Canadian Dollar to Extend Gains on Sticky Core Inflation

DailyFX.com -

- Canada Consumer Price Index (CPI) to Slow for Fourth Time in 2016.

- Core Rate of Inflation to Hold Steady at for Third Consecutive Month 2.1%.

For more updates, sign up for David's e-mail distribution list.

Trading the News: Canada Consumer Price Index (CPI)

Despite forecasts for a downtick in Canada’s Consumer Price Index (CPI), stickiness in the core rate of inflation may boost the appeal of the loonie and trigger fresh monthly lows in USD/CAD as it encourages the Bank of Canada (BoC) to gradually move away from its easing cycle.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

It seems as though the BoC will retain a wait-and-see approach over the remainder of the year as the Governor Stephen Poloz and Co. argues ‘inflation in Canada is on track to return to 2 percent in 2017 as the complex adjustment underway in Canada’s economy proceeds,’ and the central bank may continue to soft its dovish tone over the coming months as the ‘the risks to the profile for inflation are roughly balanced.’

Expectations: Bullish Argument/Scenario

Release | Expected | Actual |

Manufacturing Sales (MoM) (JUN) | 0.5% | 0.8% |

Housing Starts (JUL) | 191.0K | 198.4K |

Retail Sales (MoM) (MAY) | 0.0% | 0.2% |

The pickup in household spending accompanied by the ongoing expansion in the housing market may encourage sticky price growth in Canada, and signs of higher-than-expected inflation may spark a bullish reaction in the Canadian dollar as it boosts interest-rate expectations.

Risk: Bearish Argument/Scenario

Release | Expected | Actual |

Raw Material Price Index (MoM) (JUN) | 3.0% | 1.8% |

Gross Domestic Product (YoY) (MAY) | 1.2% | 1.0% |

CFIB Business Barometer (JUL) | -- | 57.5 |

Nevertheless, easing input costs paired with fears of a slowing recovery may drag on consumer prices, and a downtick in both the headline as well as the core CPI print may halt the recent resilience in the Canadian dollar as it fuels speculation for additional monetary support.

How To Trade This Event Risk(Video)

Bullish CAD Trade: Canada CPI Exceeds Market Forecast

Need to see red, five-minute candle following the release to consider a short trade on USD/CAD.

If market reaction favors a bullish loonie trade, sell USD/CAD with two separate position.

Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish CAD Trade: Headline & Core Rate of Inflation Disappoints

Need green, five-minute candle to favor a long USD/CAD trade.

Implement same setup as the bullish Canadian dollar trade, just in reverse.

Potential Price Targets For The Release

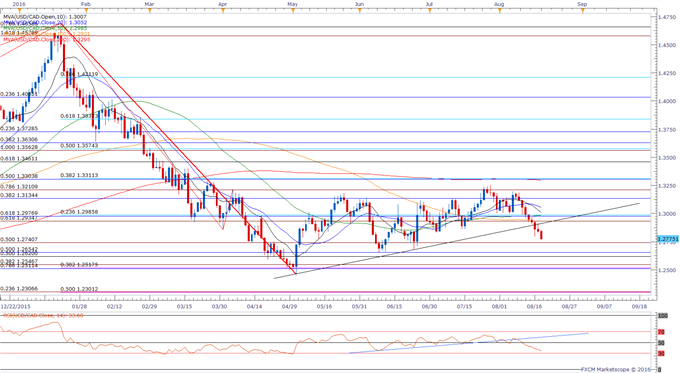

USD/CAD Daily

Chart - Created Using FXCM Marketscope 2.0

Despite the longest stretch of daily consecutive declines since 2011, failure to preserve the upward trend from May raises the risk for a further decline in USD/CAD especially as the Relative Strength Index (RSI) highlights a similar dynamic; break/close below the Fibonacci overlap around 1.2620 (50% retracement) to 1.2650 (50% retracement), which lines up with the June low (1.2653), raising the risk for a move back towards the 2016 low (1.2460).

Key Resistance: 1.3560 (100% expansion) to 1.3630 (38.2% retracement)

Key Support: 1.2510 (78.6% retracement) to 1.2520 (38.2% expansion)

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

Impact that Canada Consumer Price Index (CPI) has had on USD/CAD during the last release

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

JUN 2016 | 07/22/2016 12:30 GMT | 1.4% | 1.5% | +13 | +49 |

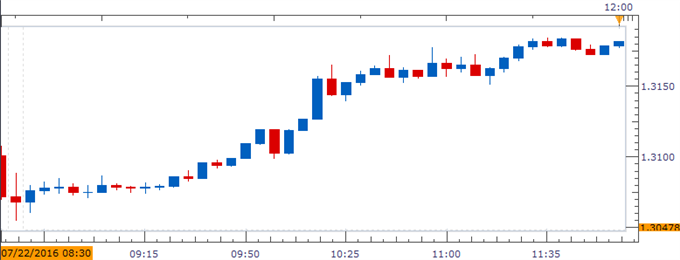

June 2016 Canada Consumer Price Index (CPI)

USD/CAD 5-Minute

Canada’s Consumer Price Index (CPI) unexpectedly held steady at an annualized 1.5% for the second consecutive month in June, with the core rate of inflation clocking in at an annualized 2.1% amid forecasts for a 2.0% print. A deeper look at the report the stickiness was led by a 4.3% rise in gasoline prices, with transportation costs advancing 1.2% in June, while prices for clothing/footwear narrowed 2.0% after holding flat in May. The initial advance in the Canadian dollar was short-lived, with USD/CAD coming off of 1.3055 to end the day at 1.3121.

Get our top trading opportunities of 2016 HERE

Check out FXCM’s Forex Trading Contest

Read More:

USD/CAD Technical Analysis: Macro Now Favoring a Breakdown?

Gold Prices Wedging into Consolidation Near Resistance

USDOLLAR Short Term Technical Update

S&P 500: Notches New Record High, Short-term Techs in Focus

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.