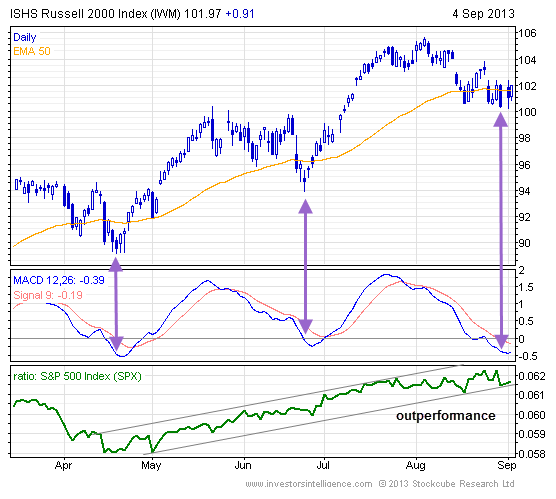

ETF Chart of the Day: U.S. Small-Cap Stocks

With Small-Caps leading the slide in equities yesterday and IWM (iShares Russell 2000, Expense Ratio 0.28%) trading at its lowest levels since early March (falling below $90 briefly), today we take a look at “Small Cap” sector ETF products that likely evade the screens of most institutional portfolio managers due to lower average daily volume levels.

With an assortment of U.S. Large Cap Equity sector ETFs available that clearly have attracted the attention of tactical sector managers (issuers such as SSGA, iShares, Vanguard, and First Trust all have their versions of ETFs that track Consumer Discretionary, Consumer Staples, Energy, Financials, Healthcare, Industrials, Basic Materials, Technology and Telecom, and Utilities) as well as billions of dollars under management, “Small Cap” sector oriented products are still largely in the “undiscovered” stage.

PSCD (PowerShares S&P SmallCap Consumer Discretionary, Expense Ratio 0.29%), PSCC (PowerShares S&P SmallCap Consumer Staples, Expense Ratio 0.29%), PSCE (PowerShares S&P SmallCap Energy, Expense Ratio 0.29%), PSCF (PowerShares S&P SmallCap Financials, Expense Ratio 0.29%), PSCH (PowerShares S&P SmallCap Healthcare, Expense Ratio 0.29%), PSCI (PowerShares S&P SmallCap Industrials, Expense Ratio 0.29%), PSCT (PowerShares S&P SmallCap Info Technology, Expense Ratio 0.29%), PSCM (PowerShares S&P SmallCap Materials, Expense Ratio 0.29%), and PSCU (PowerShares S&P SmallCap Utilities, Expense Ratio 0.29%) launched a little over three years ago, giving them a real live track record at this point in excess of three years.

The largest fund in this group in terms of assets under management is PSCT, which has $112 million, but some of the other funds are much smaller, like PSCM for instance which has shy of $7 million in the fund currently and trades about 4,800 shares on an average daily basis.

We are quite surprised that these ETFs have not been embraced more quickly by those managers that are inclined to trade sectors from a relative strength, rotational strategy standpoint, especially since live modeling data is now present and these ETFs like their large cap counterparts, track S&P indices as well.

This said, like many ETF strategies, all it takes sometimes is time and presence and small hints of trading activity and asset flows can generally lead to great things in terms of momentous asset growth.

PowerShares S&P SmallCap Info Technology

For more information on Street One ETF research and ETF trade execution/liquidity services, contact Paul Weisbruch at pweisbruch@streetonefinancial.com.