Australian Dollar at Risk Absent Dovish Shift in FOMC Rhetoric

Australian Dollar at Risk Absent Dovish Shift in FOMC Rhetoric

Fundamental Forecast for Australian Dollar: Bullish

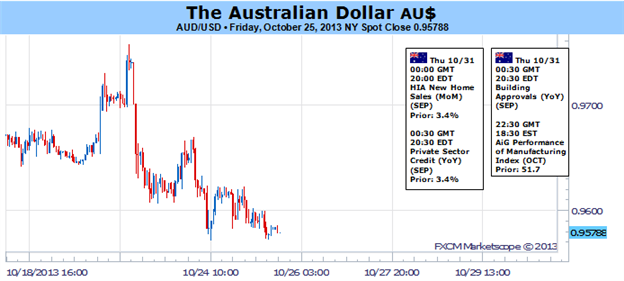

Australian Dollar Long Position Held as Prices Meet Resistance Above 0.97

Risk Aversion a Threat Absent Dovish Turn in Post-Shutdown FOMC Rhetoric

DailyFX SSI Flips as Speculative Sentiment Balance Turns Against Aussie

We’ve argued in favor of a significant Australian Dollar recoverysince early August. We thought improvingeconomic news-flow will help arrest the slide Chinese economic growth expectations, boosting the outlook for Australia’s mining sector exports and prompting an Aussie-supportive shift in RBA policy bets. The case for an upside scenario seemed all the more compelling against a backdrop ofhighly over-extended speculative net-short positioning and we proceeded to enter long AUD/USD after an attractive technical setup presented itself.

Prices turned higher as expected, with the latest COT positioning data pointing to swift short-covering. The back-story behind the move is reflecting our baseline scenario. Chinese economic growth expectations not only stopped falling, but the median 2013 forecast was upgraded (from 7.5 to 7.6 percent) in September. Meanwhile, the priced-in RBA policy outlook no longer sees any interest rate cuts over the coming 12 months (according to data compiled by Credit Suisse).

A lingering sensitivity to risk appetite trends remains a threat however. AUD/USD shows a notable correlation the MSCI World Stock Index, a proxy measure of broad-based market sentiment. That makes for a vulnerability to the outbreak of risk aversion as investors attempt to nail down the timing of the first move to “taper” Fed QE asset purchases in the aftermath of this month’s US government shutdown.

The emerging consensus seems to now call for the Fed to begin stimulus reduction in March 2014 as fiscal retrenchment hobbles the economy and derails earlier plans to begin stimulus withdrawal sometime late this year. The incorporation of this view into asset prices has pushed the S&P 500 to a new record high while sending the US Dollar sharply lower against its top counterparts, including the Aussie.

That suggests the markets are already pricing in the new timeline, meaning outsized volatility risk now comes from any indication that tapering may begin sooner rather later. Recalling the ultimately unfounded fears of the fiscal drag from an increase in payroll tax withholding and the “sequester” spending cuts on the US recovery earlier this year, the possibility that worries about the shutdown’s impact are overstated seems quite real.

While it shall be some time before hard economic data can give a clear reading on the shutdown’s real economic impact, next week’s FOMC policy meeting will be key in gauging whether Fed officials are as convinced as the financial markets of the need for a longer-term delay in policy normalization. The absence of a discernible shift in the policy statement’s rhetoric may suggest otherwise, weighing on risky assets and pulling the Aussie lower in tandem.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.