeff Saut, chief investment strategist at Raymond James. “But I don’t think we’re going to get that in the near-term, I think the numbers will continue to grind marginally higher.”

That being the case, Saut believes the Fed-fueled sell-off in late June and spike in volatility across equity and bond markets was an overreaction, and expects the Fed to hold steady on policy through the remainder of the year. He says it’s one of the few instances when he’s agreed with well-known bearish economic Nouriel Roubini.

In Saut’s view, Bernanke’s June statement and comments made in his press conference were clear as could be –that quantitative easing reduction is completely data-dependent.

But after the taper tantrum, it became pretty clear that jitters about scaling back QE will continue to impact stocks.

“It wasn’t just this market,” Saut points out, “the emerging markets (EEM), frontier markets (FRN) got hit. Europe got hit, Japan got hit. On that May 22nd downside reversal day, where we made that print high at 1,687.18 on the S&P 500, it sure seemed like it was a lynchpin announcement by the Fed. But again, if you parse what he [Bernanke] said, he said ‘it was going to be data-dependent.’”

Since then the market has been more reactionary to economic data, but mostly in the context of how it will impact Fed policy. Hence the latest financial market debate: Is good news bad news? Or have we calmed enough to realize that good news truly is good news?

At least in the near-term, Saut believes good news should be taken as such, expecting a goldilocks scenario to unfold.

“I think it’s [Jobs data] going to come in not too soft and not too strong; I think it’s going to come in just right,” he states confidently. “I think it’s going to allow the Fed to continue to do $85 billion a month in purchases. I don’t think they’re going to do anything, in fact he [Bernanke] was pretty clear on not doing anything in terms of raising interest rates in the short-run, the bond market vigilantes have pretty much done that for him. I think that’s over on a short-term basis.”

We’ll see how data-dependent we are on Friday morning with the release of the June jobs report at 8:30am/est.

More from Breakout:

The Company Steve Jobs Would’ve Bought