Commodities at Risk with Eurozone FinMin Summit, IMF Outlook Ahead

Commodity prices look to a meeting of Eurozone finance ministers and an updated IMF world economic outlook for direction, with weakness seeming likely.

Talking Points

Commodities Look to Eurozone FinMin Summit for Direction Cues

“Risk-off” Trade Expected with IMF Likely to Downgrade Outlook

Commodities are likely to find themselves at the mercy of broad-based risk sentiment trends to start the trading week as all eyes turn to the Luxembourg, where Eurozone finance ministers are due to begin a two-day meeting to discuss debt management efforts. Traders will be interested in any moves to mend disagreements between the Greek government and troika monitors that open the door for disbursement of the latest batch of bailout funding. Any clues about the timing of a Spanish request for a full-on rescue package are also sought, particularly after borrowing costs rose at a bond auction last week.

Markets already appear jittery ahead of the sit-down. Sentiment-anchored crude oil and copper prices are following Asian stocks lower while gold and silver succumb to de-facto selling pressure as safe-haven demand buoys the US Dollar. The final communiqué from the meeting will not be available until the second day of talks concludes tomorrow but investors will pay close attention to sideline commentary today for clues about the tone and trajectory of the proceedings. Against this backdrop, the IMF is due to release an updated set of global economic performance expectations, with downgrades widely expected. This suggests that absent concrete positive cues from Luxembourg, the risk-off mood is likely to carry forward.

WTI Crude Oil (NY Close): $89.88 // -1.83 // -2.00%

A burst of seesaw volatility has left prices locked between support at 87.70 and resistance at 92.56, the 38.2% and 23.6% Fibonacci expansions respectively. A break above resistance exposes the underside of a rising channel set from early July, now at 97.03. Alternatively, a drop through support targets the 50% expansion at 83.76.

Daily Chart - Created Using FXCM Marketscope 2.0

Spot Gold (NY Close): $1780.60 // -9.80 // -0.55%

Prices put in a bearish Dark Cloud Cover candlestick pattern below resistance in the 1790.55-1802.80 area, hinting a move lower is ahead. Negative RSI divergence reinforces the case for a downside scenario. Sellers are now probing below rising trend line support set from mid-August, with a confirmed break on a daily closing basis exposing the 23.6% Fibonacci retracement at 1747.20. Alternatively, a break above resistance targets 1850.00 and the 1900/oz figure.

Daily Chart - Created Using FXCM Marketscope 2.0

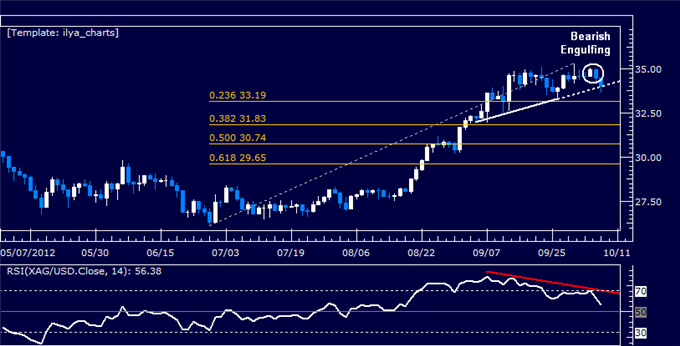

Spot Silver (NY Close): $34.52 // -0.49 // -1.40%

Prices completed a Bearish Engulfing candlestick pattern, hinting a move lower is ahead. Negative RSI divergence reinforces the case for a downside scenario. A confirmed break below rising trend line support (34.04) on a daily closing basis initially exposes the 23.6% Fibonacci retracement at 33.19. Near-term resistance stands at the 35.00 figure.

Daily Chart - Created Using FXCM Marketscope 2.0

COMEX E-Mini Copper (NY Close): $3.778 // -0.008 // -0.21%

Prices continue to consolidate below resistance at a falling trend line set from early February (3.821). A break higher exposes swing highs at 3.955 and 3.988. Near-term support lines up at 3.707, the 23.6% Fibonacci retracement. A push below that targets the 38.2% level at 3.627.

Daily Chart - Created Using FXCM Marketscope 2.0

--- Written by Ilya Spivak, Currency Strategist for Dailyfx.com

To contact Ilya, e-mail ispivak@dailyfx.com. Follow Ilya on Twitter at @IlyaSpivak

To be added to Ilya's e-mail distribution list, send a note with subject line "Distribution List" to ispivak@dailyfx.com

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.