Death Of The CME’s Big S&P Futures Contract

Harry “The Hat” Lawrence once ruled the CME trading floor. If you had a problem you went to “HAT.” The orders in HAT’s hands consisted of thousands of contracts that paid brokerage from $1.50 to $2.00 a contract. HAT was the sponsor for my membership on the floor and was always a good friend.

While no one likes to use the term “in the old days,” that’s how this has story has to begin, in the old days. I was on the floor at the old Chicago Mercantile Exchange floor at Riverside Plaza. Back then the futures pits were front and center. As soon as you walked on the floor you could hear the “growling of the pits.”

It was a shocking place if you were a guest and saw 30 people all come flying off the top step of the S&P pit [CME:SPM14] and it was even more shocking to see how fast they got back up there. It was a constant battle for everything from getting a parking spot at the exchange to getting a Coke in the members’ lounge. Competition was everywhere. Everything was a fight, but the biggest threat to a floor trader was his spot in the pit.

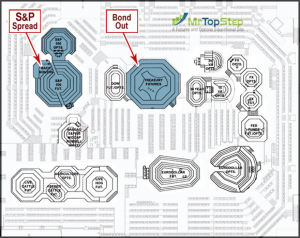

Futures pits

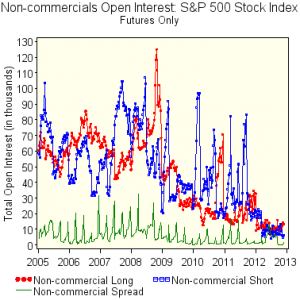

The bond and S&P [SNP:^GSPC] roll that used to take over a month to do is now done in one to two days as more traders move away from the pit the the screen. On March 3 during the S&P rollover there was over 210,000 SPH big S&P open interest and on April 1 total open interest was 110,000. As of this morning total SPM opening interest is 124,000.

The line from the old Army ballad, “old soldiers never die; they just fade away” applies to traders as well. But no one could have known what was going to happen to the trading floor and its occupants after electronic trading took over. The gold pit, the bond pit, the crude pit, the Eurodollar pit , the meat pits, the grain pits—one by one they all died as the futures contracts they used to buy and sell with “paper” disappeared.

There was a time in the S&P pit when if you tried to grab the spot an order filler or local stood in, your life would get threatened. I am 100% serious—and so were some of the guys making the threats. In high-volume places like the bond and S&P pits, your “spot” in the pit could mean the difference between making millions or making nothing.

You messed with the wrong guys in the pit they would shut you out, not look at you when you said “buyem” or “sold.” Literally, you could become the invisible man if you didn’t play the game right, and if the order filler wanted he could turn around and sell you a 50-lot or 100-lot and then unload 900 more lots right in your face. Back then one point or handle in the S&P on a 100-lot was $50,000. If you messed with the wrong people you could end up paying for it.

End of the big S&P

At the height of the S&P pit came record open interest. At one point the big S&P had over 650,000 contracts of total open interest. On a good day 150,000 to 180,000 contracts would trade in the pit. During the rollover a broker that did Merrill Lynch, JP Morgan or Goldman Sachs business could fill 100,000 contracts in a day. It was a big business for the order fillers but it was even more critical to be able to trade with the order filler or you would miss all the good trades and more than likely get stuck with the bad ones.

In its heyday there was no place on earth where someone could make or lose so much money so fast. The S&P pit became the mecca of futures trading and that’s coming from me, who had operations in every pit in both the CME Group and the Chicago Board of Trade. Sure the NYMEX’s crude pit was big and the locals and order fillers made millions, but the S&P dominated them all. When the S&P is moving it takes no prisoners.

Electronic trading killed the goose

When the CME flipped the switch on electronic trading, many pit people left. In the early days many of the locals and order fillers thought the game was over; little did they know the traders in the S&P pit were not going to just give up. As more contracts moved to the screen it was “attrition” that moved traders and order fillers out of the pits. As a member you are still allowed to trade in the futures pits, but most of the pits are down to less than 10 traders standing in them.

The exception to the rule has always been the S&P. Years after most futures pit traders had left the floor, the S&P pit still held a local population. Not until the last 18 months did that start to change, going from 60 to 80 locals on a good day down to 40 to 50 on a good day and 15 or 20 when the markets are quiet.

One of the things holding the pit together was the “S&P quarterly roll.” Despite having nearly 2.8 million in open interest in the e-mini S&P, the big contract held its own for years. Every rollover the spreaders and clerks would return and start rolling positions. It is one of the easiest jobs in the industry: come in for two or 3 weeks a quarter, fill a bunch of big S&P spreads and come back 2 1/2 months later and make some big bucks. The idea in the big S&P spread was that it saved the customer commissions to roll the ES positions in the big contract, but that’s not how it works anymore. And after the March rollover that may not be how it works for much longer.

Going into the March rollover we had already seen the open interest drop from 650,000 down to 225,000 over the last several years. For several years the big open interest held above 200,000 contracts up to 230,000 but during the last rollover nearly 100,000 big S&P expired, leaving the big contract open interest at just over 110,000 contracts. Over the last few weeks some EFPs (exchange for physical) have pushed it back up to 120,000, but it’s my guess that it’s just a matter of time until it goes from 120,000 down to 70,000 and lower.

Institutions and big hedge funds have no use for the big S&P anymore. Deutsche Bank, Merrill Lynch and Goldman, who used to roll thousands of big S&P contracts, are not using the pit anymore. Sure, they still do some spreads, but every roll just gets smaller and smaller.

The conclusion is that while the spread may be disappearing, the ultimate effect is less volume both in the spread and the pit, where the locals that still depend on the open outcry orders to trade are starting to disappear.

The CME said years ago that when the threshold of volume reached 99% in the electronic, the pit would be closed. Well, that threshold was reached years ago. Now it looks like the pit will close when the open interest in the big S&P disappears … which at this rate can be very long.

Today the Asian markets closed mostly higher and in Europe 9 of 12 markets are trading higher. Today’s economic and earnings calendar starts with jobless claims, Philadelphia Fed Business Survey, EIA natural gas report, 5- and 7-year note announcement, Fed balance sheet, money supply and earnings from General Electric, Morgan Stanley, Pepsico and Chipotle.

Our view: Rockem Sockem Robots

When the robots get going they really get going. The last 3 weeks have been filled with an overabundance of program and algorithmic trading. The range and the volumes have exploded, going from an average of 1.3-1.4 million contracts a day to 2.2mil to 2.5 mil a day. We were right; this week just had too many obstacles: Passover, mid-month rebalance, the options expiration, and the shortened week due to Good Friday and the stock market being closed.

Our view is the S&P is still going up, but after being up 3 days in a row for a total gain of over 40 handles we are just unsure how much higher the S&P can go before it pulls back again. What we do know is volatility has been spiking a lot recently and we don’t think it’s over.

As always, keep an eye on the 10-handle rule and please use stops when trading futures and options.

In Asia, 8 of 11 markets closed higher: Shanghai Comp. +0.28% , Hang Seng +0.02%, Nikkei +0.2%

In Europe, 8 of 12 markets are trading lower: DAX -0.20%, FTSE -0.11%

Morning headline: “S&P futures seen lower;Google and IBM earning weigh down”

S&P Fair Value: 1855.81 (futures same at 1856.25 as of 7:39AM CT)

Total volume: 1.64M ESM and 5.7K SPM traded

Economic calendar: Jobless claims, Philadelphia Fed Business Survey, EIA natural gas report, 5- and 7-year note announcement, Fed balance sheet, money supply and earnings from General Electric, Morgan Stanley, Pepsico and Chipotle.

[s_static_display]