Australian Dollar at Potential Turning Point

Receive the Weekly Speculative Sentiment Index report via PDF via David’s e-mail distribution list.

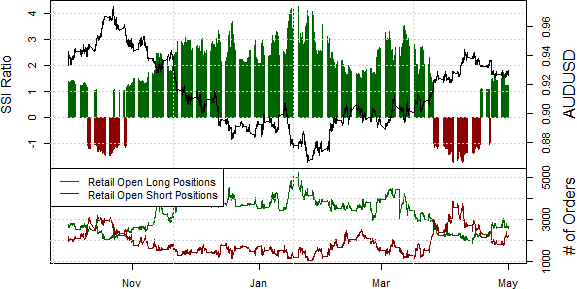

AUDUSD –Retail forex traders remain heavily long the Australian Dollar versus its US namesake, and a contrarian view of crowd sentiment leaves us focused on continued weakness.

Trade Implications AUDUSD – The majority of traders most recently turned long AUDUSD as it traded below $0.95, and the fact that crowds continue buying leaves the downtrend intact. Yet our Senior Technical Strategist notes that an AUDUSD close above $0.9160 would complete an important technical reversal pattern. Absent such a move, our trading bias will remain in favor of Aussie Dollar weakness.

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

Automate our SSI-based trading strategies via Mirror Trader free of charge

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

Facebook at http://www.Facebook.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.