EUR/USD to Press Fresh Monthly Highs on Lackluster U.S. CPI

DailyFX.com -

- U.S. Consumer Price Index (CPI) to Slow for Fourth Time in 2014.

- Core Rate of Inflation to Hold at Annualized 1.7% for Third Month.

For more updates, sign up for David's e-mail distribution list.

Trading the News: U.S. Consumer Price Index (CPI)

A downtick in the U.S. Consumer Price Index (CPI) may spark a more meaningful rebound in EUR/USD as it dampens the interest rate outlook for the world’s largest economy.

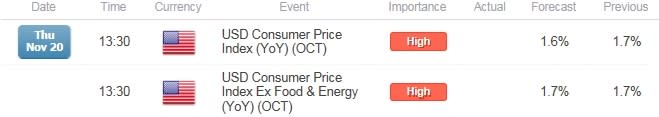

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

It seems as though the Federal Open Market Committee (FOMC) is in no rush to normalize monetary policy as a growing number of central bank officials highlight the downside risk for inflation expectations, and a marked slowdown in price growth may undermine the bullish sentiment surrounding the greenback as central bank hawks Richard Fisher and Charles Plosser lose their vote in 2015.

Expectations: Bearish Argument/Scenario

Release | Expected | Actual |

Average Hourly Earnings (YoY) (OCT) | 2.1% | 2.0% |

Personal Income (SEP) | 0.3% | 0.2% |

ISM Non-Manufacturing (OCT) | 58.0 | 57.1 |

Subdued wages paired with the slowdown in service-based activity may drag on price growth, and a weaker-than-expected CPI print may trigger a larger rebound in EUR/USD as market participants scale back bets for higher borrowing costs in the U.S.

Risk: Bullish Argument/Scenario

Release | Expected | Actual |

U. of Michigan Confidence (NOV P) | 87.5 | 89.4 |

NFIB Small Business Optimism (OCT) | 96.0 | 96.1 |

Consumer Confidence (OCT) | 87.0 | 94.5 |

Nevertheless, the ongoing improvement in household and business confidence may stoke faster price growth, and a strong inflation report should boost the appeal of the greenback as it raises the Fed’s scope to normalize monetary policy sooner rather than later.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

How To Trade This Event Risk(Video)

Bearish USD Trade: U.S. CPI Slows to Annualized 1.6% or Lower

Need to see green, five-minute candle following the release to consider a long trade on EURUSD

If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bullish USD Trade: Headline & Core Price Growth Exceed Market Expectations

Need green, five-minute candle to favor a short EURUSD trade

Implement same setup as the bearish dollar trade, just in the opposite direction

Potential Price Targets For The Release

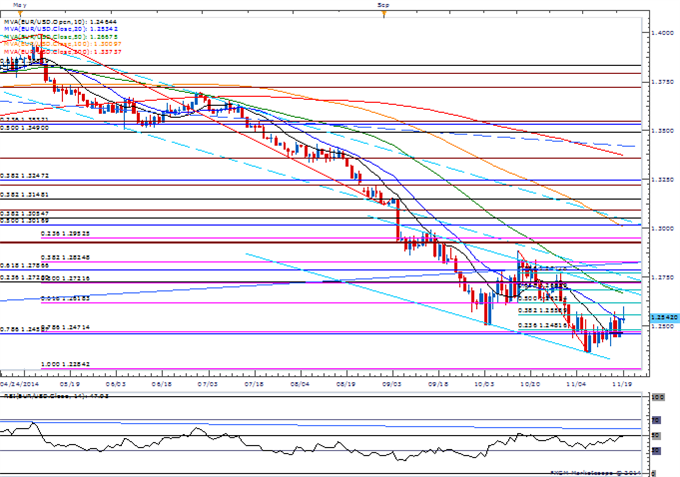

EUR/USD Daily Chart

Chart - Created Using FXCM Marketscope 2.0

With the break of the monthly opening range, will watch former support on EUR/USD for new resistance.

Interim Resistance: 1.2610 (61.8% expansion) to 1.2620 (50% retracement)

Interim Support: 1.2280 (100% expansion) to 1.2300 pivot

Read More:

Scalping the EURNZD Recovery- Interim Resistance 1.5980

Price & Time: Make Or Break For AUD/USD

Impact that the U.S. CPI report has had on EUR/USD during the last release

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

SEP 2014 | 10/22/2014 12:30 GMT | 1.6% | 1.7% | -24 | -59 |

September 2014 U.S. Consumer Price Index

The U.S. Consumer Price Index (CPI) held steady at an annualized rate of 1.7% in September amid forecasts for a 1.6% print. At the same time, the core rate of inflation also remained unchanged at 1.7% during the same period. Lower energy and transportation costs continued to drag on price growth, while the report showed stable prices for nearly all other sectors. With the subdued outlook for inflation, the Fed may retain the highly accommodative policy for an extended period of time in order to balance the risks surrounding the region. The better-than-expected CPI print spurred a bullish reaction in the greenback, with EUR/USD slipping below 1.2675 during the North America trade to end the day at 1.2637.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.