Going Shopping With Retail ETFs

The consumer discretionary sector has roared back in 2015 with the Consumer Discretionary Select Sector SPDR (XLY) posting a gain of almost 5.7%.

Improved performance for the discretionary sector has bolstered an array of related sub-sectors, including specialty retail.

“Specialty retailer revenues should benefit from sustained economic growth and net new retail store openings, despite peer-group consolidation and store closings, according to S&P Capital IQ. We expect specialty retail revenues to increase at mid-single-digit rates annually through 2016. Steadily improving macroeconomic fundamentals, which include declining U.S. unemployment, increased consumer confidence, and low borrowing costs that further boost personal consumption and housing affordability and activity, should continue to underpin the specialty retail industry in 2015 and 2016,” said S&P Capital IQ in a new research note.

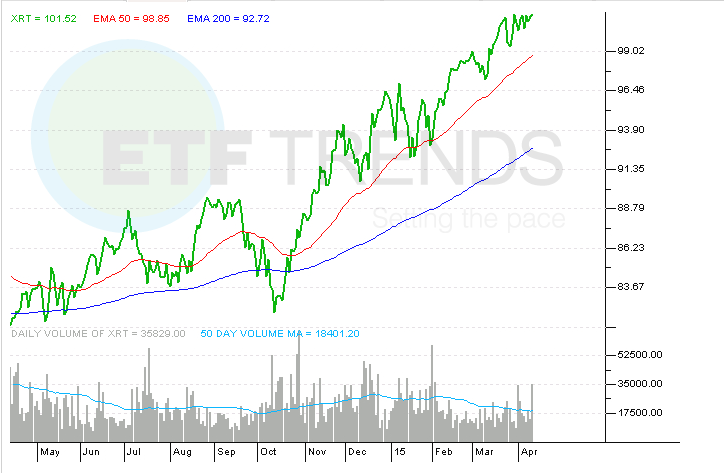

The $1.42 billion SPDR S&P Retail ETF (XRT) , an ETF that allocates 16.7% of its weight to specialty retailers, is higher by 5.7% this year. XRT and rival ETFs have benefited from the strong U.S. dollar and mostly solid U.S. economic data points. Clothing, electronics and automobiles will likely see prices decline as the stronger dollar permeates the economy. The cheaper prices could help attract greater demand, bring more traffic into stores and bolster the retail space. [Deflation Aids Consumer ETFs]

Among apparel retailers, a sub-sector that accounts for almost 24% of the equal-weight XRT’s weight, S&P Capital is bullish on TJX Cos. (TJX), Ross Stores (ROST) and Foot Locker (FL). The research firm has four-star ratings on those stocks, which combine for nearly of XRT’s weight. S&P Capital IQ rates XRT overweight.

Investors can also consider the $345 million Market Vectors Retail ETF (RTH) . Thanks in part to its 17.5% combined weight to Amazon (AMZN) and Home Depot (HD), RTH is up 8.3% this year.

Home Depot is one of just eight members of the Dow Jones Industrial Average up at least 5% year-to-date. Rival Lowe’s (LOW) is higher by 7.7%. The stocks combine for nearly 13.4% of RTH’s weight. [Home Depot Helps These ETFs]

Home improvement retailers “will likely experience mid-single digit revenue growth in the next fiscal year according to S&P Capital IQ Equity Analyst Efraim Levy, driven by new store additions and the benefits of a recovery in the housing market and improving consumer confidence,” according to S&P Capital IQ.

The research firm has a marketweight rating on RTH, which was last year’s best-performing consumer discretionary ETF.

SPDR S&P Retail ETF