BlackRock CEO Larry Fink wants two things from Trump's tax plan

Larry Fink, CEO of BlackRock (BLK), the world’s largest investment firm, has sent out his annual letter to CEOs at S&P 500 companies and major European corporations.

And while Fink’s letter again focused on the need to promote long-term thinking, no major corporate or political commentary these days will go without mentioning Donald Trump.

Specifically, Fink hopes Trump’s stated desire to reform the US tax code will address two issues: capital gains taxes and cash held overseas.

Extend the threshold for long-term capital gains tax

“As the U.S. begins to consider tax reform this year, it should seize the opportunity to build a capital gains regime that truly rewards long-term investments over short-term holdings,” Fink wrote.

“One year is far too short to be considered a long-term holding period. Instead, gains should receive long-term treatment only after three years, and we should adopt a decreasing tax rate for each year of ownership beyond that.”

Currently, most investment gains are taxed at either 15% or 20% depending on household income as long as the asset is held longer than one year. Gains on assets held for less than a year are taxed as ordinary income based on your tax bracket.

And so Fink’s plan not only wants to extend the minimum threshold for long-term capital gains taxes by two years, but incentivize even longer holding periods.

Of course, some will note that BlackRock owns significant, long-term stakes in companies as the result of its offering index-related products — for example, BlackRock has to own proportionally as much Apple stock as Apple represents in the S&P 500 based on how much money its S&P 500 index fund holds — and that enticing investors to be long-term oriented will benefit BlackRock as much, if not more than, anyone else in the market.

BlackRock is, however, tasked with acting as a fiduciary on behalf of these clients and so, yes, one would expect the firm is going to support proposals from which it will (likely) benefit.

“The private sector alone is not capable of shifting the tide of short-termism afflicting our society,” Fink writes. “We need government policy that supports these goals.”

Scaled rewards for taking long-term views on investing have been implemented by some investment firms already. Formalizing incentives for long-term investment holding periods in the tax code would certainly count as government support in this area.

Repatriated cash should be used for investment

On the topic of repatriating cash held by US companies overseas — an issue more often mentioned by Wall Street types than anyone in the Trump administration — Fink says that any plan to get this money back to the US should be careful to incentivize US-based investment rather than simple return of capital to shareholders.

“If tax reform also includes some form of reduced taxation for repatriation of cash trapped overseas, BlackRock will be looking to companies’ strategic frameworks for an explanation of whether they will bring cash back to the U.S., and if so, how they plan to use it,” Fink writes.

“Will it be used simply for more share buybacks? Or is it a part of a capital plan that appropriately balances returning capital to shareholders with prudently investing for future growth?”

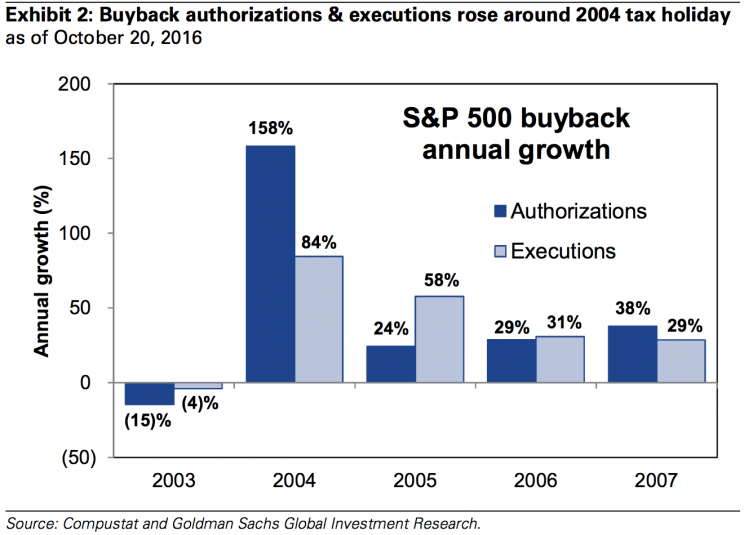

In 2004, a repatriation tax holiday was implemented as part of the Homeland Investment Act of 2004. That same year, S&P 500 buyback executions rose 84%. In 2005, buyback executions were up 58%.

In other words, companies used this money to repurchase shares, rewarding existing shareholders, rather than make new investments in the US. And this history likely does not encourage Fink, who again this year railed against buybacks.

“Companies have begun to devote greater attention to these issues of long-term sustainability, but despite increased rhetorical commitment, they have continued to engage in buybacks at a furious pace,” Fink writes.

“In fact, for the 12 months ending in the third quarter of 2016, the value of dividends and buybacks by S&P 500 companies exceeded those companies’ operating profit. While we certainly support returning excess capital to shareholders, we believe companies must balance those practices with investment in future growth.

“Companies should engage in buybacks only when they are confident that the return on those buybacks will ultimately exceed the cost of capital and the long-term returns of investing in future growth.”

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: