Forex News: AUD/USD Down on Disappointing Australian Retail Sales

The Takeaway: Australian Retail Sales in December and fourth quarter came in well below expectations -> Further easing polices by RBA is possible -> AUD/USD dropped

The Australian Retail Sales excluding inflation posted a 0.1% increase (QoQ) in the fourth quarter of 2012, compared with a revised -0.3% decrease (QoQ) in the third quarter. The figure missed expectation set for 0.3%. Meanwhile, the seasonally adjusted retail sales posted a -0.2% decrease (MoM) in December, compared with a revised -0.2% decrease (MoM) in November, also came in well below expectation set for 0.3%.

The worse-than expected retail sales depict a mixed economic outlook for Australia when combined with the encouraging trade report released yesterday. The figures suggest that consumer confidence was weak in December and consumers were reluctant to spend. According to the latest RBA’s monetary policy decision, government officials hinted that further easing policy to support demand is possible. Therefore, if the unemployment rate in January that will be released tomorrow came in well below expectations, it may prompt the RBA to adopt easing policies in an effort to sustain its inflation target that was set at 2 to 3 percent and help rejuvenate the job market.

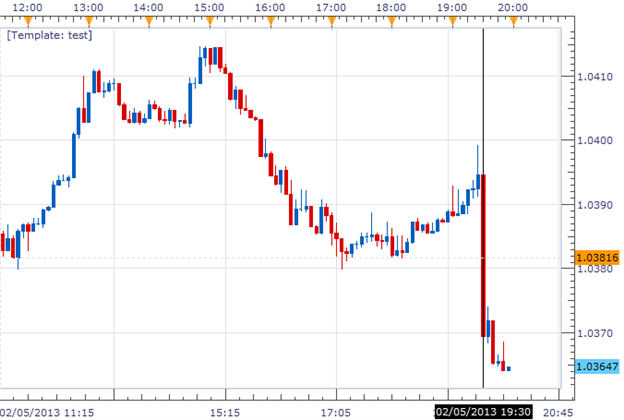

The AUD/USD dropped by 25 pips upon the announcement. At the time of writing, the currency pair is trading at 1.03650.

AUD/USD 5 Minute Chart

Charts Created by Robin Leung using Marketscope 2.0

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.