What is the Best 3D Printing Stock to Buy This Earnings Season?

Earnings season is well underway, and some notable 3D printing stocks have yet to report their quarterly earnings. Optimism is budding for the industry, and uses of the technology are being seen across multiple industries. In fact, Ford F has been experimenting with a type of 3D printing for manufacturing purposes.

The technology has potential, and it is already impacting industries. As 3D printing builds momentum, what is the best 3D printing stock for your portfolio this earnings season? Below, we outline three popular 3D printing stocks and assess how likely they are to surpass our EPS (earnings per share) consensus estimate when they release their quarterly earnings.

Voxeljet AG-VJET

Voxeljet is a small 3D printing company with a market capitalization of just $112.34 million. It serves the automotive, aerospace, film and entertainment, art and architecture, engineering, and consumer product industries. Voxeljet stock is a Zacks Rank #3 (Hold).

Voxeljet has seen an unfavorable trend of negative earnings estimate revisions from financial analysts over the last 60 days. In that time frame, there have been four estimate revisions, with all of those being revised lower. Our EPS consensus estimate for this quarter has seen some deterioration over the last 30 days, going from an estimate of -$0.10 to -$0.11. Our fiscal year EPS consensus, however, has been improving over the last 90 days, going from an estimate of -$0.45 to -$0.26.

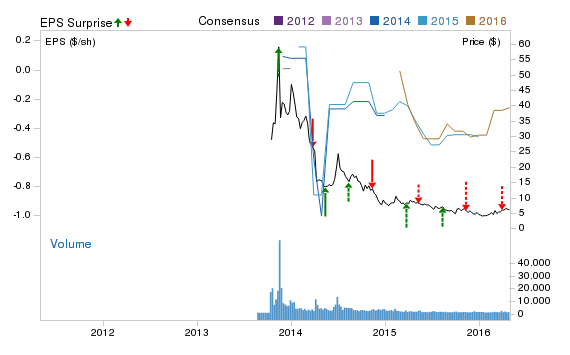

The company has missed our EPS consensus estimate in three of the last four quarters, missing by an average of -22.33% per quarter over that span of time. VJET is expected to release its earnings on the 10th of May. Below is a chart that shows how VJET’s stock price has reacted to earnings beats and misses.

3D Systems Corporation-DDD

3D Systems is a leading provider of 3-D modeling, rapid prototyping, and manufacturing solutions. DDD is the largest stock by market cap in this article at a value of $1.97 billion. It is a Zacks Rank #2 (Buy).

3D, unlike Voxeljet, has seen earnings estimates being revised upwards this quarter. The company has received three earnings estimate revisions over the last 60 days, and all of those were revised in the positive direction. This has helped to boost the company’s quarterly EPS consensus. Over the last 60 days, our EPS consensus estimate for this quarter has improved, going from -$0.05 to -$0.01. Our yearly consensus has seen a dramatic improvement over the last two months as well, going from $0.00 to $0.16.

3D Systems has beaten our EPS consensus in two of the last four quarters, but it should be noted that the company beat our earnings estimate by 433% when it released its earnings last quarter. 3D Systems reports its earnings on the 5th of May. Below is a graph depicting how 3D’s share price has reacted to EPS surprises over the last few years.

Stratasys Ltd-SSYS

Stratasys is a manufacturer of 3D printers and materials. It has a market cap of about $1.28 billion, and it is a Zacks Rank #1 (Strong Buy).

Stratasys has received one positive earnings estimate revision in the last two months for this quarter. Our consensus has increased over that time frame, going from -$0.22 to -$0.15. Our fiscal year consensus has improved as well, going from -$0.56 to -$0.21.

It won’t be too surprising if the company beats our -$0.15 EPS estimate when it releases its earnings on the 9th of May. After all, the company has beaten our earnings consensus in each of the last four quarters, with an average beat of 83.33% per quarter. The graph below shows how correlated Stratasys’ share price is with our fiscal year EPS consensus.

Bottom Line

Stratasys is the clear winner in this contest. While DDD has seen a lot of improvement in our quarterly earnings consensus, it doesn’t have the track record SSYS has when it comes down to posting earnings beats every quarter in the last year. Voxeljet is probably a stock you want to avoid buying this earnings season, as it has become the victim of unanimous negative earnings estimate revisions over the last two months.

The Zacks Rank is a truly marvelous trading tool. Our ranking system has beaten the S&P 500, yielding an average return of 25% per year for the last 29 years! Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FORD MOTOR CO (F): Free Stock Analysis Report

STRATASYS LTD (SSYS): Free Stock Analysis Report

3D SYSTEMS CORP (DDD): Free Stock Analysis Report

VOXELJET AG-ADR (VJET): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research