Daily ETF Roundup: Lackluster ISM Data Pulls Stocks Lower

Wall Street was in for yet another choppy trading session to start out the week, as investors weighed the continuing fiscal cliff talks and two important economic reports. The Institute of Supply Management reported that its purchasing managers’ index fell to 49.5 last month, below economist’s expectations and the threshold reading of 50, indicating a contraction in activity for the month of November. Meanwhile, construction spending increased by 1.4% in October, a significantly larger gain than the expected 0.5% increase. In Washington, House Speaker John Boehner and six other House Republican leaders sent a letter to Obama calling for $800 billion in revenues through tax reforms and $2.2 trillion in net savings. Though the counter offer sparked some sense of optimism, bearish momentum quickly resumed, pushing markets lower [see also 101 ETF Lessons Every Financial Advisor Should Learn].

Global Market Overview: Lackluster ISM Data Pulls Stocks Lower

After a rather volatile session, all three major U.S. equity indexes slid into negative territory. The S&P 500 (SPY) posted a 0.02% came in at the bottom of the barrel, sliding 0.46% during the session. Led down by materials and industrials, the Dow Jones Industrial Average (DIA) logged in a 0.46% loss, while tech-heavy Nasdaq (QQQ) fell 0.27%. In Europe, markets were broadly higher after Greece announced its plan to repurchase $12.98 billion worth of its outstanding debt. Asian equities also closed higher after China’s purchasing mangers’ index for November rose to a seven-month high; Japan’s Nikkei Stock Average inched 0.1% higher, while China’s Shanghai Composite jumped 1.0%.

Bond ETF Roundup

Prices for U.S. Treasuries were mixed today, as investors weighed weak manufacturing data and continuing negotiations in Washington. Yields on 5 and 10-year notes rose, while 30-year bond yields slipped 1 basis point to 2.80%. Bond investors will be keeping a close eye on the November U.S. jobs report due Friday, which could play a key role in the Fed’s interest rate meeting next week.

Commodity ETF Roundup

Everyone’s favorite precious metal made headlines today, as gold for February delivery rose 0.5% during the session on a weaker dollar after falling 2.3% last week. Oil futures also rose, scoring a third-straight gain. Prices for soybeans, corn, and silver also closed higher [see also Citi's Energy Outlook For 2013].

ETF Chart Of The Day #1: XLI

The State Street Industrial Select Sector SPDR ETF (XLI, A+) was one of the worst performers today, shedding 1.08% during the session. Industrial shares were among today among today’s laggards after ISM manufacturing came in lower than expected. In response, this ETF tumbled following the report, only to inch lower throughout the day. XLI eventually settled at its low of $36.73 a share [see also High Tech ETFdb Portfolio].

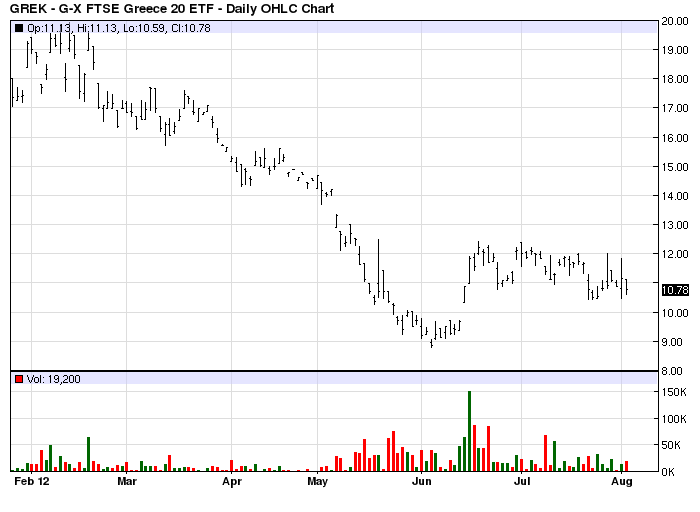

ETF Chart Of The Day #2: GREK

The Global X FTSE Greece 20 ETF (GREK, C) was one of the best performers of the day, gaining 1.92% during the session. Following Greece’s announcment that it plans to repurchase $12.98 billion worth of its outstanding debt, this ETF gapped significantly higher at the open. GREK slid sideways for the rest of the day, eventually settling at $15.93 a share [see also Euro Free Europe ETFdb Portfolio].

ETF Fun Fact Of The Day

Only four ETFs offer exposure to SuperValu (SVU), whose shares jumped 12.61% today after news that a private equity firm is willing to pursue multiple options for a deal. The Mid Cap Fund (RWK) allocates 1.68% to the grocer.

[For more ETF analysis, make sure to sign up for our free ETF newsletter or try a free seven day trial to ETFdb Pro]

Disclosure: No positions at time of writing.

Click here to read the original article on ETFdb.com.

Related Posts:

Wednesday’s ETF Chart To Watch: Industrial Select Sector SPDR (XLI)

Friday’s ETF Chart To Watch: Industrial Select Sector SPDR (XLI)