BuyBack ETFs Underperform in Low-Growth, Low-Rate Environment

Company buybacks have helped support the stock market rally since the financial downturn, but the gimmick may be running out of steam, with exchange traded funds that focus on the buyback strategy underperforming.

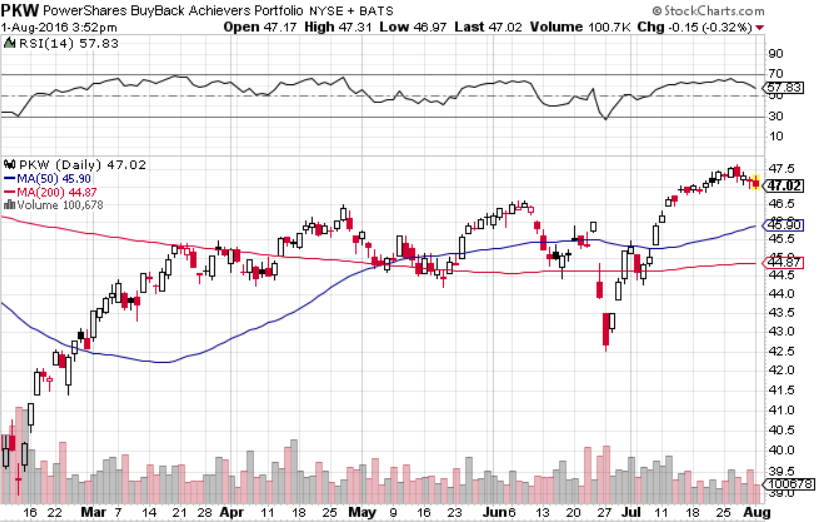

Year-to-date, the PowerShares Buyback Achievers Portfolio (PKW) , the largest buyback ETF, rose 4.5% and the SPDR S&P 500 Buyback ETF (SPYB) gained 6.2%, whereas the S&P 500 Index increased 7.7%.

“Investors have rewarded buybacks for many years but the pattern has reversed in 2016,” according to the Goldman Sachs Group team, led by Chief U.S. Equity Strategist David Kostin, Bloomberg reports.

SEE MORE: ETF Investors Look to Dividend Payers Over Buybacks

Goldman’s proprietary buyback basket, which is comprised of stocks with the highest share repurchases over the past four quarters, has underperformed the wider market this year, bucking an historic trend of buyback friendly companies outperforming on an annual basis.

The extended low-rate environment in the wake of the financial crisis has encouraged Corporate America to heavily borrow and add value to share prices in the form of stock buybacks.

However, the buyback strategy has underperformed as investors looked to yield-generating assets this year.

Trending on ETF Trends

Gold Miners ETFs Confirm Strength Against Broad Market

Energy ETFs Oversold as Oil Prices Enter Bear Market?

Amid Biotech Rally, Investors Show Jitters

A Global Solution for Low Volatility Fans

It Could be a Golden Summer For Gold ETFs

“During periods of low growth and low interest rates, firms with the highest buybacks fail to provide investors with either the consistent yield of bond-like assets or the prospect of future growth,” Goldman said.

Additionally, the pace of buybacks seem to be slowing after repurchases by S&P 500 companies totaled $163 billion in the first quarter, the highest level since the third quarter of 2007. The rate at which buybacks are being issued declined by 18% in the second quarter year-over-year. Goldman argued that the increasingly high valuations have made it less attractive for companies to buy back their stocks.

SEE MORE: Investors Look to Dividend-Paying Stock ETFs as Interest Rates Stay Low

Citigroup Analysts have also warned of slowing company buybacks in the face of a slow rise in interest rates and potential turn in the credit cycle that would make it more expensive for companies to finance repurchases through leverage.

“Managers should focus on firms returning cash to shareholders via dividends,” Goldman added. “Low, albeit rising, interest rates, a recovery in dividend growth expectations, and modest economic growth should benefit this strategy in [the second half] 2016.”

For more information on buyback stocks, visit our buybacks category.

PowerShares Buyback Achievers Portfolio

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.