These 2 'Hated' Stocks Might Be The Best Rebound Candidates of 2014

It's been hard to lose money in the market in 2013. But anyone unlucky enough to own the worst-performing stocks among the various S&P indices (400, 500 and 600) has to be less than displeased.

In my first look at 2013's losers earlier this week, I reviewed the carnage among commodity producers and retailers. This time around, I'm looking at the rest of the 2013 laggards in search of the best rebound candidates.

I took a look at the factors affecting these stocks, and to be sure, many of them should still be avoided.

Among the "don't bother" names:

• Cincinnati Bell (NYSE: CBB), which is on the wrong end of the sweeping changes in the wireline and wireless telecom industry.

• Strayer Education (Nasdaq: STRA), a for-profit educator that is posting falling sales and profits in the face of staff layoffs and school closures.

[More from StreetAuthority.com: Buy This Game-Changing Stock's Pullback For 50% Upside]

• Rackspace Holding (NYSE: RAX), as price cuts from cloud storage rivals such as Google (Nasdaq: GOOG) ratchet up the pressure. Similar competitive pressures will likely dog Teradata (NYSE: TDC) in 2014 as well.

Among the remaining stocks on that table, some have huge upside but carry high risks, while other represent more modest upside but with lower risk.

Insurer Tower Group (Nasdaq: TWGP), which has fallen 75% this year, is a high-risk/high-reward play. While most insurance firms expend a great deal of energy analyzing their risk exposure and capital allocation strategies, Tower Group's management seemed downright reckless.

In the second quarter, this company had to write down more than $5 a share worth of assets, due largely to weak financial controls in place over the past few years. As a result, Tower has been working with its lenders to keep from getting its loans called in. Why any investor would invest alongside a management team like that is anyone's guess.

But this management team may not be sticking around much longer, and the underlying assets of the business could be worth considerably more than the current share price suggests. And how that plays out depends on the company's next moves. Tower has conceded the need to raise fresh funds, either through asset sales (a potential positive) or a through a capital raise (a potential negative).

So where is the value? Well, even after the write-downs, tangible book value stands above $7 a share, or nearly double the current share price. Tower has been working with J.P. Morgan since early October to identify potential options, and asset sales appear almost inevitable. When that happens, the debt risk will fall, and shares may trade back toward tangible book value. The best-case scenario: The entire company is sold, and a different management team takes the reins.

[More from StreetAuthority.com: Profit From International Growth With These Unloved U.S. Blue-Chip Stocks]

Short sellers are betting that an easy fix won't happen. The short interest just spiked another 700,000 shares to 11.6 million, representing 21% of the trading float.

An E-Commerce Star Stalls Out

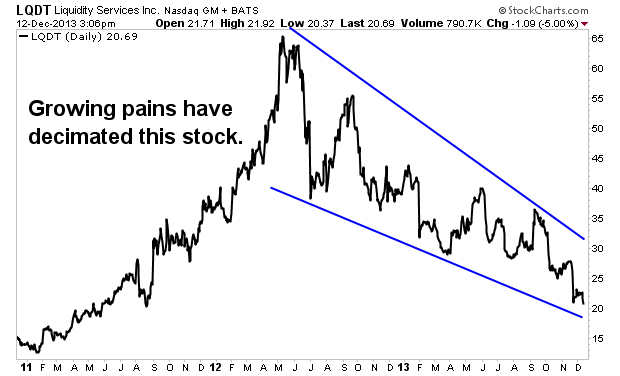

Helping companies sell their surplus assets through a Web portal would be a seemingly attractive business. And Liquidity Services (Nasdaq: LQDT) has become a leading player: Its sales surged from $220 million in fiscal 2009 to $475 million by fiscal 2012, which helped push shares north of $60. But growth has since slowed sharply, and investors have been selling for more than a year.

The key culprit: customer concentration. Wal-Mart (NYSE: WMT) and the U.S. Department of Defense had become huge customers, yet these two behemoths have had less surplus equipment to buy and sell in recent quarters.

And analysts don't spy a quick rebound. Sales are likely to be flat in the current fiscal year, and perhaps rise at a 5% to 8% pace in fiscal 2015 as well. Per-share profits appear to be stuck in a $1.60 to $1.75 range.

[More from StreetAuthority.com: Which Of This Year's 'Dogs' Can Bounce Back in 2014?]

Yet it's too soon to think that this company has already hit its peak in terms of business activity. The company's various sites should still benefit in a firming economy, as companies step up their rate of asset purchases, while still looking for bargains in the used goods market.

I'm intrigued by a statement from CEO Bill Angrick in a recent press release: "We are excited by the numerous related opportunities to create value for our buyers and clients by delivering supply-chain efficiencies, protecting their brands and providing technology-enabled services to better compete in an increasingly complex environment." CEOs have to sound bullish, but you can envision how the right tweaks to Liquidity Services' various websites enhance its sales proposition.

To be sure, this company has built the critical mass of buyers and sellers (with that $500 million revenue base to back it up), and the deployment of more tools for buyers and sellers may just what this business model needs to grow to the next level. I don't see much downside for this stock in light of that low price-to-earnings multiple, and could envision 30% to 50% upside in 2014 if sales and profit forecasts stop falling and start to march higher again.

Risks to Consider: Not all of these stocks have hit bottom, and even the stocks that do have solid upside must convince an increasingly dubious set of investors that has already been badly burned.

Action to Take --> It's often shrewd to focus on hated stocks. Emotional selling may have pushed them to even lower levels than any intrinsic value suggests, as appears to be the case with both Towers Group and Liquidity Services.

Related Articles