Olin to Fill in a Piece of the Gun Demand Picture

Olin (OLN), the owner of one of the best-known firearms brands in the world, will be posting its fourth-quarter results after the bell Monday. This will be its first financials since the national gun-control debate reached a pitch not heard in years.

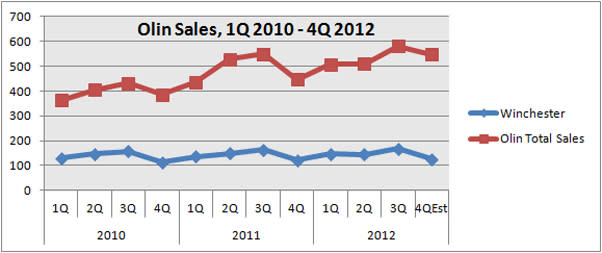

The Clayton, Mo., company oversees Winchester ammunition and trademarks on long guns, and it's expected to report earnings of 35 cents a share on sales of $546.6 million for the final quarter of 2012. Beyond those numbers, what should be more telling are any details Olin may provide with regard to Winchester, specifically about the unit's performance since the quarter ended and what it foresees for the months ahead.

Source: Olin

Following the December shooting at Sandy Hook Elementary in Newtown, Conn., gun-control advocates went on the offensive, calling for stricter laws about the types of firearms that could be sold in the U.S. and to whom. Gun-rights supporters have fought back hard, saying that the Constitution governs citizens' firearm ownership and that any laws to dilute the Second Amendment can't be allowed to proceed.

[Read Related Piece: Businesses React to Newtown Tragedy]

Anecdotal evidence and emotional exchanges on both sides of the argument have been flooding the media since Sandy Hook, but hard numbers on sales for firearms and accessories haven't been as common. One data point, however, has come from the FBI, which said a record 2.8 million background checks were performed in December. These checks generally cover those submitted by federally licensed gun dealers, but wouldn't account for all person-to-person or used firearm sales.

Olin is up about 8.5% since the Newtown school shooting, and its shares are near a 52-week high (according to FactSet, the stock's all-time was was $32.55 in November 1997). We don't know yet what Olin will say about the performance of its Winchester division in the past month and a half, but it should provide at least some quantitative sense of demand for firearms and cartridges of late, and perhaps also into the near future. After Newtown, Olin had only about two weeks left in its fourth quarter. The company will hold a conference call Tuesday morning to review its results.

Winchester as a percentage of Olin's overall sales is expected to be at its lowest level in at least three years, if analyst estimates are correct. In the fourth quarter, analysts estimate Winchester had revenue of $126.8 million. The larger part of Olin makes chlorine and caustic soda, and it recently bought KA Steel Chemicals, making that segment of the company an even larger piece of overall sales. And Winchester is only one brand among many sold across the nation. Outside of cartridges, it's not a player in handguns, a significant component of the firearms industry (Winchester arms are produced outside the company under license from Olin).

So no matter what happens with Olin and Winchester, it has to be stressed that this week's report will be only one sample of the overall picture for the firearms market -- an important part, potentially, but again just one.

Source: Olin

Alliant Techsystems (ATK), an aerospace and defense company that also makes shooting products for consumers, including Weaver scopes and Federal Premium ammunition, will report its quarterly data the first week of February. Firearms manufacturers Smith & Wesson (SWHC) and Sturm Ruger (RGR) are still a few weeks away from disclosing their earnings.