EUR/USD Eyes Monthly Low as ECB Draghi Hints at QE- CPI in Focus

DailyFX.com -

Talking Points:

- EUR/USD Breaks Weekly Opening Low as ECB President Draghi Hints at QE.

- USD/CAD Threatens Bullish RSI Momentum on Strong Canada CPI.

- USDOLLAR to Face Larger Pullback as RSI Divergence Continues to Take Shape .

For more updates, sign up for David's e-mail distribution list.

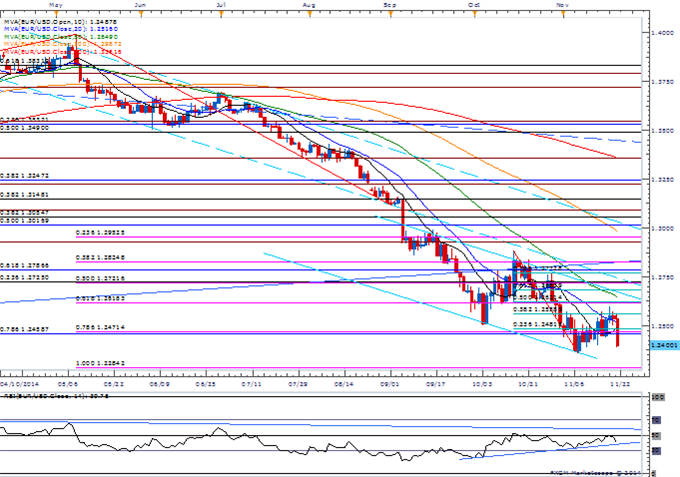

EUR/USD

Chart - Created Using FXCM Marketscope 2.0

EUR/USD slips to fresh weekly low of 1.2404 as European Central Bank (ECB) President Mario Draghi pledges to implement more non-standard measures should the current policy fail to boost growth & inflation.

Euro remains at risk for a further decline next week as the Euro-Zone Consumer Price Index (CPI) is expected to slow further in November.

Seeing increased volatility in the DailyFX Speculative Sentiment Index (SSI) as retail crowd turns net-long EUR/USD today, with the ratio currently standing at +1.24.

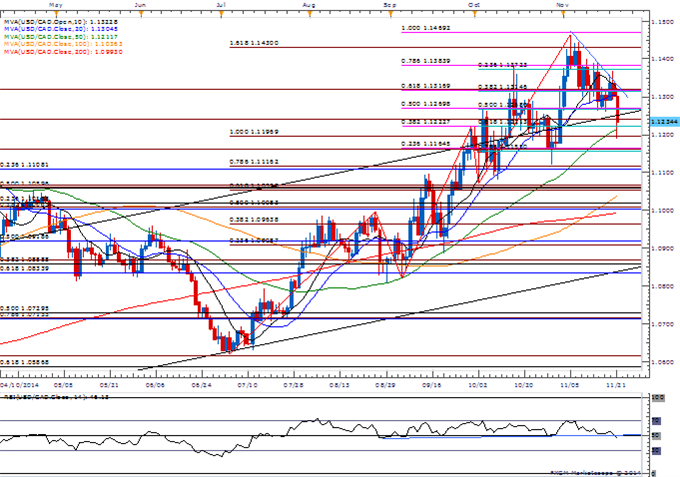

USD/CAD

USD/CAD looks poised for a larger correction as Canada CPI beats market expectations, while the Relative Strength Index (RSI) struggles to retain the bullish momentum from back in September.

Nevertheless, will look for a resumption of the series of higher highs & lows as the Bank of Canada (BoC) retains a wait-and-see approach; will keep a close eye on Canada’s 3Q Gross Domestic Product (GDP) report as the economy is expected to grow an annualized 2.1% after expanding 3.1% during the three-months through June.

Next downside region of interest comes in around 1.1155 (78.6% retracement) to 1.1165 (23.6% expansion).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Scalping the AUDUSD Correction- Longs Favored Above 8565

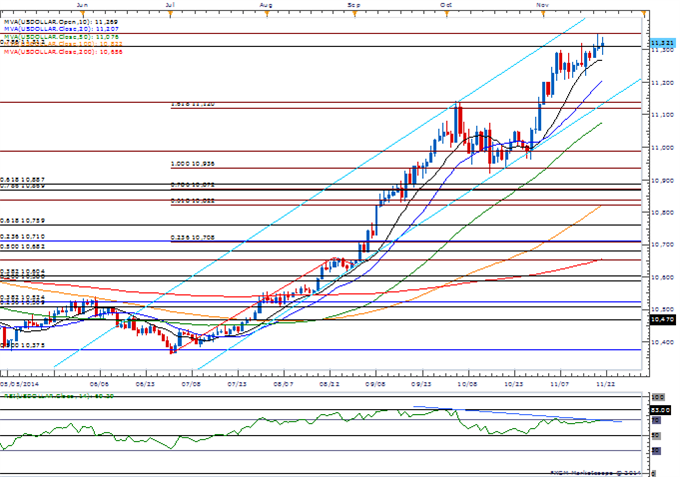

USDOLLAR(Ticker: USDollar):

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 11321.61 | 11339.42 | 11286.29 | 0.07 | 83.08% |

Chart - Created Using FXCM Marketscope 2.0

Dow Jones-FXCM U.S. Dollar Index may face a larger pullback amid the ongoing series of failed attempts to close above 11,312 (78.6% retracement); will wait for a bullish RSI break to revert back to the approach of buying dips in the greenback.

May see the preliminary 3Q GDP report undermine the bullish sentiment surrounding the USDOLLAR as market participants looks for a downward revision to 3.3% from 3.5%; will also keep a close eye on Personal Income & the Personal Consumption Expenditure (PCE) amid the subdued outlook for inflation.

As the failure to close above 11,312 (78.6% retracement) to 11,351 (78.6% expansion) raises the risk for a near-term top, will keep an eye on former resistance around 11,120 (161.8% expansion) to 11,138 (61.8% expansion) for initial support.

Join DailyFX on Demand for Real-Time SSI Updates!

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.