Emerging Market ETFs Pay Dividends Too

The dividend growth style has been a popular investment theme this year as volatility gripped U.S. Exchange traded fund investors, though, need not limit themselves to domestic markets as there are international dividend growth strategies as well.

For example, the relatively new ProShares MSCI Emerging Markets Dividend Growers ETF (EMDV) is the sixth ETF in the ProShares lineup of dividend growers funds, which includes the popular ProShares S&P 500 Aristocrats ETF (NOBL) .

The ProShares MSCI Emerging Markets Dividend Growers ETF follows the MSCI Emerging Markets Dividend Masters Index, which targets MSCI Emerging Market components that have increased dividend payments each year for at least seven consecutive years.

SEE MORE: Stick With Emerging Market ETF Leaders

The index contains a minimum of 40 stocks, which are equally weighted. No single sector may compose more than 30% of the index, and no single country may compose more than 50% of the index. If there are fewer than 40 stocks with at least seven consecutive years of dividend growth, or if sector or country caps are breached, the index will include companies with shorter dividend growth histories.

The underlying index shows a dividend yield of 3.32%.

A strategy centered around dividend growth has been used as a way to screen for quality companies that may have the ability to provide sustainable growth and payouts along the way.

SEE MORE: Looking to ETF Dividend Growers During Uncertain Times

“Companies that consistently grow their dividends tend to be high-quality companies with the potential to withstand market turmoil and can still deliver strong risk-adjusted total returns over time,” according to ProShares. “Companies that cut or suspend a dividend may have cash flow problems or too much debt on the books. Target the companies that have consistently grown dividends over time has historically been an effective way to outperform the market.”

EMDV currently includes a large 22.1% tilt toward China, along with 17.2% India, 16.1% South Africa, 8.5% Taiwan, 5.6% Colombia, 5.1% Korea, 4.8% Indonesia, 3.8% Turkey, 3.5% Thailand, 3.4% Mexico, 3.3% Russia, 1.8% Brazil, 1.7% Malaysia, 1.6% Qatar and 1.5% UAE.

Financial services, typically the largest dividend payers in many emerging markets, are EMDV’s largest sector weight at 29.7%. Technology, consumer staples and consumer discretionary names combine for over 39% of the ETF’s weight.

For more information on the developing economies, visit our emerging markets category.

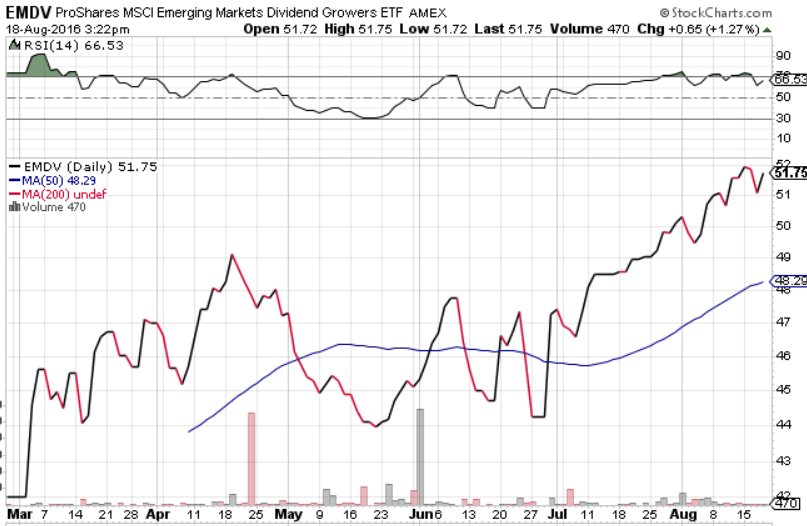

ProShares MSCI Emerging Markets Dividend Growers ETF