BRIC ETFs Fight Off Brazil Weakness

Stocks in Brazil, Latin America’s largest economy, are floundering after soaring through the latter stages of the first quarter and into April.

Last month, the iShares MSCI Brazil Capped ETF (EWZ) lost 0.8%. That does not sound too bad until taking a close look at the ETF. From May 1 through May 14, EWZ gained 6%, but from May 15 through May 30, the ETF tumbled 5.1%.

The ETF struggled to close May after data showed Brazil’s economy expanded just 0.2% in the first quarter. Banco Fibra SA downwardly revised its forecast for Brazil’s economy to grow 0.8% from 1.5% after the GDP report, the slowest pace since the economy contracted in 2009. Economists estimate that the economy will average a 1.8% expansion in 2014, down from a 2.5% outlook last year. [Brazil ETF's Chart Weakens]

Fortunately for BRIC ETFs and investors in those funds, India and Russia are picking up the slack created by Brazil, a departure from the first quarter when it was a combination of Brazil and India that drove ETFs such as the iShares MSCI BRIC ETF (BKF) higher. [Brazil, India Lift BRIC ETFs]

The $373.9 million BKF features a 26.2% weight to Brazil and thee Brazilian stocks among its top-10 holdings, but that was not enough to stop the ETF from gaining 4.6% last month. A combined 29.4% weight to India and Russia undoubtedly helped. Of May’s top 20 ETFs, 14 were India or Russia ETFs. [Russia, India ETFs Soar in May]

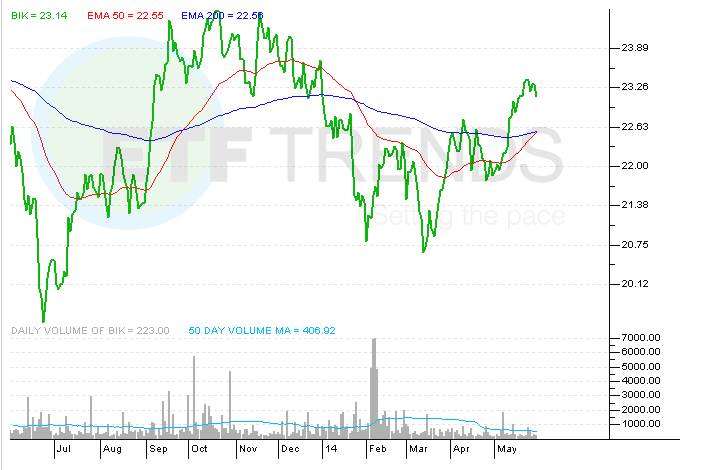

The SPDR S&P BRIC 40 ETF (BIK) takes a different BRIC approach than BKF, which was key to BIK’s 5.7% May gain. The State Street offering’s 17.9% weight to Brazil is healthy, but an almost 21% weight to Russia, the second- largest among the BRIC ETFs, proved advantageous in a month when Russia’s benchmark Micex soared almost 10%.

With over 32% of its weight allocated to Brazil, the Guggenheim BRIC ETF (EEB) features the largest allocation to that country among the BRIC ETFs. However, EEB was still able to post a May gain of 4.7%, which was driven by a better than 36% combined weight to Russia and India. EEB’s 24.8% weight to Russia is the largest among BRIC ETFs. [Calm in Ukraine Ignites Russia ETFs]

Although money poured into EWZ, the Market Vectors Russia ETF (RSX) and the WisdomTree India Earnings Fund (EPI) last month, investors were less enthusiastic about multi-country BRIC ETFs. BIK, BKF and EEB lost over $37 million combined in May.

SPDR S&P BRIC 40 ETF

Tom Lydon’s clients own shares of EEB.