GBP/USD Vulnerable on Dovish BoE Minutes, Scotland Independence

DailyFX.com -

Fundamental Forecast for Pound:Bearish

British Pound Looking to BOE Commentary to Fuel Recovery

For Real-Time Updates and Potential Trade Setups on the British Pound, sign up for DailyFX on Demand

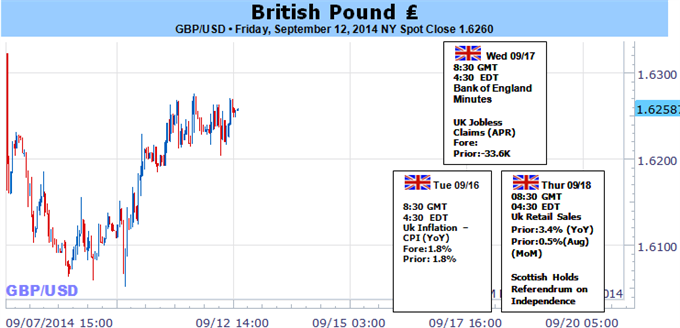

The British Pound is likely to face heavy volatility in the week ahead as the Bank of England (BoE) publishes the policy meeting minutes, while Scotland takes to the polls to vote for independence on September 18.

It seems as though we will see another 7-2 split within the Monetary Policy Committee (MPC) as Ben Broadbent and David Miles remain in no rush to normalize monetary policy, but the fresh batch of central bank rhetoric may continue to prop up interest rate expectations as Governor Mark Carney retains an upbeat view for the U.K. economy. Despite the risk of Scotland leaving the U.K., it seems as though the central bank will retain its game plan to normalize monetary policy as Mr. Carney sees the first rate hike coming in the Spring of 2015, and a more upbeat tone from the MPC may generate a larger recovery in the British Pound as the BoE moves away from its easing cycle.

At the same time, the Federal Open Market Committee (FOMC) policy meeting will also be closely watched as Janet Yellen and Co. look to halt its asset-purchase program in October, but we would need to see a material shift in the forward-guidance to see a major market reaction as the central bank remains reluctant to move away from the zero-interest rate policy (ZIRP).

With that said, the Scottish Referendum holds the biggest risk for surprise as independent polls continue to highlight the threat for a breakup, and the outcome is likely to have a material impact on the near-term outlook for the GBP/USD as a departure from the monetary union may spark a material shift in the policy outlook.

Nevertheless, there are tentative signs of a more meaningful rebound in the GBP/USD as the Relative Strength Index (RSI) comes off of oversold territory, but we would need to see a break of the bearish momentum along with a move and closing price above former support (1.6280-1.6300) to favor a more bullish outlook for the pound-dollar. - DS

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.