Gold Slides as Cypress Survives- Range Break to Offer Clarity

Gold Slides as Cypress Survives- Range Break to Offer Clarity

Fundamental Forecast for Gold: Neutral

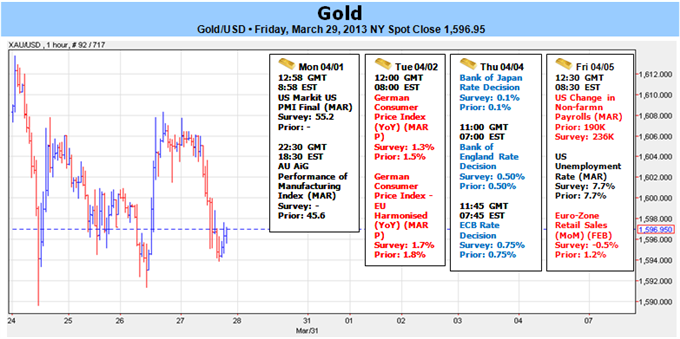

Gold was weaker at the close of trade this week as prices pulled back from interim resistance noted in last week’s forecast, with the precious metal off by 0.82% to trade at $1595 as of Thursday afternoon. The gold trade has remained uninspiring as we close out March trade and we now look for the start of 2Q trade for further guidance as US data continues to improve and prospects of possible cessation of QE operations gather pace.

Register HERE to take this short quiz assessing your FX trading knowledge and receive a learning curriculum based on your responses.

Despite the negative headlines surrounding the Cyprus bailout, gold struggled to hold its ground, with U.S. equities trading near record-highs. Although the periphery country was able to avoid a bank-run, the ongoing turmoil in Europe may continue to drag on market sentiment, and a rebound in safe-haven flows could prop up the precious metal next week as the EU retails a reactionary approach in addressing the risks surrounding the region.

Beyond the slew of central bank interest rate decision on tap for the following week, the U.S. Non-Farm Payrolls report highlights the biggest event risk for gold as the world’s largest economy is expected to add another 195K in April. Although the jobless rate is projected to hold steady at 7.7%, the ongoing improvement in the U.S. labor market may dampen the appeal of bullion as it limits the Fed’s scope to carry out its easing cycle throughout 2013. As such, gold demand may remain limited as concerns over the impact of the Fed’s easing policy on inflation diminish. Should the data come in significantly weaker than expected, look for gold to check key interim support just below this week’s range.

From a technical standpoint, our bias remains unchanged and while out broader bias remains weighted to the downside, the risk for a topside run into key resistance in the range between $1626-$1631 remains. Historically speaking, April has typically been a strong month cyclically for gold (albeit not as strong as Sept/Nov) and as we head into April trade it’s worth noting that a weekly close above this key threshold invalidates our medium-term outlook. Such a scenario would look to target the 38.2% retracement taken from the October decline at $1646 and the 200-day moving average at $1664. Key interim support rests at $1585 with a break below this mark eyeing critical Fibonacci support in the range between $1550- $1555. With the monthly and quarterly opening ranges now coming into focus, we will maintain a neutral stance as we head into next week with price action likely to offer further conviction on a medium-term bias. Bottom line, look for a break of the $1585- $1615 range to offer a near-term directional bias. -MB

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.