Brexit Weighs on Big Oil ETFs

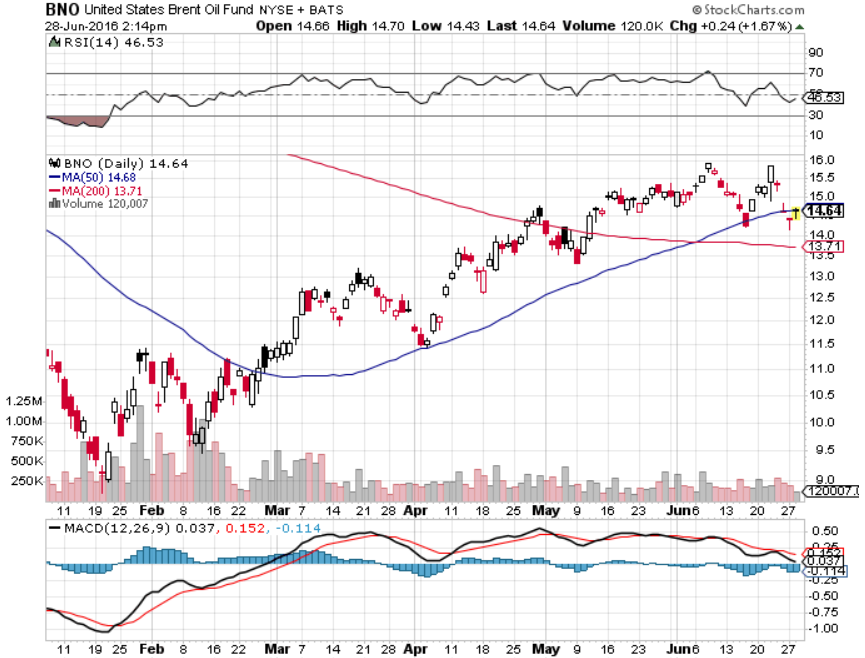

The United States Oil Fund (USO) , which tracks West Texas Intermediate crude oil futures, and the United States Brent Oil Fund (BNO) , which tracks Brent crude oil futures, are among the various commodities exchange traded products that have been stung by the Brexit result.

A stronger dollar coupled with downward revisions to U.K. economic growth forecast are among the factors pressuring crude in Brexit’s wake and there could be more near-term pain for oil because some market observers see Brexit also affecting Chinese economic growth.

Related: The Worst Could be Over for Oil ETFs

“The Brexit also likely has a negative impact for China by strengthening the Japanese Yen and triggering a sell-off in the Yuan. The future of EU Oil imports is also brought into question, given the risk of other countries following England’s lead in exiting the Union. Despite the risks, inventory levels are expected to inch lower over the summer months, which may underpin Oil prices. US production is expected to decrease over the coming months, which may offset decreased UK/EU demand,” according to OptionsExpress.

Brexit’s subsequent volatility could drag on riskier assets like commodities and add to concerns over a global slowdown in energy demand. Moreover, commodities may find pressure from a strengthening U.S. dollar as many expect the British pound to depreciate following a break.

Trending on ETF Trends

11 Surging Silver ETFs as Two-Year High Looms

A Gold Boon for these Glistening ETFs

As Bank of England Mulls Rate Cuts, More Pound Punishment Likely

As Q3 Begins, Gold Miner ETFs Keep Shining

Winklevoss Bitcoin ETF Will Trade on BATS

Elevated levels of production remain an issue for oil as well. OPEC has kept up production to pressure high-cost rivals, such as the developing U.S. shale oil producers. The International Energy Agency expects it will take several years before OPEC can effectively price out high-cost producers.

Saudi Arabia previously said it would join a production freeze deal if Iran agreed to curb output. However, Iran has maintained that it should be allowed to raise production to previous levels before the introduction of Western sanctions over Iran’s nuclear program, instead arguing for individual-country production quotas.

Related: Oil ETFs at 7 Month High on Falling U.S. Inventories

“Turning to the chart, we see the August Crude Oil contract forming what could become a double top formation. If confirmed, the measure of the double top could result in a test of the $40 level. The recent closes below the 20-day moving average (“MA”) suggest that a near-term high may be in place,” adds Options Express.

For more information on the oil market, visit our oil category.

United States Brent Oil Fund