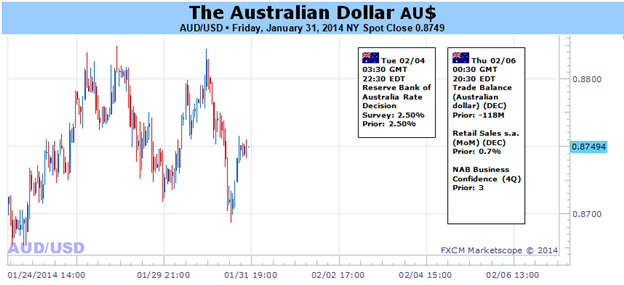

Australian Dollar Outlook Clouded Ahead of Critical Event Risk

Fundamental Forecast for Australian Dollar: Neutral

RBA Rate Decision on Tap Domestically, Policy Statement in the Spotlight

Impact of US Data on QE Taper Bets, EM-Driven Risk Aversion Also Critical

Help Time Key Turning Points for the Australian Dollar with DailyFX SSI

The Australian Dollar faces a perfect storm of fundamental event risk in the week ahead, with major trend-defining developments on the domestic and the external front. That makes for a clouded outlook in the week ahead, with the presence of sharp seesaw volatility shaping up to be the only thing that can be deduced with confidence.

First, the Reserve Bank of Australia (RBA) is due to deliver its monthly policy announcement. Economists forecast that policymakers will keep the baseline lending rate unchanged at 2.5 percent. Investors seem to agree, with priced-in expectations (as tracked by Credit Suisse) showing a mere 6 percent probability of rate cut and no policy changes over the coming 12 months.

That puts the spotlight on the statement accompanying the announcement. Australian economic news-flow began to dramatically deteriorate relative to expectations in January; if this translates into a dovish turn in official rhetoric, the Aussie seems likely to find itself under pressure. The year-on-year CPI inflation rate hit a two-year high at 2.7 percent in the fourth quarter however. That puts baseline price growth just a hair below the RBA’s upper target limit of 3 percent, which seemingly argues against further easing in the near term.

Turning to external forces, a slew of top-tier US economic data releases threaten to generate volatility amid speculation about the future course of Fed QE “tapering” efforts. January’s manufacturing and service-sector ISM figures as well as the all-important Nonfarm Payrolls print headline the docket. The Fed went out of its way to cement the idea that a soft patch in late 2013 would not delay the stimulus reduction process.

Investors took that message at face value, writing off December’s disappointing round of key data points as an anomaly within a broadly firming recovery. That argument will be difficult to sustain if news-flow continues to register on the soft side however. On balance, firm results may prove AUD-negative if they prove to spark a recovery in US Treasury rates, narrowing the Australian unit’s yield advantage. Needless to say, weak results stand to yield the opposite result.

Finally, continued churn in the risk sentiment space represents yet another driving catalyst for Aussie price action. A formidable correlation between the MSCI Emerging Markets stock index and a trade-weighted average of the Australian Dollar’s average value against its top counter-parts speaks to the currency’s vulnerability to risk aversion. The speculative equities benchmark closed last week at the softest level in five months after a second consecutive week of aggressive selling. If liquidation continues, the AUD may well sink along with the spectrum of assets geared toward underlying investor confidence. - IS

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.