Candy Crush Saga Could Be Far Better IPO Story Than Zynga

The publisher of the world's most addictive mobile game, Candy Crush Saga, is going public, stirring memories of one of the worst IPOs of all time: Zynga's (ZNGA) 2011 debut.

But, although both companies are in the online and mobile gaming business, King has a different profile and a different business model — one that looks much more sustainable over the long term.

The London-based King has reportedly filed a confidential IPO registration statement with the U.S. Securities and Exchange Commission, The Telegraph reported late Thursday. Using the same tactic as social network Twitter, King is keeping the filing secret until just before starting its investor roadshow, typically about a month before a deal is priced. Assuming the market remains stable, pricing could come in the next few months.

Zynga went public at $11 a share in December 2011. But a series of disappointments and missteps pummeled the shares, which now trade at $3.71, off 66% from the IPO.

To be sure, investors have yet to see King's detailed financial disclosures. Thus, there is no way to gauge whether the reported $5 billion valuation (Zynga currently has a $3 billion market cap) is sensible or insane. But there are several reasons why the company could be a better investment than Zynga.

Go mobile

Zynga's top games ran on top of Facebook's (FB) application platform, making the company vulnerable to the social network's policy whims. Sure enough, last year Facebook changed its algorithms in a way that made it harder for users to find Zynga games such as FarmVille. The number of Facebook users on FarmVille dropped from 80 million in March 2012 to 20 million by mid-year, Appdata reported. Revenue and profits plunged along with Zynga's stock price.

King puts its games on Facebook but is also the leading publisher of games on mobile phones and tablets. Candy Crush is the top grossing game in Google's (GOOG) Android Play store in 26 countries, including the United States, India and Mexico, according to NewZoo. And it's on top in 19 countries in Apple's (AAPL) iPhone iTunes store. A follow-on game, Pet Rescue Saga, also ranks in the top 10.

Zynga, which recently hired Don Mattrick from Microsoft as CEO, has no top-grossing apps in the top 10 on iTunes. And while mobile users now make up about 30% of its total customers, up from under 10% a year ago, that's mostly due to massive declines in its Facebook business.

King’s mobile business strategy remains solid and stable – put free games in the app stores, encourage players to spend in-game for treats and cheats, and pay a share of revenue back to the store owners.

Totally addictive

King's games are built around a host of psychologically derived features designed to keep users playing — and paying. Colors, patterns, and timing of rewards and challenges encourage players to stay on for just one more level and pony up cash at regular intervals.

Many Zynga games are less scientifically crafted, based instead on traditionally popular games in the real world such as poker, Scrabble, crossword puzzles and charades. That means they are not only less addictive but are also easier to copy. Zynga's once popular online poker app, for example, has been dinged by copycats.

Not just the guys

Videogaming has come a long way from the hardcore teenagers shooting up enemies on their XBoxes. King and Zynga have both capitalized on the trend toward more-casual gaming and away from games that run only on high-powered, specialized consoles.

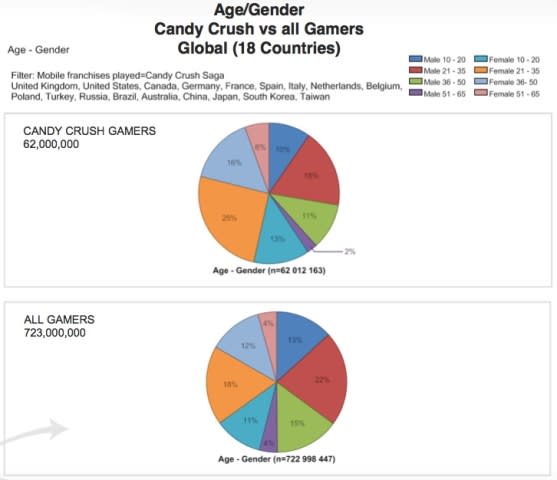

But King may have cracked the code to reach a broader range of casual gamers playing on phones and tablets. Unlike even most casual games, Candy Crush is more popular with woman than men. About 60% of players are women, versus 45% of all mobile gamers in major markets, according to NewZoo.

It’s too soon to decide whether King’s IPO is a must-buy or a total avoid. But it’s also not something to ignore just because another gaming company sank like a stone.

To keep up with all the latest tech industry news, follow Aaron Pressman on Twitter and Tumblr.

Check out more Yahoo! Finance content here on Tumblr.