Alibaba Lifts China Internet ETF Ahead of Singles’ Day

China’s Singles’ Day, that country’s equivalent of a shopping holiday that mixes Cyber Monday with a dash of anti-Valentine’s Day sentiment, arrives on Tuesday Nov. 11.

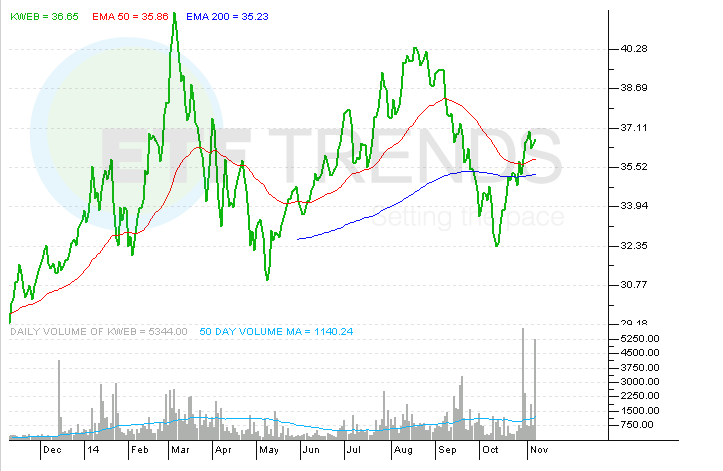

Amid expectations that single Chinese men will attempt to soothe their lonely status with ramped up online shopping, shares of Alibaba (BABA) and the KraneShares CSI China Internet Fund (KWEB) , the exchange traded fund with the largest weight to Alibaba, are rallying Monday.

KWEB is up 2.6% on volume that is already more than double the daily average while Alibaba, China’s largest e-commerce company, is higher by 2.4% on heavy volume after earlier touching a new all-time high. Alibaba has surged nearly 38% over the past month while Amazon (AMZN), one of the U.S. companies Alibaba is most often compared to, has traded lower. KWEB is up 16.5% over that period. [Alibaba ETFs Crush Amazon Counterparts]

The Singles’ Day catalyst is legitimate. Last year, Alibaba generated nearly $5.8 billion in Singles Day sales. Analysts are forecasting that number could be as high as $8 billion this year.

“If Alibaba has the same revenue growth for Singles’ Day this year that it had in the third quarter (53%), Singles’ Day revenue could be $8.7 billion. I think it will be $8.5 billion,” said Big Tree Capital’s Kevin Carter in an interview with ETF Trends.

California-based Big Tree is introducing the Emerging Markets Internet & Ecommerce Index (EMQQI) later this week. That index is designed to give investors exposure to the fast-growing emerging markets e-commerce and Internet companies that are often left out of traditional benchmarks tracking developing world equities.

Alibaba is EMQQI’s largest holding with a weight of 8%, according to issuer data.

Although Alibaba is by far the largest Chinese e-commerce company, there are plenty of other U.S.-listed companies that stand to benefit from a potential surge in Singles’ Day spending. Baidu (BIDU), China’s largest Internet search provider, JD.com (JD) and Vipshop Holdings (VIPS) could all get a lift from increased Singles’ Day spending. [Vipshop Boosts These ETFs]

Those stocks have already been bid up in advance of Singles’ Day, so much so that JD.com is the worst performer over the past month with a gain of 10.6%. Vipshop and Baidu are up 44% and 23.2%, respectively, over that period.

KWEB allocates over 20% of its combined weight to Baidu, JD.com and Vipshop. Big Tree’s Emerging Markets Internet & Ecommerce Index devotes 17.5% of its weight to those stocks.

There is no denying the potency (and growth) of Singles’ Day. “Five hundred million packages are expected to be delivered between Tuesday and Sunday, a near 50 percent on-year increase,” CNBC reports, citing Barclays.

Alibaba, which is now larger than all but six public companies trading in the U.S., said more than $2 billion was settled through Alipay on Alibaba’s China and international retail marketplaces within the first hour and 12 seconds of Single’s Day.

KraneShares CSI China Internet Fund

Todd Shriber owns shares of Alibaba.