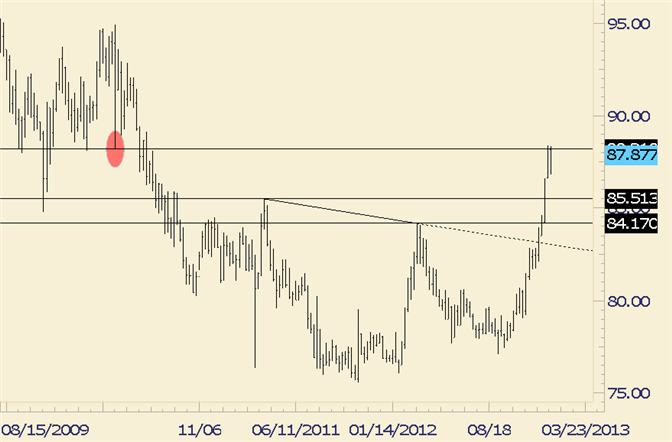

FOREX Technical Analysis: USD/JPY Responding to 2010 Support Level

Weekly Bars

Chart Prepared by Jamie Saettele, CMT

FOREXAnalysis: The USDJPY is trading between former support from 2010 (2010 flash crash low is circled) and the 1/3 low. Pattern since the 1/4 high suggests that weakness is probably a 4th wave. In other words, additional sideways trading is possible but another high (in wave 5 and probably to complete the cycle that began on 11/9) is the likely outcome before a deeper decline.

FOREXTrading Strategy: If the USDJPY trades above 8842, then I’ll be on the lookout for signs of a top at 90. Aside from the obvious psychological implications, 8999 is the width of consolidation (8241-8683) added to the top. Consolidations can be used to identify measured moves.

LEVELS: 8617 8683 8760 8842 8900 9000

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.