Gold Losses to Persist on Disinflation- Bearish Below $1385

Fundamental Forecast for Gold: Bearish

Gold continued its descent this week with the precious metal down nearly 3% to trade around $1430 at the close of trade in New York on Friday. Persistent strength in equities accompanied by a massive rally in the US dollar have continued to weigh on demand for the yellow metal with recent price action suggesting further loss are likely in the medium-term.

Recent rhetoric from central bank officials has continued to suggest that the FOMC is beginning to take note of the strengthening recovery and while last week’s policy statement opened the door to further expansion in the Fed’s balance sheet, it seems unlikely in the near-term. Philadelphia Fed President Charles Plosser warned that the risks surrounding the Fed’s non-standard measures ‘are high’ and went onto say that the committee should ‘gradually ease’ its asset purchase program as the efficacy of further easing comes into question. Chicago Fed President Charles Evans – who serves on the FOMC this year – argued that the central bank should push its highly accommodative policy stance ‘as hard as we can,’ the central bank dove sounded rather upbeat on the economy amid the better-than-expected recovery in the labor market. With the Fed continuing to assert that inflation expectations remain well anchored and steady (albeit slow) improvement in the labor markets, it will be difficult for the central bank to justify further expansion of QE operations. As such, its unlikely gold will catch any kind of substantial bid as amid the recent slump in broader commodity markets.

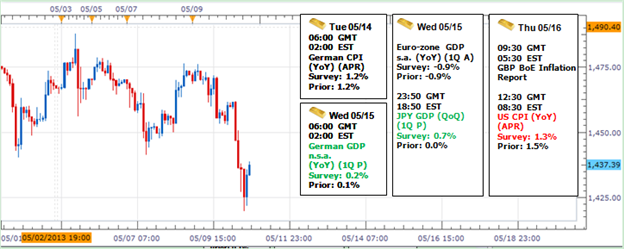

Looking ahead to next week, gold traders will closely eying US economic data with the advanced retail sales, CPI, and the University of Michigan confidence survey on tap. April retail sales hit the wires on Monday morning with consensus estimates calling for the third monthly contraction this year at -0.3% m/m. The Michigan confidence survey is widely expected to rebound off last month’s three-month low to 78.0 with the NFIB small business optimism survey early in the week also eyed higher at 90.5. The consumer price index will likely be the main event for gold with expectations for continued lackluster price growth likely to offer no support for bullion which fell to a two week low on Friday.

The May opening range has now reaffirmed our bearish outlook with the rejection off the 61.8% Fibonacci retracement of the April range at $1487 offering further conviction on our directional bias. Our initial objective rests in the support range between $1385- $1397 with a break below threshold targeting the 2011 low at $1307. Interim resistance stands with the 23.6% retracement of the late April advance at $1449 with only a breach above the $1482-$1487 range invalidating our broader bias. Note that daily RSI is now poised for a break back below 40 with such a scenario suggesting that he rally off the April lows remains just a correction within the broader down-trend. -MB

---Written by Michael Boutros, Currency Strategist with DailyFX

To contact Michael email mboutros@dailyfx.com or follow him on Twitter @MBForex

To be added to Michael’s distribution list Click Here

Introduction to Scalping Strategies Webinar

Beginner Fibonacci Expo Presentation

New to FX Trading? Watch this Video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.