Canadian Dollar Outlook Bullish On Low Budget Deficit, Inflation

Canadian Dollar Outlook Bullish On Low Budget Deficit, Inflation

Fundamental Forecast for US Dollar: Bullish

The Canadian dollar finished slightly lower on Friday after trimming most of its earlier losses against the greenback following Thursday’s release of Canada’s 2013 Budget Report. The report included a deficit-reduction plan aimed at eliminating the country’s deficit by 2015, as well as initiatives meant to boost the manufacturing sector and to improve labor skills. , The prospect of a deficit cut resulted in praise from rating agencies, providing support for Canada’s triple A-rating and the Loonie. Additionally, a better than expected Retail Sales report, signaled that the economy may be recovering, pushing the Canadian dollar to trade higher than its counterparties.

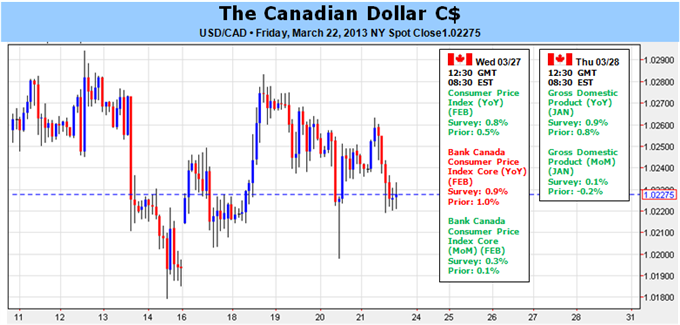

While European countries face debt to GDP ratios well over 100 percent, a plan to eliminate a C$26 billion deficit within two years makes Canada an attractive candidate within the forex market. Unlike U.K. Chancellor George Osborne, who conceded lack of progress in improving his country’s imbalance, Canadian Finance Minister Jim Flaherty provided a credible plan. Spending growth is forecasted to average 2.1 percent over the next five years, while revenues are expected to expand at an average rate of 4.6 percent over the same period. Both forecasts appear realistic, but would be more convincing if accompanied by improving key economic indicators, signifying a stable recovery. Thus, January’s Gross Domestic Product scheduled for release next Thursday will be among the top headlines for investors trying to gauge the overall outlook of the Canadian economy and its currency.

Meanwhile, some uncertainties over Canada’s economy still remain, specifically when taking a deeper look into the recent budget statement. The report indicated that 2013 GDP is projected to grow at 1.6 percent, which is notably different from January’s estimate of 0.9 percent growth and the expected 0.8 percent increase in the previous month. Canada’s ability to achieve this new growth target will depend upon how effective the new policies are at combating the unemployment rate through improved labor skills and government investment aimed at increasing manufacturing activity. If the fundamentals do strengthen as expected, the Canadian dollar should gain more support.

Another top headline for the Canadian dollar, in the coming week, is the February Consumer Price Index report. The Bank of Canada chose to maintain the over-night rate during their most recent meeting as the inflation rate remains below its 2% target.. The likelihood of a future rate increase also remains low thanks to the BOC’s priority of boosting economic growth, which requires stable inflation and low volatility., The outlook of the central bank rate will mostly stay unchanged until output returns to full capacity and inflation gradually rises in the second half of 2014, as expected. Given this lack of monetary stimulus, the Canadian dollar faces less downside pressure. - RM

New to FX? Register for this free 20 minute course HERE and learn common FX terms like leverage and how to implement conservative amounts.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.