Consumer Discretionary ETFs Celebrate Amazon Anniversary in Style

E-commerce giant Amazon (AMZN) is leading the charge in the consumer discretionary space and sector-related exchange traded funds as the retailer celebrates its 20th anniversary.

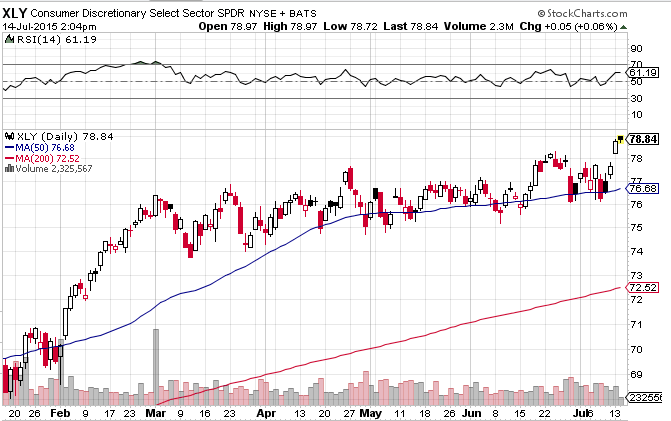

Amazon stocks jumped 2.5% Tuesday to a new all-time high. Additionally, consumer discretionary ETFs also touched new highs. For instance, the Consumer Discretionary Select Sector SPDR (XLY) was up 0.1%, Vanguard Consumer Discretionary ETF (VCR) was 0.1% higher and iShares US Consumer Services ETF (IYC) was slightly higher.

Amazon is the second largest component in the consumer discretionary ETFs, including 7.2% of XLY, 5.5% of VCR and 5.6% of IYC.

The e-commerce giant was rallying a day after company stocks surged 2.7% to a record close Monday, and a day ahead of its scheduled “Prime Day” on Wednesday.

The company’s so-called Prime Day event is said to rival Black Friday deals, but the massive sales will only be available to Prime members, reports Tomi Kilgore for MarketWatch.

Analysts have turned optimistic on the future outlook of the online retailer. For instance, Wells Fargo analyst Matt Nemer also reiterated his top outperform rating. UBS analyst Eric Sheridan upgraded Amazon to buy from neutral, with a price target of almost 18% above current levels, pointing to the “fast growing and higher spending Prime subscriber base.”

“Further, we believe the resultant increase in Prime eligible product selection will lead to greater site conversion, increased annual spend per customer, and ultimately, higher levels of gross merchandise value for Amazon,” Sheridan added.

The consumer sector was strengthening on Tuesday, despite negative data on U.S. retail sales. The Commerce Department stated that U.S. retail sales dipped 0.3% last month, the weakest reading since February, and May retail sales were downwardly revised as well, Reuters reports.

Consumer Discretionary Select Sector SPDR

For more information on the discretionary sector, visit our consumer discretionary category.

Max Chen contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.