Crude Oil, Gold Look to US Retail Sales Data for Fed Policy Clues

Crude oil and gold prices are looking to May’s US Retail Sales Report to guide the markets’ expectations of a cutback in the Fed’s QE efforts.

Talking Points

Commodities Tread Water as Markets Weigh US, Chinese Economic Data

Crude Oil, Gold Look to Fed-Speak to Guide QE3 Taper Expectations

Cycle-sensitive crude oil and copper prices are joining in the rout in risky assets that started yesterday on Wall Street and continued overnight in Asia. The dour mood seems to reflect jitters ahead of May’s US Retail Sales report, the first big-ticket bit of event risk for the week since Friday’s NFP result that directly pertains to the central Fed QE3 reduction debate raging around the markets. Expectations call for receipts to rise 0.4 percent, marking an improvement from the 0.1 percent increase recorded in the prior month.

Investors seem to be concerned that a stronger outcome will increase the probability of a relatively sooner cutback in the size of Fed asset purchases. If that materializes, sentiment-geared commodities are likely to extend losses, with gold and silver likewise under pressure amid fading anti-fiat demand. Needless to say, a soft result will probably produce the opposite dynamic.

Crude Oil Technical Analysis (WTI)- Prices continue to consolidate in a choppy range below a falling trend line set from late January. This barrier is reinforced by the 50% Fibonacci expansion at 97.09, with a break above that initially exposing the 61.8% level at 98.47. Near-term support is at the 94.00 figure, with a move beneath that eyeing the June 3 low at 91.23.

Daily Chart - Created Using FXCM Marketscope 2.0

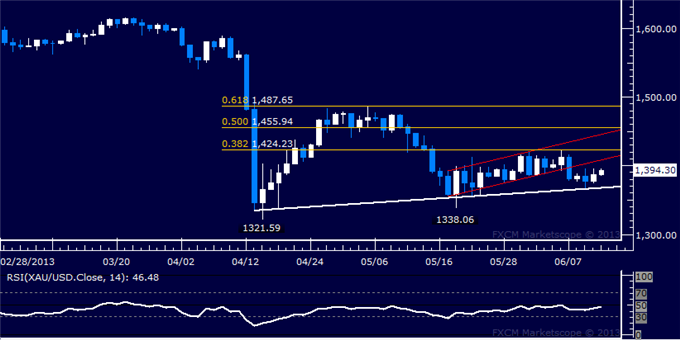

Gold Technical Analysis (Spot)- Prices are testing rising trend line support set from mid-April – now at – with a break lower aiming for recent swing lows in the 1321.59-38.06 area. Rising channel support-turned-resistance is at 1408.78. This barrier is reinforced by the 38.2% Fibonacci retracement at 1424.23, with a break above the latter level targeting the 50% Fib at 1455.94.

Daily Chart - Created Using FXCM Marketscope 2.0

Silver Technical Analysis (Spot)- Prices took out support at the 38.2% Fibonacci retracement (22.03) to expose the 50% level at 21.17. A further push beneath that aims for the 61.8% Fib at 20.31. Alternatively, a move back above 22.03 aims for the 23.6% expansion at 23.10.

Daily Chart - Created Using FXCM Marketscope 2.0

Copper Technical Analysis (COMEX E-Mini)- Prices broke support at 3.241, the 23.6% Fibonacci expansion, after putting in a bearish Evening Star candlestick pattern. Sellers now target the 38.2% level at 3.132. Alternatively, a reversal back above 3.241 aims for the May 8 highat 3.398.

Daily Chart - Created Using FXCM Marketscope 2.0

--- Written by Ilya Spivak, Currency Strategist for Dailyfx.com

To contact Ilya, e-mail ispivak@dailyfx.com. Follow Ilya on Twitter at @IlyaSpivak

To be added to Ilya's e-mail distribution list, please CLICK HERE

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.