3 India ETFs Rising Back to Health

Despite a tepid market, India country-specific exchange traded funds stood out Thursday after strong earnings among top companies fueled optimism for further growth in the emerging economy.

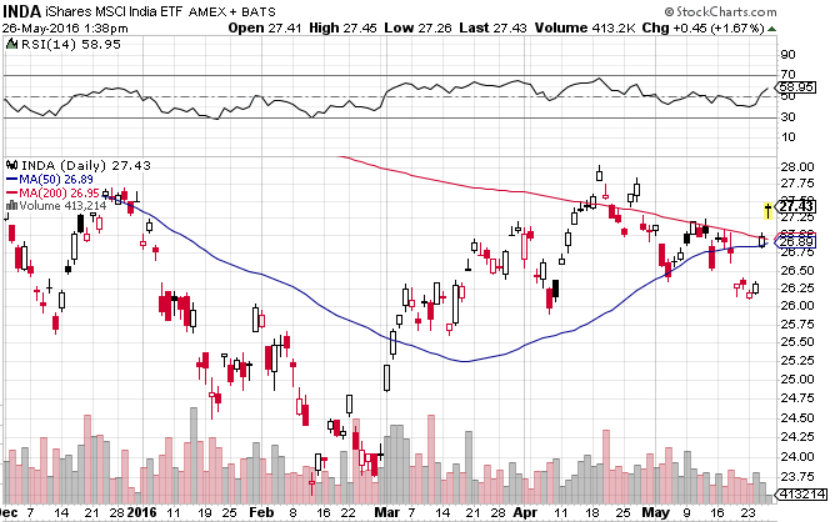

On Thursday, the iShares MSCI India ETF (INDA) rose 1.7%, PowerShares India Portfolio (PIN) gained 1.3% and WisdomTree India Earnings ETF (EPI) increased 1.6%. All three funds are now trading above their 50- and 200-day simple moving averages.

Indian equities rallied after Larsen & Toubro Ltd. (LT), the most-valuable engineering company, surged 13.9%, the most in seven years, after announcing quarterly profits beat estimates, reports Rajhkumar K Shaaw for Bloomberg.

Related: India ETFs Surge After $12.9bn Budget Proposal

“Larsen is a proxy for other investments as it signals first-level development happening in the economy,” Deven Choksey, managing director of K.R. Choksey Shares & Securities Ltd., told Bloomberg.

Larsen & Toubro makes up 2.1% of INDA’s underlying portfolio, 0.8% of EPI and 1.1% of PIN.

Trending on ETF Trends

Energy Loan Woes Weigh on Financial ETFs

9 Reasons Why You Should Be Investing in Short-Term Munis

How an ETF Can Add Benefits in Real Asset Investing

Waning ETF Confidence in Metal Miners Sector

Nigeria ETF Surging on Central Bank Forex Relief

Indian corporate earnings are rebounding after declining four of the past five quarters, the worst performance since the financial crisis. So far, thirteen of 23, or 57%, of Sensex companies have revealed better or matching results to estimates.

“Better-than-expected earnings, buoyant global markets and a favorable outlook on the monsoon led to the rally,” Prateek Agrawal, chief investment officer at ASK Investment Managers Pvt., told Bloomberg. “People are expecting the earnings trajectory to improve this fiscal year and beyond.”

Related: India ETFs Could Regain EM Leadership Role

The agricultural sector could enjoy increased rains as showers in the June to September season are expected to be 109% of the mean of 35 inches, the highest since 1994 and more than the 105% previously predicted, according to Skymet Weather Services Pvt.

“Monsoon is one major positive sentiment driver and global markets are also looking calm,” Rikesh Parikh, vice-president of equities at Motilal Oswal Securities, told TheHinduBusinessLine.

For more information on India, visit our India category .

iShares MSCI India ETF