Charles Brandes Trimmed Holdings in 2nd Quarter

- By David Goodloe

In six of his top 10 quarterly transactions, Charles Brandes (Trades, Portfolio), chairman of Brandes Investment Partners, trimmed positions in the portfolio in the second quarter.

Warning! GuruFocus has detected 6 Warning Signs with SBS. Click here to check it out.

The intrinsic value of SBS

Three of the companies are based in South America, one is based in London, one is based in Luxembourg, and the sixth is based in Chicago.

In all, the guru reduced 79 holdings in the second quarter.

The guru's largest reduction nearly resulted in the elimination of Companhia de Saneamento B?sico do Estado de S?o Paulo S.A. (SBS), a Brazilian water and waste management company based in S?o Paulo, from the portfolio. Brandes sold 13,209,570 shares for an average price of $7.5 per share, leaving 13,112 shares in the portfolio. The deal had a -1.25% impact on the portfolio.

Paul Singer (Trades, Portfolio) is the company's leading shareholder among the gurus with a stake of 8,102,584 shares. The stake is 1.19% of the company's outstanding shares and 0.64% of Singer's total assets.

The company has a price-earnings (P/E) ratio of 15.55, a price-book (P/B) ratio of 1.35 and a price-sales (P/S) ratio of 1.57. GuruFocus gives the company a Financial Strength rating of 5/10 and a Profitability and Growth rating of 8/10 with return on equity (ROE) of 9.27% that is higher than 56% of the companies in the Global Utilities - Regulated Water industry and return on assets (ROA) of 3.94% that is higher than 64% of the companies in that industry.

The company sold for $9.03 per share at market close Tuesday. The DCF Calculator gives the company a fair value of $5.84.

Brandes trimmed the stake in Exelon Corp. (EXC), a Chicago-based energy company, by more than 49% with the sale of 2,050,919 shares for an average price of $34.7 per share. The transaction had a -1.05% impact on the portfolio.

The remaining stake of 2,133,548 shares is 0.23% of Exelon's outstanding shares and 1.18% of the guru's total assets. T Rowe Price Equity Income Fund (Trades, Portfolio) is Exelon's leading shareholder among the gurus with a stake of 4.1 million shares. The stake is 0.44% of Exelon's outstanding shares and 0.71% of the guru's total assets.

Exelon has a P/E of 22.78, a forward P/E of 13.40, a P/B of 1.21 and a P/S of 1.08. GuruFocus gives Exelon a Financial Strength rating of 4/10 and a Profitability and Growth rating of 6/10 with ROE of 5.45% that is lower than 65% of the companies in the Global Utilities - Diversified industry and ROA of 1.36% that is lower than 71% of the companies in that industry.

Exelon sold for $33.91 per share Tuesday. The DCF Calculator gives Exelon a fair value of $15.95.

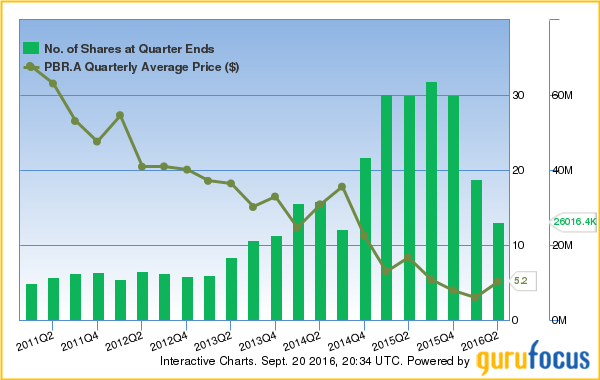

The guru reduced the stake in Petroleo Brasileiro SA Petrobras ADR (NYSE:PBR.A), a Brazilian petroleum company based in Rio de Janeiro, by more than 31%, selling 11,699,477 shares for an average price of $5.16 per share. The deal had a -0.78% impact on the portfolio.

The remaining stake of 26,016,378 shares is 0.4% of the company's outstanding shares and 2.38% of the guru's total assets. Dodge & Cox is the company's leading shareholder among the gurus with 194,732,203 shares. The stake is 2.99% of the company's outstanding shares and 1.12% of Dodge & Cox's total assets.

The company has a forward P/E of 5.59, a P/B of 0.69 and a P/S of 0.65. GuruFocus gives the company a Financial Strength rating of 4/10 and a Profitability and Growth rating of 7/10 with ROE of -14.76% that is lower than 76% of the companies in the Global Oil & Gas Integrated industry and ROA of -4.68% that is lower than 79% of the companies in that industry.

The company sold for $8.21 per share Tuesday. The DCF Calculator gives the company a fair value of $-17.55.

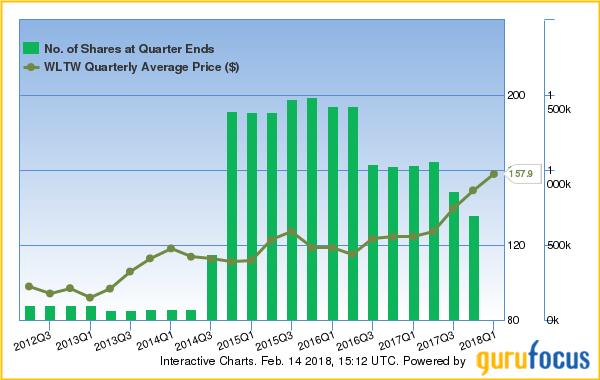

The guru reduced the stake in Willis Towers Watson PLC (WLTW), a London-based risk management, insurance brokerage and advisory company, by more than 27% with the sale of 389,183 shares for an average price of $123.33 per share. The transaction had a -0.66% impact on the portfolio.

The remaining stake of 1,040,026 shares is 0.75% of Willis Towers Watson's outstanding shares and 1.97% of the guru's total assets. Jeff Ubben (Trades, Portfolio) is the leading shareholder among the gurus with a stake of 8,108,015 shares. The stake is 5.87% of Willis Towers Watson's outstanding shares and 9.15% of Ubben's total assets.

Willis Towers Watson has a P/E of 35.02, a forward P/E of 14.16, a P/B of 1.58 and a P/S of 2.19. GuruFocus gives Willis Towers Watson a Financial Strength rating of 4/10 and a Profitability and Growth rating of 7/10 with ROE of 6.90% that is higher than 57% of the companies in the Global Insurance Brokers industry and ROA of 1.67% that is higher than 51% of the companies in that industry.

Willis Towers Watson sold for $125.68 per share Tuesday. The DCF Calculator gives Willis Towers Watson a fair value of $38.53.

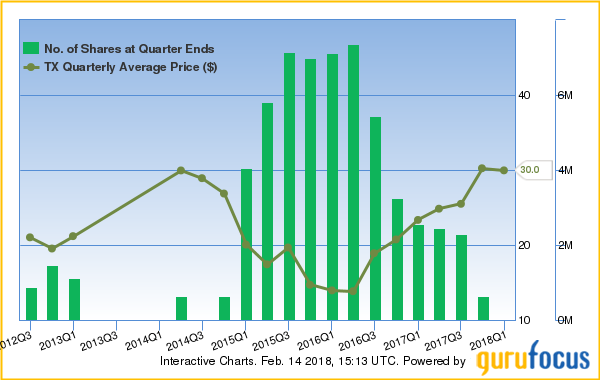

The guru sold more than 26% of the stake in Ternium SA (TX), a Luxembourg-based steel products manufacturing company. The guru sold 1,925,593 shares for an average price of $18.91 per share. The deal had a -0.49% impact on the portfolio.

The remaining stake of 5,441,515 shares is 2.77% of Ternium's outstanding shares and 1.58% of the guru's total assets. Brandes is Ternium's leading shareholder among the gurus.

Ternium has a P/E of 27.15, a forward P/E of 9.36, a P/B of 0.93 and a P/S of 0.52. GuruFocus gives Ternium a Financial Strength rating of 6/10 and a Profitability and Growth rating of 7/10 with ROE of 3.50% that is higher than 55% of the companies in the Global Steel industry and ROA of 1.74% that is higher than 58% of the companies in that industry.

Ternium sold for $19.28 per share Tuesday. The DCF Calculator gives Ternium a fair value of $7.6.

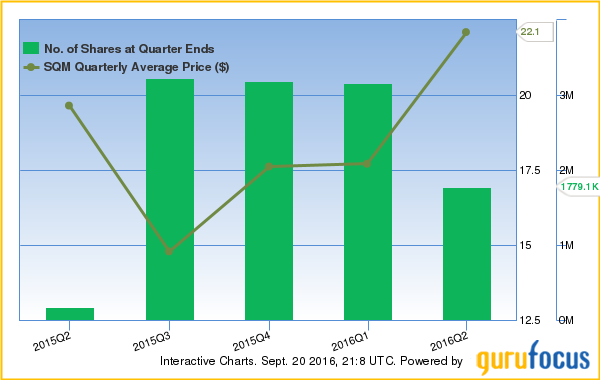

The guru trimmed the stake in Sociedad Quimica Y Minera De Chile SA (SQM), a chemicals and mining company based in Chile, by nearly 44%. The guru sold 1,376,054 shares for an average price of $22.08 per share. The transaction had a -0.41% impact on the portfolio.

The remaining stake of 1,779,140 shares is 0.68% of the company's outstanding shares and 0.67% of the guru's total assets. Brandes is the company's leading shareholder among the gurus.

The company has a P/E of 31.64, a forward P/E of 26.04, a P/B of 2.92 and a P/S of 3.82. GuruFocus gives the company a Financial Strength rating of 6/ 10 and a Profitability and Growth rating of 5/10 with ROE of 8.92% and ROA of 4.47% that are higher than 55% of the companies in the Global Chemicals industry.

The company sold for $24.78 per share Tuesday. The DCF Calculator gives the company a fair value of $10.78.

Disclosure: I do not own any stocks mentioned in this article.

Start a free seven-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 6 Warning Signs with SBS. Click here to check it out.

The intrinsic value of SBS