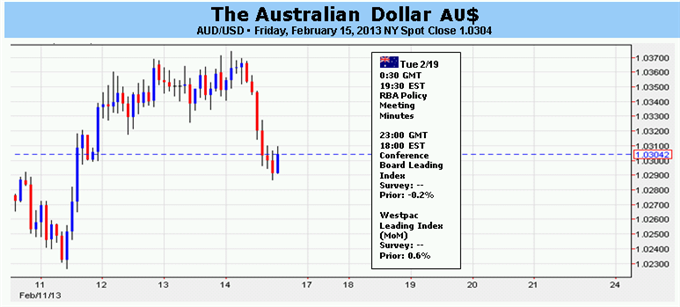

Forex: Australian Dollar Looks to RBA Minutes for Rate Cut Timing

Fundamental Forecast for Australian Dollar: Neutral

Australian Dollar Finds Support Near Key Range Bottom Yet Again

Speculative Sentiment Hints at Australian Dollar Weakness Ahead

The Australian Dollar will see the outlook for RBA monetary policy return to the spotlight in the week ahead. First, the central bank is due to release minutes from its February meeting. The statement released alongside the rate decision revealed a decidedly dovish lean, saying the “inflation outlook…afford[s] scope to ease policy further”.

With that in mind, forex traders will be keen to dissect the meeting minutes for clues about the possible timing of the next rate cut as well as the extent to which it be followed by a prolonged easing cycle. Later in the week, RBA Governor Glenn Stevens will help define expectations as he gives his semi-annual testimony to the House of Representatives’ Economics Committee.

As it stands, the markets are pricing in a mere 34 percent probability of another 25bps cut in the benchmark lending rate at the March meeting, according to data from Credit Suisse. The 12-month outlook calls for 36bps in additional accommodation, which suggests investors’ outlook leans toward the likelihood of just one more rate cut between now and early 2014 rather than a sustained easing campaign.

Meanwhile, AUDUSD continues to show a significant correlation to our in-house risk-reward gauge, suggesting the influence of sentiment trends remains an important consideration. With just two weeks left until the onset of the so-called “sequester” spending cuts in the US, speculation about the impact of fiscal retrenchment in the world’s top economy may begin to fuel risk aversion and make for a potent downside catalyst for the Aussie.

The Eurozone represents another potential source of volatility in sentiment trends, with assorted event risk scattered throughout the week and threatening to re-ignite sovereign stability concerns. EU President Herman Van Rompuy speaks to Parliament about the EU budget, whose ratification is critical to secure funding for on-going bailout programs.

Elsewhere, Spain’s Premier Mariano Rajoy is set to speak to his legislature amid calls for his resignation on corruption charges while candidates for the top job in Italy will hold a televised debate. Trades worry that Rajoy’s exit or Silvio Berlusconi’s return to power in Rome will derail fiscal reforms and plunge both countries disarray anew.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.