ETF Investing Ideas for 2013

The exchange traded fund industry continues to innovate and evolve. Strategies have emerged to help investors cope with market uncertainty while other products have dissolved due to lack of investor interest.

“In this country, we like ‘new and improved,’ but in the world of investing, just because it’s new and improved doesn’t mean it’s necessarily better,” says Adam Bold, founder and chief investment officer of investment adviser the Mutual Fund Store, in a recent report.

Some of the more successful trends recently seen in the ETF industry include low-volatility stock ETFs, emerging market local currency bonds and actively managed bond ETFs.

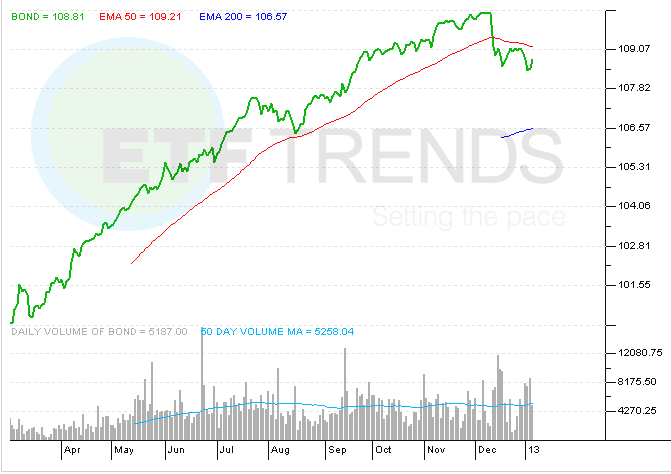

The PIMCO Total Return ETF (BOND) paved the way for active management in the ETF industry as well as actively managed bonds. There was about $4.9 million in inflows for actively managed bond funds in early 2012, compared to $112.5 million into stock ETFs.

“While most ETFs track the performance of indexes or other benchmarks, some 55 actively managed ETFs have been launched, according to Morningstar, including 38 in the past three years. Only 12 of those 38 were actively managed,” Anna Prior wrote for The WSJ. [2012 Was the Year of the Bond ETF]

Due to the market uncertainty, low-volatility stock ETFs appealed to investors last year, with about 6 such funds coming to market and pulling in $2.2 billion in inflows. The PowerShares S&P Low-Volatility ETF (SPLV) gave back 10.1% last year, which was less than the 16% return for the S&P 500, according to Morningstar data. These types of funds seem to favor upward cycles in equities and take a hedge fund type approach while reducing overall portfolio volatility. [Three Types of Low-Volatility ETFs]

Emerging market local currency bond funds track bonds from foreign countries such as Brazil or Turkey and have a much higher yield than similar bonds from developed markets. Besides serious portfolio diversification, some argue that such funds are better than traditional U.S.-dollar-denominated emerging-markets debt at reflecting the economic climates in their countries. The higher credit quality in shorter durations has proven helpful than those overseas bond denominated n U.S. dollars, reports Prior. [ETF Trends for 2013: Bonds, Dividends, Emerging Market Debt]

ETF industry flops include the 130/30 strategy, where the fund is 130% long and 30% short while invested in the market. The target of these funds is to outperform ETFs that only buy equities, while risk-reduction is not a goal. Volatility-tracking ETFs and ETNs (exchange traded notes) give investors the ability to bet on increasing volatility within the stock market, measured by the VIX Volatility Index. As a group, this ETF category was down 18% in 2012.

PIMCO Total Return ETF

Tisha Guerrero contributed to this article.

Full disclosure: Tom Lydon’s clients own BOND.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.