Chart of the day: Warning sign for small-caps

Small-caps have been a real force behind the recent rally, exploding the day after the election as investors bet on Trump’s protectionist platform.

But since the new year, the Russell 2000 index (^RUT), which tracks small-caps, has petered off into a fairly narrow trading range.

Given that small-caps are considered a leading indicator of market performance, we’re going to take a look at one potential warning sign that could imply investor over-exuberance.

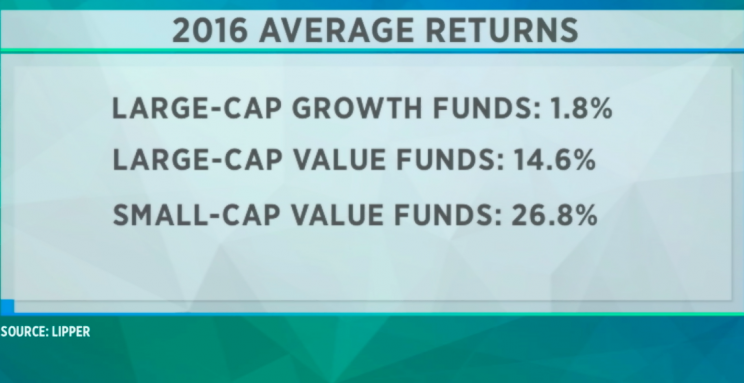

But first, some background. According to Lipper, last year’s large-cap growth funds posted average returns of 1.8%, while large-cap value funds gained 14.6%. Small-cap value funds stole the show, beating almost all other stock-fund categories, with returns of 26.8%.

Value funds have really been leading the way for the Russell 2000, driven mostly by cyclicals. But have they come too far too fast?

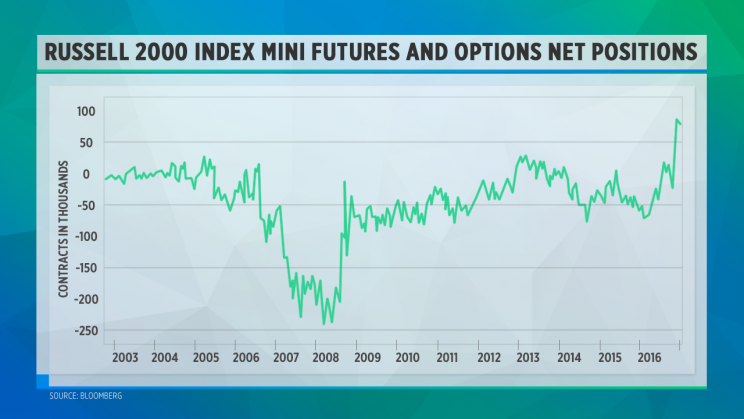

The net speculative position in Russell 2000 index mini futures and options could be a cautionary sign. The four largest net positions ever in the contracts were recorded in the past four weeks, signaling that small-caps are over owned, according to David Rosenberg of Gluskin Sheff & Associates. The record speculation could be hinting at over-excitement in the market.

The nosebleed valuations in small-caps right now could continue to be an overhang on the market, unless substantial earnings growth comes through.

For more on small-caps, check out The Final Round, live today at 4 p.m. EST, right here on Yahoo Finance.