Eurozone Debt Sell-Off Drags on U.S. Bonds, Mortgage-Backed Securities ETFs

The global fixed-income sell-off is taking a toll on government bonds, pressuring mortgage-backed securities and related exchange traded funds.

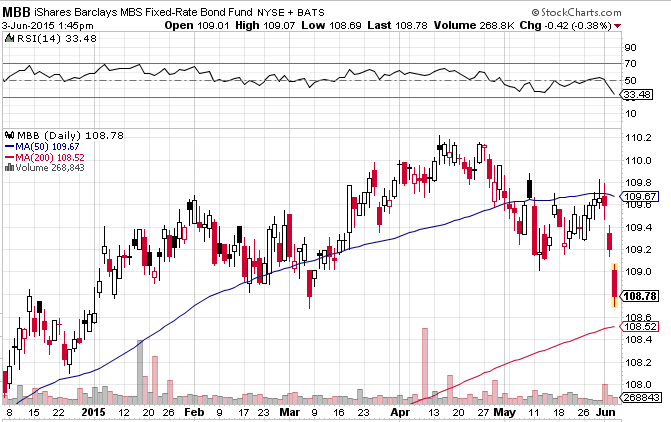

Mortgage securities-related ETFs are in their third day of selling Wednesday, with the iShares MBS ETF (MBB) down 0.4%, Vanguard Mortgage-Backed Securities Index ETF (VMBS) 0.2% lower and SPDR Barclays Mortgage Backed Bond ETF (MBG) down 0.6%. The MBS ETFs are beginning to test their long-term, 200-day simple moving averages.

MBB has a 3.58 year duration and a 1.37% 30-day SEC yield. VMBS has a 5.8 year duration and a 1.24% 30-day SEC yield. MBG has a 4.44 year duration and a 2.05% 30-day SEC yield.

Brad Scott, a mortgage-bond trader at Royal Bank of Canada’s capital-markets unit, argued that the sell-off is a result of pressures from overseas markets, notably on selling in Eurozone debt, reports Jody Shenn for Bloomberg.

“We are being led down by German bunds and European government bonds,” Scott told Bloomberg.

Scott believed that foreign investors who have been actively acquiring U.S.-dollar denominated debt are now stepping back in light of the recent increase in yields – bond prices and yields have an inverse relationship, so rising yields correspond with falling bond prices.

The fixed-income market was upended Wednesday after European Central Bank raised its inflation forecast and President Mario Draghi warned of heightened volatility ahead, reports Daniel Grote for Citywire.

Yields on Fannie Mae securities inched up 0.11 percentage points to 3.08% in mid-day Wednesday, touching their highest level since Oct. 7. In contrast, the mortgage-bond yields traded at a low of 2.43% in January but are still below the 3.15% five-year average.

Meanwhile, the thirty-year fixed-mortgage rates increased to 3.82%, compared to the previous week’s average of 3.74%.

Moreover, mortgage-bond yields are rising faster than Treasury yields. For instance, Fannie Mae bonds showed yields of 1.05 percentage points more than those on five- and 10-year Treasuries, the widest spread since November.

Nevertheless, Scott pointed out that the sell-off could have been worse. Banks are stepping up their purchases to take advantage of the yield increases, helping “make this move very orderly versus what could have been expected, given the magnitude of it.”

iShares MBS ETF

For more information on the fixed-income market, visit our bond ETFs category.

Max Chen contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.