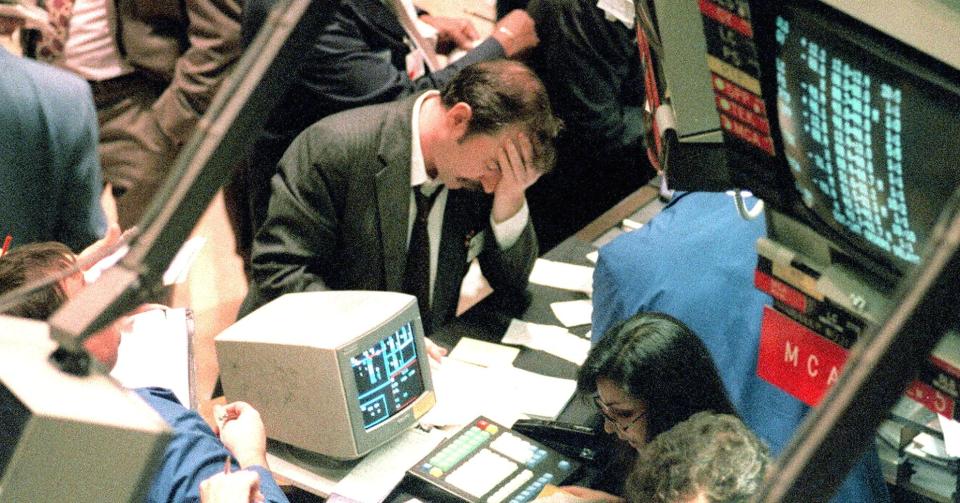

An overwhelming majority of Wall St. pros who try to beat the market fail

In the investment world, a fund can be managed in two ways: actively and passively.

According to a new study from S&P, the actively managed fund industry is failing to deliver.

Active fund managers are paid to generate above-average returns for their clients. To do this, they will tilt their portfolios in various ways to go overweight certain assets and underweight others. They differ from passive fund managers, who aim to track the returns of certain benchmarks like the S&P 500.

Unfortunately, most active fund managers actually end up lagging their benchmarks instead of beating them.

“Our findings show that within domestic equity, the majority of managers in nearly every category underperformed their respective benchmarks over the five-year horizon, for both retail funds and institutional accounts,” S&P analysts Ryan Poirier, Aye Soe and Hong Xie wrote.

Through the five years ending in December 2015, 76.23% of large-cap US equity fund managers failed to beat the S&P 500. Among institutional large-cap equity fund managers, 85.81% underperformed during that same period.

The track records don’t get much more impressive when you shorten those time horizons. Over one-year and three-year periods, only 61.31% and 73.05%, respectively, of institutional managers lagged the S&P 500.

The performance isn’t much better for other categories of funds.

When you adjust for fees, which tend to be high for actively managed funds, the numbers get much worse. While 76.23% of large-cap mutual funds already lag the S&P 500, when you adjust for fees that number balloons to 84.15%.

Fees tend to be particularly onerous for retail investors — who are buying the mutual funds — relative to institutional investors. The S&P analysts explain: “In general, retail investors tend to pay higher advisory and management fees than institutional investors. Institutional investors have the option to negotiate fees directly with asset managers based on the size of a mandate and how many strategies may already exist with one manager. Retail investors, on the other hand, lack such bargaining power.”

“Across various categories within the domestic equity space, the overwhelming majority of active managers, both retail and institutional, lagged their respective benchmarks,” the S&P analyst said. “Overall findings suggest that on a gross- or net-of-fees basis, the U.S. equity space poses meaningful challenges for active managers to overcome.”

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

Everyone complaining about P/E ratios is using them wrong

Stocks today are reminiscent of 2 of history’s most exciting buying opportunities – RBC

The most important question in the stock market right now

The dumbest math mistake investors make in the stock market

Gutsy Wall Street analyst dares to debunk a sacred truism about the stock market