Commodity ETFs Take Beating from Fed

As the U.S. dollar rallies off the Federal Reserve’s tightening monetary policy, commodity exchange traded funds are slipping to new lows.

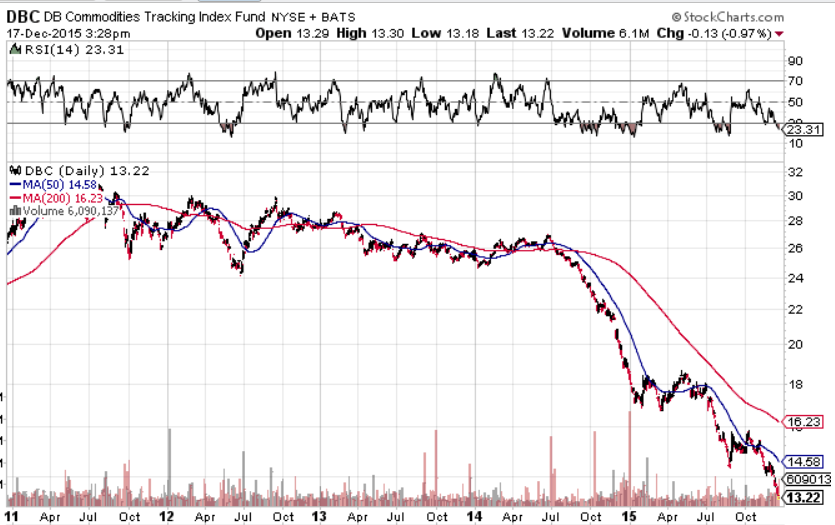

On Thursday, the GreenHaven Continuous Commodity Index Fund (GCC) fell 0.9%, PowerShares DB Commodity Index Tracking Fund (DBC) declined 0.8%, iPath Dow Jones-UBS Commodity Index Total Return ETN (DJP) decreased 0.9%% and iShares GSCI Commodity-Indexed Trust (GSG) retreated 1.0%. The four broad commodity-related exchange traded products all hit new lows Thursday. [Fed Fans Flame on Inverse Commodity ETFs]

The commodities market was weakening Thursday after the Fed hiked interest rates and the U.S. dollar rallied. [Dollar ETFs Can Still Beat Euro Rivals]

Following the Fed’s decision to increase rates, “the commodity complex is likely to remain under pressure in the near term as the dollar strength and strong supplies for most of the major commodities remain major headwinds,” Rob Haworth, senior investment strategist at U.S. Bank Wealth Management, told the Wall Street Journal.

The U.S. dollar strengthened as a tighter monetary policy would diminish the amount of money floating around the market. Consequently, USD-denominated commodities from oil to gold are more expensive for foreign investors – West Texas Intermediate crude oil futures dipped 1.7% to 34.9 per barrel while Comex gold futures fell 2.4% to $1,051 per ounce.

The broad commodity ETPs include a heavy tilt toward energy-related commodities. For instance, DBC holds a 51.7% exposure to raw crude oil and refined energy, GCC includes a 18% tilt toward energy and DJP includes a 24.6% weight toward energy commodities.

Investors may also be shying away from the commodities space as the raw resources do not provide yield opportunities.

“Commodities are still out of favor among the financial investors,” Daniel Briesemann, a commodities analyst at Commerzbank AG, told the Wall Street Journal . “They probably are of the opinion that they can earn more money in other asset classes.”

Moreover, other fundamental factors are weighing on the commodities outlook. For instance, signs of a slowdown in China, the world’s second largest economy, could translate to diminished demand for raw materials from the emerging market. China is the world’s second largest oil consumer and biggest consumer of most metals, accounting for about 45% of demand in most major base metals.

The stronger dollar would also weaken the emerging currencies and make it costlier for developing economies to acquire USD-denominated materials.

“Emerging market economies are trying to manage with weaker currencies which raises ‘shock wave’ demand concerns for commodities,” Hamza Khan, head of commodities strategy at ING Bank, told the Wall Street Journal.

PowerShares DB Commodity Index Tracking Fund

For more information on the commodities market, visit our commodity ETFs category.

Max Chen contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.