Euro to Rebound as Unemployment Declines- Former Support in Focus

- German Unemployment to Decline for Three Straight Month

- Unemployment Reported to Hold at 6.8% for Third Month

Trading the News: German Unemployment Change

Another 10.0K drop in German Unemployment may spur a bullish reaction in the EURUSD as it limit’s the European Central Bank’s (ECB) scope to further embark on its easing cycle at the March 6 meeting.

What’s Expected:

Time of release: 02/27/2014 8:55 GMT, 3:55 EST

Primary Pair Impact: EURUSD

Expected: -10K

Previous: -28K

DailyFX Forecast: -10K to 10K

Why Is This Event Important:

With the ECB interest rate decision quickly approaching, positive developments coming out of Europe’s largest economy may limit the downside risk for the single currency, but the Governing Council may have little choice but to implement more non-standard measures this year amid the persistent threat for disinflation.

Expectations: Bullish Argument/Scenario

Release | Expected | Actual |

IFO Business Climate (FEB) | 110.5 | 111.3 |

IFO Expectations (FEB) | 108.1 | 108.3 |

Gross Domestic Product s.a. (QoQ) (4Q P) | 0.3% | 0.4% |

German’s unemployment report may continue to exceed market expectations as the rise in business confidence instills a positive outlook for the labor market, and a better-than-expected print may generate a short-term rebound in the EURUSD as it dampens bets for additional monetary support.

Risk: Bearish Argument/Scenario

Release | Expected | Actual |

Industrial Production s.a. (MoM) (DEC) | 0.3% | -0.6% |

Factory Orders (MoM) (DEC) | 0.2% | -0.5% |

Retail Sales (MoM) (DEC) | 0.2% | -2.5% |

However, the slowdown in business outputs paired with the ongoing weakness in private sector consumption may limit the prospects for a marked decline in unemployment, and a dismal print may heighten the bearish sentiment surrounding the single currency as it curbs the outlook for growth and inflation.

How To Trade This Event Risk(Video)

Join DailyFX on Demand to Cover Current Trade Setups on the Euro

Bullish Euro Trade: German Unemployment Falls 10.0K or Greater

Need green, five-minute candle following the report to consider a long Euro trade

If the market reaction favors a bullish EURUSD trade, buy with two position

Set stop at the near-by swing high/reasonable distance from entry with at least 1:1 risk-to-reward

Move stop to cost on remaining position once initial target is met; set reasonable limit

Bearish Euro Trade: Labor Report Disappoints

Need red, five-minute candle following the release to look at a short EURUSD entry

Implement same setup as the bullish Euro trade, just in reverse

Potential Price Targets For The Release

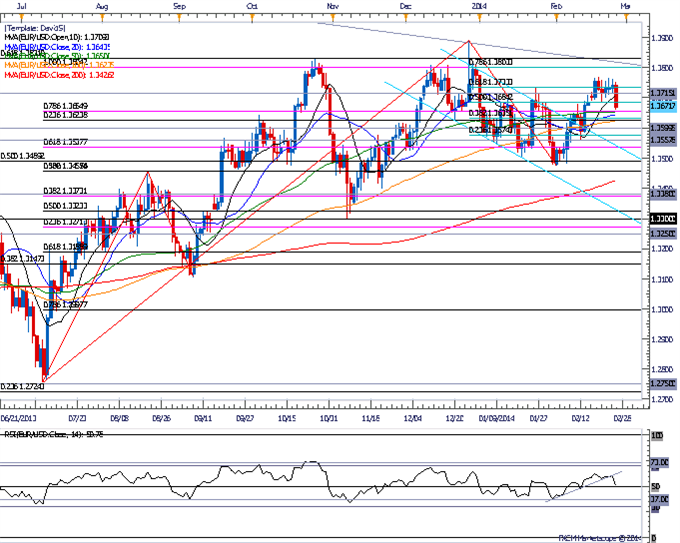

EUR/USD Daily

Chart - Created Using FXCM Marketscope 2.0

Carves Lower High Within 2008 Down Trend; At Risk for Lower Low

RSI Fails to Preserve Bullish Momentum from Start of February

Interim Resistance: 1.3800 (100.0 expansion) to 1.3830 (61.8 retracement)

Interim Support: 1.3450 (38.2% retracement) to 1.3460 (50.0% expansion)

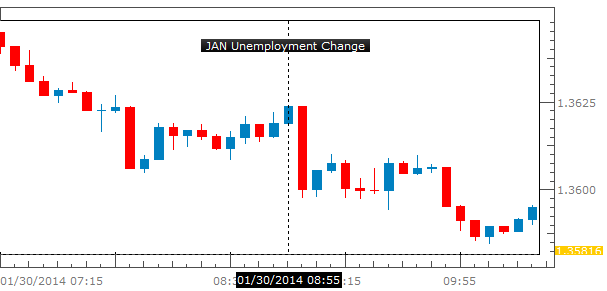

Impact that the change in German Unemployment has had on EUR during the last month

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

JAN 2014 | 01/30/2014 8:55 GMT | -6K | -28K | -27 | -67 |

January 2014 German Unemployment Change

Germany’s January unemployment change print came in far better than market expectations and the -28K change figure was the best since 2011. The unemployment figure also ticked down by a tenth of a percent to 6.8%, but the Euro fell against the Dollar and continued to until bottoming out on February third. Although inflation data met estimates on Monday, EUR crosses remain at key technical levels and negative catalysts could bring out sellers in EUR/USD and EUR/JPY pairs.

--- Written by David Song, Currency Analyst and Gregory Marks

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.