Forex: Fed Beige Book Highlights Strong Consumption, Housing Recovery

THE TAKEWAY: Fed Sees ‘Modest to Moderate’ Growth > Stronger Private Consumption, Rising House Prices > U.S. Dollar Tips Higher

The Fed’s Beige Book struck an improved outlook for the world’s largest economy amid the resilience in private sector consumption along with the budding recovery in the housing market, and saw ‘modest or moderate’ economic growth across the 12-districts as the recovery gradually gathers pace.

While wage growth remained ‘stable’ across the different regions, all 12 districts reported growth in private sector consumption, while auto sales were ‘steady or stronger’ in 10 region. At the same time, the survey noted the outlook for manufacturing remains ‘generally optimistic’ as businesses confidence picks up, and went onto say that home prices increased in all of the districts as the economic recovery becomes more broad-based.

Indeed, the Beige Book suggests that the FOMC will stick to the sidelines in 2013 as the world’s largest economy gets on a more sustainable path, and we may see a growing number of Fed officials scale back their dovish tone for monetary policy as the rise in private sector activity heightens the long-term risk for inflation. In turn, we may see the FOMC ultimately switch gears in 2013 and the central bank may start to discuss a tentative exit strategy in the second-half of the year as the outlook for growth and inflation picks up.

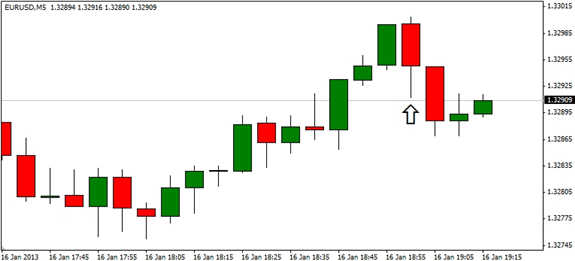

Despite the upbeat tone struck by the Fed’s Beige Book, the dollar show a fairly muted reaction to the release, with the EURUSD just edging down from the 1.3300 figure, but the bullish sentiment surrounding the greenback should gather pace over the near to medium-term as the central bank appears to be slowly moving away from its easing cycle.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.