Gold Still Bearish below $1504- Rebound at Risk Ahead of FOMC, NFPs

Gold Still Bearish below $1504- Rebound at Risk Ahead of FOMC, NFPs

Fundamental Forecast for Gold: Bearish

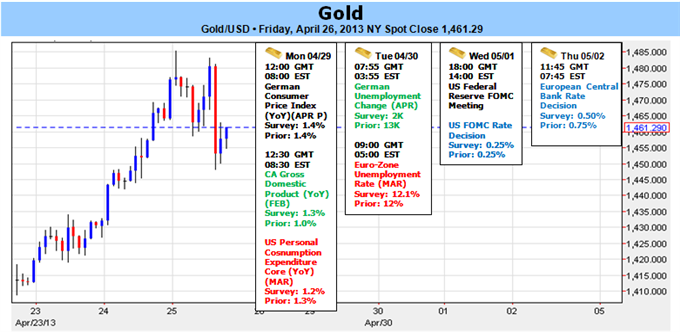

The gold rebound gathered pace this week with the precious metal advancing more than 4% to trade at $1462 at the close of trade in New York on Friday. While the rebound off the monthly lows has been impressive, the broader outlook on bullion remains weighted to the downside below $1504 with event risk next week likely to offer a catalyst for the distressed metal. Economic data this week was mixed with stronger than expected prints on new home sales and initial jobless claims, with existing homes sales and durable goods orders disappointing to the downside. Weakness in the greenback also contributed to gold’s ascent as the USDollar index rebounded off key support early in the week. Despite the losses though, the dollar is likely to see limited downside with near-term support seen at 10,480 and 10,450.

Looking ahead to next week, gold traders will be closely eying the FOMC rate decision on Wednesday and the highly anticipated non-farm payroll print on Friday. Although the central bank is widely expected to maintain its highly accommodative policy, we may see a stronger argument to scale back on quantitative easing measures amid the resilience seen in private sector consumption and the more robust recovery seen in the housing market. Friday’s NFP print will be the main event with consensus estimates calling for a print of 150K with unemployment rate expected to hold at 7.6%. Note that last month’s dismal 88K print saw gold well supported on expectations that the Fed will be forced to maintain its $85 billion in monthly asset purchases throughout 2013. Should that data top market expectations, look for gold to come under pressure as the correction off the April lows begins to taper off.

From a technical standpoint, the rebound has now tagged key resistance in the range between the 50% Fibonacci retracement taken from the March decline and the long-term 78.6% extension taken from the decline off the record highs made in 2011 at $1470-$1483. We favor shorts in this region against the 61.8% retracement at $1504 targeting the objective range cited earlier in the month at $1302-$1307. Only a breach above $1504 invalidates our near-term bias with such a scenario eying resistance targets at the former 2012 low at $1527 and the key 61.8% extension off the all-time highs at $1550. -MB

To contact Michael email mboutros@dailyfx.com or follow him on Twitter @MBForex

To be added to Michael’s distribution list Click Here

Introduction to Scalping Strategies Webinar

Beginner Fibonacci Expo Presentation

New to FX Trading? Watch this Video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.