5 Questions Tesla Analysts Want to Ask Elon Musk Ahead of Earnings Report

This much is certain about Tesla Inc.’s earnings report on Wednesday: It won’t be boring.

The electric-car maker will release its first set of results since Elon Musk grew exasperated with questions, including whether the company needed more capital, back in May. The chief executive officer cut off several analysts’ questions, invited a YouTube host who owned a small number of shares to engage in a 23-minute exchange, then advised investors wary of volatility or worried about the short term to stay away from Tesla stock.

One quarter later, analysts are speculating not only on the magnitude of Tesla’s latest loss and cash burn, but also on whether Musk strikes a patient or petulant tone. “We expect a more measured Elon Musk on the earnings call,” said Gene Munster of Loup Ventures, who warned that a repeat performance would spur “a material loss of investor confidence.”

Here are some queries that may run the risk of being labeled “boring, bonehead questions” again by Musk:

1. Are you really sure you’ve got enough capital?

Musk has ruled out the need to sell new shares or bonds this year, insisting that Tesla will be able to fund itself as it manufactures more Model 3 sedans. He tweeted in April that he expected Tesla to be profitable and cash-flow positive in the third and fourth quarters, “so obv no need to raise money,” and has reiterated this since.

Analysts are likely to press the CEO on if he can afford to stay so adamant. On average, they predict Tesla will report about $900 million in negative free cash flow for the second quarter, according to data compiled by Bloomberg. That’s after burning through at least $1 billion in three of the previous four quarters left the company with a $2.7 billion cash balance at the end of March.

Bloomberg Intelligence credit analyst Joel Levington has estimated Tesla will need at least a $2 billion infusion this year, while Jeff Osborne of Cowen expects a $2.5 billion convertible debt offering in the fourth quarter.

Looking ahead, Musk has a long laundry list of expensive future projects, including building factories in China and Europe and bringing out new vehicles such as the Semi truck, Roadster sports car and Model Y crossover. Goldman Sachs’s David Tamberrino projects the company could end up having to raise $10 billion by 2020.

Read more: Tesla is said to weigh Chinese funding for $5 billion factory

2. Can you keep picking up the production pace with Model 3?

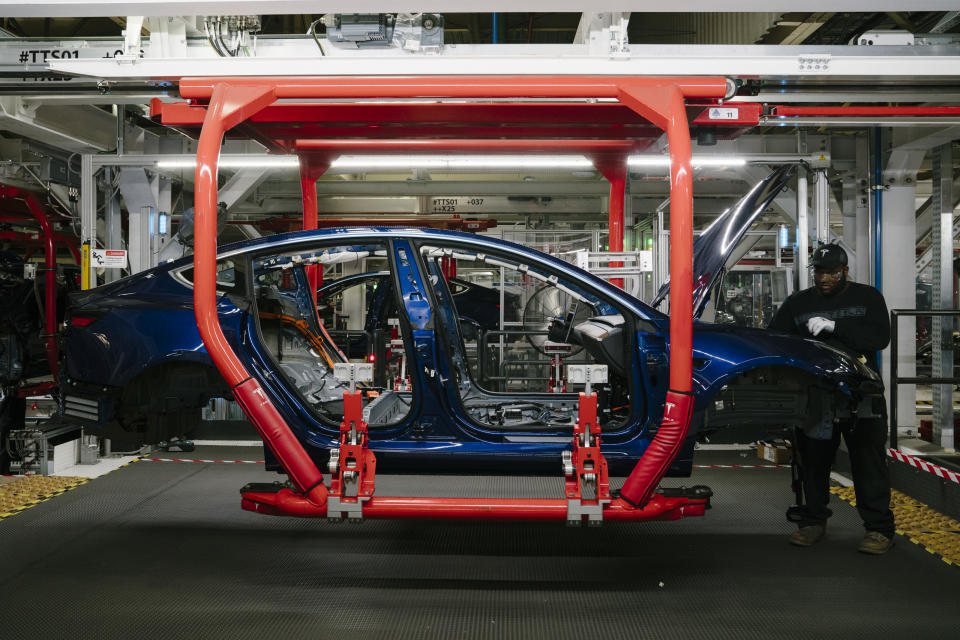

Tesla managed to manufacture more than 5,000 Model 3s in the final week of June, thanks to Hail Mary heroics. The company flew in a production line from Germany on a cargo plane, adopted an around-the-clock schedule and erected a massive tent in the parking lot of its assembly plant to boost output. It expects to make 6,000 Model 3s a week by late August.

“Further understanding of where Model 3 production sits today is the number one priority for most investors,” Evercore ISI analysts George Galliers and Arndt Ellinghorst wrote in a report. “Investors want to know what the steady rate is today and when that ramps to 5,000 units a week. It would also be helpful to know the milestones and cash requirements to get to 10,000 units a week.”

Bloomberg’s Model 3 tracker suggests the company hasn’t been able to sustain its end-of-quarter burst rate of 5,000 a week. According to the model, which estimates production using two data sets of vehicle identification numbers, the average weekly rate since July 1 has fallen just short of 4,000.

An update on Model 3 production “could be the most important factor” in the earnings release, Robert W. Baird analyst Ben Kallo said in a note to clients. “We continue to believe Tesla may have a higher sustainable rate of production than many expect and think management commentary could be a positive catalyst.”

3. Just how profitable are those sedans?

Another metric that’s become the subject of much speculation is the gross margin Tesla is making with the Model 3, a measure of the revenue that the company retains after costs associated with producing it.

The company has been delivering more expensive versions of the vehicle, with a much-hyped $35,000 base model still not in production. But pulling out all the stops to make those cars may have been costly. CNBC reported Tuesday that the company has been flying in employees from out of state to staff up its vehicle and battery assembly lines and putting those workers up in hotels.

“Manufacturing margin on Model 3 is the key driver for Tesla to reaching positive operating cash flow,” Oppenheimer analyst Colin Rusch wrote in a report. Results will be driven by labor costs, rework expense and what share of production and deliveries are the priciest iterations, he said, warning that the company “currently has an abnormally high level of hands-on activity for the Model 3.”

Tesla makes components such as seats itself instead of purchasing them from suppliers, a move Consumer Edge analyst James Albertine predicts will start to pay off. “As the Model 3 scales, these in-sourcing decisions will reap significant margin benefits on the path to 25 percent or higher Model 3 gross margins,” he wrote in a report.

4. Is your service operation in need of repair?

Tesla owns and operates all of its delivery and service centers, eschewing traditional dealerships. As its customer base grows, those operations are showing signs of strain, particularly in key markets like Norway.

It’s also unclear who’s in charge of shoring up service efforts following a series of senior management departures and Musk’s reorganization of the company.

Jon McNeill, who was president of sales and service, left Tesla in February and is now the COO at Lyft. Karim Bousta, vice president of worldwide service and customer experience, also departed for the ride-hailing company. Musk announced in June that Tesla would dismiss 9 percent of the workforce, and service representatives and technicians were among those cut.

5. How’s Model 3 demand holding up?

In July, Tesla said that its “remaining net Model 3 reservations count” was about 420,000 at the end of the previous month.

Then, just a couple weeks after inviting all Model 3 reservation holders in the U.S. and Canada to configure their car, the company opened up the flood gates. It made the ordering process available even to those who hadn’t put down the $1,000 deposits that it began taking from would-be customers in March 2016.

The moves raised questions about the state of the queue and demand. Tesla crossed the 200,000 cumulative U.S. vehicle sales threshold in July, meaning that in 2019 customers will no longer be eligible for the full $7,500 federal tax credit toward electric-car purchases.

“We believe a clear conversation around the composition of the demand for the different version of the vehicle would benefit investors greatly,” Cowen’s Osborne said.

Just the Numbers

2Q adjusted loss per share estimate $2.90 (range loss/share $2.19 to $3.52) 2Q revenue estimate $3.97 billion (range $3.49 billion to $4.39 billion) 2Q adjusted automotive gross margin estimate +16% 3Q adjusted automotive gross margin estimate +17.6% 3Q capital expenditure estimate $754 million (range $500 million to $903 million)

Data

Tesla has 10 buys, 11 holds, and 11 sell ratings. The average analyst price target is $312, according to data compiled by Bloomberg. Implied 1-day share move following earnings is 9% Shares fell following seven of the 12 prior earnings announcements Adjusted EPS beat estimates in seven of past 12 quarters

Timing

Earnings release scheduled for Aug. 1 after market close Conference call website