Energy ETF Rally has Options Bears Waving the White Flag

Thursday was a bad day for stocks, but oil did not get the memo. The United States Oil Fund (USO) climbed nearly 2% to its highest levels of the year, finishing April with a gain of nearly 20%.

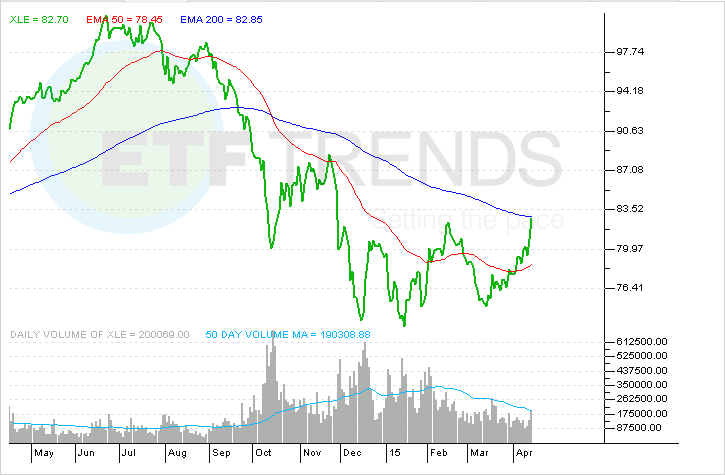

Oil’s April surge lifted the Energy Select Sector SPDR (XLE) to a gain of almost 6% and the recent bullishness for the largest equity-based energy exchange traded fund is chasing bearish options traders.

“On Wednesday, when bulls in the options for the XLE outpaced bears by a ratio of 2 to 1, a trader sold 5,000 contracts of 75-strike puts expiring in June for a price of 45 cents each. As this was a closing trade, the trader is indicating that he or she no longer expects the XLE to see a price below $75-or nearly 10 percent lower than where the ETF finished the day on Wednesday-any time in the next two months,” according to CNBC.

After tumbling 8.7% last year, making it the worst of the nine sector SPDRs, XLE is up 5.1% this year, making it the second-best SPDR behind the Health Care Select Sector SPDR (XLV).

Even with last year’s struggles, the energy sector is still expensive on valuation and perhaps even more so when considering the dismal profit and revenue expectations for the group. [Energy ETFs Still Expensive]

“Forward revenues is at a six-year low, and forward earnings is at an 11-year low. Both are also down the most among the 10 S&P 500 sectors over the past month, three months, and six months. For the next 12 months, forward revenues is expected to fall 18.6%, and forward earnings is expected to decline 40.1%–lowest among the 10 sectors and the only sector with negative readings. Analysts expect annual earnings to fall 58.0% in 2015 after rising 1.0% in 2014,” according to a note published by Yardeni Research on April 22.

XLE bulls got some welcomed news earlier this week when the ETF’s largest holding, Exxon Mobil (XOM) raised its dividend. That extended Exxon’s dividend increase streak, quashing fears that the largest U.S. oil company would respond to lower prices by foregoing its dividend aristocrat status. [Exxon Stays in Dividend ETFs]

Schlumberger (SLB) and Kinder Morgan (KMI), XLE’s third- and fourth-largest holdings, respectively, have also recently boosted payouts. Exxon, Schlumberger and Kinder Morgan combine for 27.2% of XLE’s weight. The ETF has a dividend yield of 2.35%.

Energy Select Sector SPDR