Gold ETFs Fall Below 200-Day Average; First Time Since August

For the first time in months in gold ETFs, we saw more evidence of put buying in SPDR Gold Shares (GLD) than outright call buying, and this comes with little surprise given the metal’s sharp reversal in recent days.

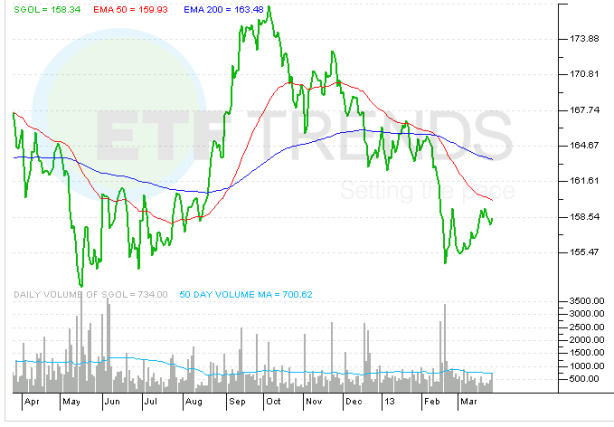

In the past five trading sessions, GLD has fallen 3.74% and today dropped below its 200 day moving average for the first time since August.

Gold ETFs are no doubt back in focus with the recent sharp sell-off in the precious metal. As we mention in our options recap this morning, GLD puts have been active, which is in contrast to the theme of call buying (both outright as well as via call spreads) that has been prevalent over the past several months. [Gold ETFs as a Leading Indicator]

GLD and related ETF iShares Gold Trust (IAU) have been hammered in recent sessions, down 3.74 and 3.72% respectively in just the past five trading days. We also note that both ETFs have gapped below their 200 day moving averages and have not traded at these levels since August. [10 Things to Know About Gold ETFs]

Interestingly, despite the weak price action in GLD and related long Gold ETPs, there has not been significant redemption activity in terms of assets in either GLD nor IAU (trailing one month net flows in GLD is +$484 million and +$202 million in IAU).

With the spot price of Gold on the move in recent sessions, we will likely continue to see accelerated volumes in not only GLD and IAU, but other products in the space as well including ETFS Swiss Gold (SGOL) and DGL

PowerShares DB Gold), as well as leveraged/inverse ETPs that track Gold such as UGL (ProShares Ultra Gold), GLL (ProShares UltraShort Gold), DGZ (PowerShares DB Gold Short ETN), UGLD (VelocityShares 3X Long Gold ETN), and DGLD (VelocityShares 3X Inverse Gold ETN).

Year to date, long Gold ETFs GLD and IAU are still managing to show some green, up 4.62% and 4.86% respectively, and the trailing 5 year numbers are compelling (+103.03% and +102.51% respectively), so there are obviously a bevy of longer term holders that are likely sitting on lofty longer term investment gains at this point.

SPDR Gold Shares

For more information on Street One ETF research and ETF trade execution/liquidity services, contact Paul Weisbruch at pweisbruch@streetonefinancial.com.