Elliott Management's Paul Singer Reports Activist Position, 5 Other New Buys

Paul Singer (Trades, Portfolio) is the founder of Elliott Management, a $24 billion New York-based hedge fund. The money manager is known for being zealous regarding conservative fiscal causes and highly critical of fiscal stimulus and other actions of the Fed. In 2014, he has entered the activist investment space with positions in Juniper and Riverbed, where he is pushing for change.

The long portfolio of Elliott Management followed by GuruFocus contains 42 positions with a value of $4.4 billion. It is 33.7% weighted in the energy sector, followed by technology at 23.5% and ETF, options and preferred at 22.5%.

In the fourth quarter of 2013, Singer bought six new stocks: Juniper Networks Inc. (JNPR), Companhia De Saneamentao Basico Do Estado De Sao Paulo (SBS), Time Warner Cable Inc. (TWC), Anadarko Petroleum Corp. (APC), PowerShares QQQ Trust (QQQ) and General Motors (GM).

Juniper Networks Inc. (JNPR)

Singer began purchasing shares of Juniper in the fourth quarter, and became a significant stakeholder beginning in January 2014. After a series of 13D filings, Elliott reported owning 36,915,600 shares, or 7.4% of the company, as of March 12.

Elliott Management has also nominated several candidates for election to the company's board of directors, who will be voted on at the 2014 Annual Meeting of Stockholders.

After being pressured by Singer and several other activist firms, Juniper on Feb. 27 announced a $1.2 billion accelerated share repurchase program.

Juniper Networks is a networking company founded in 1996 and reincorporated in Delaware in 1998. Juniper has a market cap of $12.77 billion; its shares were traded at around $25.48 with a P/E ratio of 29.7 and P/S ratio of 2.8. Juniper Networks had an annual average earnings growth of 6.10% over the past five years.

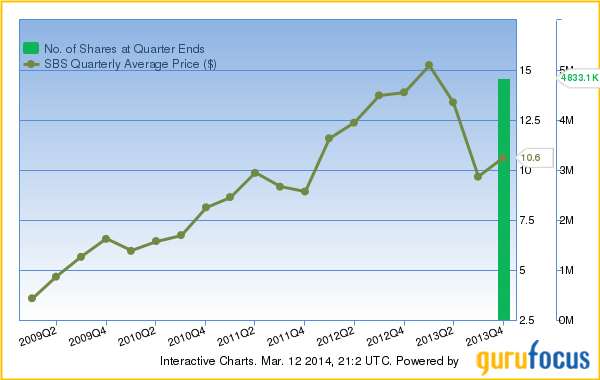

Companhia De Saneamento Basico Do Estado De Sao Paulo (SBS)

Singer purchased 4,833,099 shares of Companhia De Saneamento in the fourth quarter when the stock's price averaged $11. The price has since dropped 15% from the average. It is 1.2% of his portfolio.

Companhia De Saneamento Basico provides water and sewage services to residential, commercial, industrial & governmental customers. Companhia De Saneamento Basico has a market cap of $6.14 billion; its shares were traded at around $8.98 with a P/E ratio of 6.10 and P/S ratio of 1.30. Companhia De Saneamento Basico had an annual average earnings growth of 10.30% over the past five years.

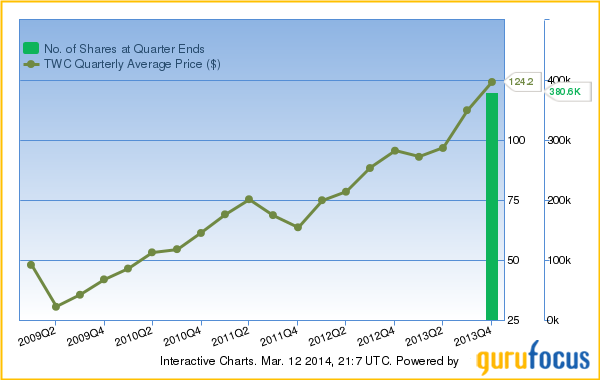

Time Warner Cable Inc. (TWC)

Singer bought 380,563 shares of Time Warner Cable in the fourth quarter, when the price averaged $124 per share. It has since dropped 12% from the average to $139. The holding makes up 1.2% of his portfolio.

Time Warner Cable was incorporated as a Delaware corporation on March 21, 2003. Time Warner Cable has a market cap of $38.44 billion; its shares were traded at around $138.56 with a P/E ratio of 20.70 and P/S ratio of 1.80. The dividend yield of Time Warner Cable stocks is 1.90%. Time Warner Cable had an annual average earnings growth of 12.20% over the past five years.

Anadarko Petroleum Corp. (APC)

Singer purchased 515,000 shares of Anadarko Petroleum in the fourth quarter, when the price averaged $87. The price has since dropped 8% from the average. The holding is 0.93% of his portfolio.

Anadarko Petroleum Corp. was incorporated in the State of Delaware. Anadarko Petroleum Corp. has a market cap of $41.42 billion; its shares were traded at around $82.23 with a P/E ratio of 52.60 and P/S ratio of 2.9. The dividend yield of Anadarko Petroleum Corp. stocks is 0.8%. Anadarko Petroleum Corp. had an annual average earnings growth of 12.2% over the past five years.

QQQ Trust (QQQ)

Singer bought 50,000 shares of the PowerShares QQQ Trust, Series 1 ETF in the fourth quarter, at a total value of $4.4 billion. The holding encompasses 0.1% of the portfolio.

PowerShares QQQ Trust, Series 1 (ETF) has a market cap of $41.19 billion; its shares were traded at around $90.56. The dividend yield of PowerShares QQQ Trust, Series 1 (ETF) stocks is 1.00%.

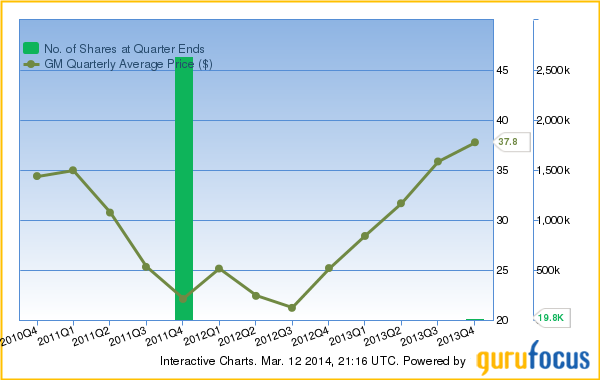

General Motors (GM)

Singer bought 19,759 shares of General Motors, his smallest new holding, during the quarter when the price averaged $38 per share. He previous owned more than 2.6 million shares of the company in fourth quarter 2011, and sold out the position in the subsequent quarter. The price has dropped 8% from the quarter's average price, and the holding is 0.018% of the portfolio.

General Motors designs, builds and sell cars, trucks and automobile parts. General Motors has a market cap of $55.42 billion; its shares were traded at around $34.86 with a P/E ratio of 24.80 and P/S ratio of 0.40.

For more Paul Singer (Trades, Portfolio) buys and sells, see his portfolio here. Not a Premium Member of GuruFocus?Try it free for 7 days here!

This article first appeared on GuruFocus.