Growing Earnings for 7 Undervalued Stocks

- By Tiziano Frateschi

Companies with growing earnings per share (EPS) are often good investments as they can return a good profit to investors. Here is a selection of the most undervalued companies, according to the DCF calculator, that have five-year growing EPS.

Warning! GuruFocus has detected 4 Warning Signs with RGR. Click here to check it out.

The intrinsic value of RGR

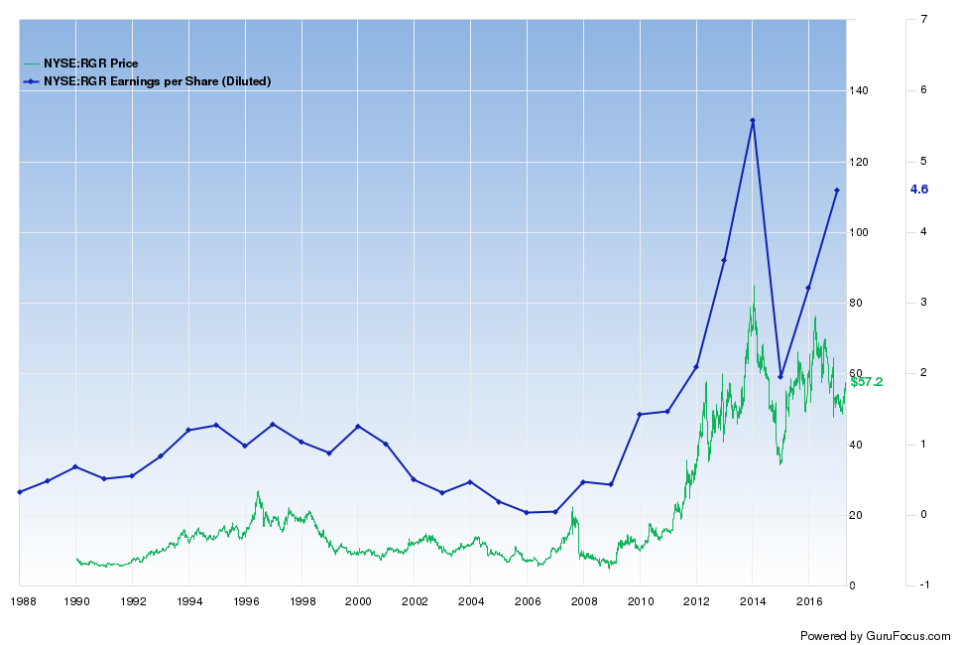

EPS of Sturm Ruger & Co. Inc. (RGR) grew by 8% over the last five years.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 56% at the price of $56.85. The price-earnings (P/E) ratio is 12.43; the price has been as high as $70.30 and as low as $47.15 in the last 52 weeks and is 19.13% below its 52-week high and 20.57% above its 52-week low.

Sturm Ruger has a market cap of $1.01 billion and is engaged in the design, manufacture and sale of firearms to domestic customers. The company also manufactures and sells investment castings made from steel alloys for internal use in the firearms segment.

The company's largest shareholder among the gurus is Jim Simons (Trades, Portfolio) with 1.55% of outstanding shares followed by Joel Greenblatt (Trades, Portfolio) with 0.27% and Paul Tudor Jones (Trades, Portfolio) with 0.08%.

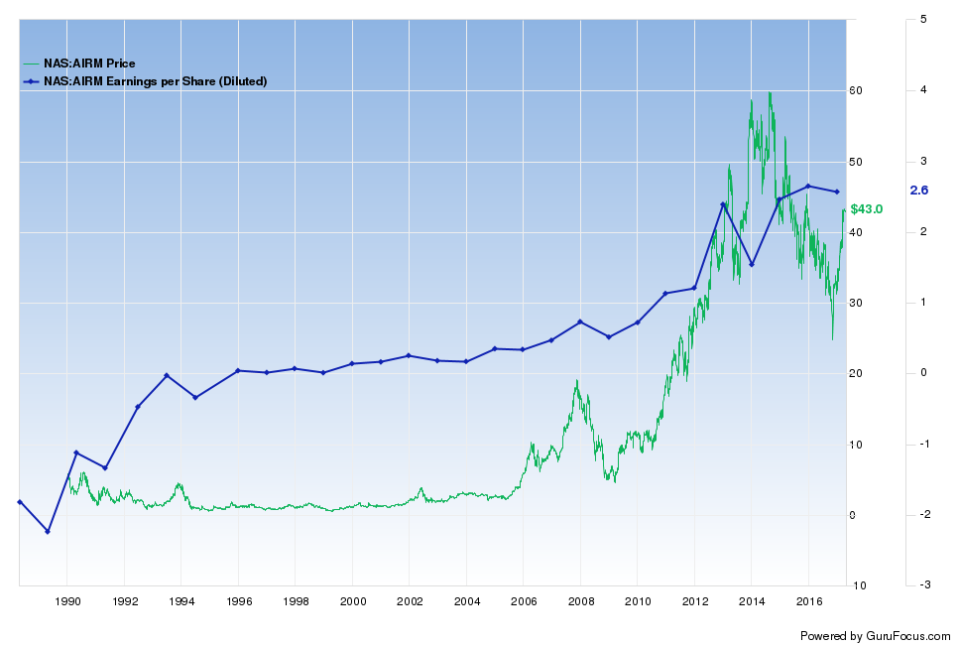

EPS of Air Methods Corp. (AIRM) grew by 14% over the last five years.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 41% at the price of $43.05. The P/E ratio is 16.75; the price has been as high as $43.95 and as low as $23.75 in the last 52 weeks and is 2.05% below its 52-week high and 81.26% above its 52-week low.

Air Methods has a market cap of $1.75 billion and is a provider of air medical emergency transport services and systems throughout the U.S. It also designs, manufactures and installs medical aircraft interiors and other aerospace and medical transport products.

Simons with 0.47% of outstanding shares is the largest investor among the gurus followed by Greenblatt with 0.15% and Jones with 0.1%.

EPS of Boston Beer Co. Inc. Class A (SAM) grew by 11% over the last five years.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 28% at the price of $139.05. The P/E ratio is 20.38; the price has been as high as $195.35 and as low as $135.10 the last 52 weeks and is 28.82% below its 52-week high and 2.92% above its 52-week low.

Boston Beer has a market cap of $1.8 billion and is engaged in the business of selling low alcohol beverages in the U.S.

The company's largest shareholder among the gurus is Ken Fisher (Trades, Portfolio) with 2.72% of outstanding shares followed by Greenblatt with 0.23%, Mario Gabelli (Trades, Portfolio) with 0.21%, Jones with 0.04% and Murray Stahl (Trades, Portfolio) with 0.02%.

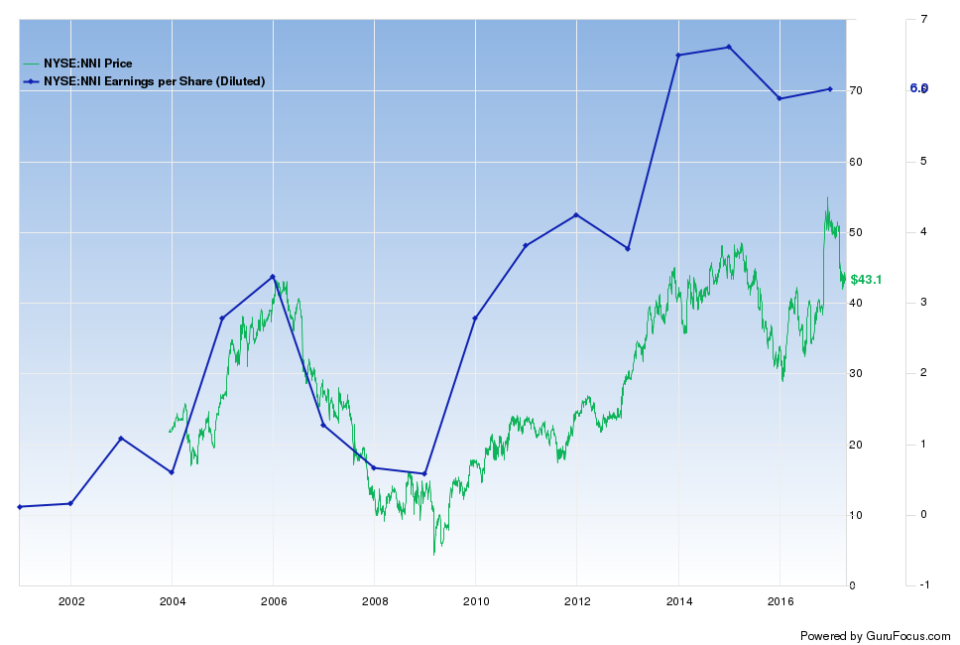

EPS of Nelnet Inc. Class A (NNI) grew by 9% over the last five years.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 75% at the price of $43.12. The P/E ratio is 7.14; the price has been as high as $55.01 and as low as $31.49 the last 52 weeks and is 21.61% below its 52-week high and 36.93% above its 52-week low.

Nelnet has a market cap of $1.82 billion and provides educational services in loan servicing, payment processing, education planning and asset management. The company also provides federally insured student loans.

Simons with 0.85% of outstanding shares is the largest investor among the gurus followed by Chuck Royce (Trades, Portfolio) with 0.11%.

EPS of Eagle Bancorp Inc. (EGBN) grew by 21% over the last five years.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 31% at the price of $55.05. The P/E ratio is 19.26; the price has been as high as $64.94 and as low as $45.07 in the last 52 weeks and is 15.23% below its 52-week high and 22.14% above its 52-week low.

Eagle Bancorp has a market cap of $1.88 billion and through EagleBank provides commercial banking services to its business and professional clients and full service consumer banking services to individuals and working. It also offers online banking, mobile banking and a remote deposit service.

The company's largest shareholder among the gurus is Fisher with 0.13% of outstanding shares followed by Simons with 0.04%.

EPS of Ebix Inc. (EBIX) grew by 10% over the last five years.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 27% at the price of $59.75. The P/E ratio is 20.84; the price has been as high as $65.10 and as low as $40.45 in the last 52 weeks and is 8.22% below its 52-week high and 47.71% above its 52-week low.

Ebix has a market cap of $1.88 billion and provides software and e-commerce solutions to the insurance, finance and health care industries.

John Hussman (Trades, Portfolio) with 0.32% of outstanding shares is the largest investor among the gurus followed by Royce with 0.25% and Jones with 0.03%.

EPS of GATX Corp. (GATX) grew by 21% over the last five years.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 26% at the price of $59.11. The P/E ratio is 9.35; the price has been as high as $64.46 and as low as $40.66 in the last 52 weeks and is 8.30% below its 52-week high and 45.38% above its 52-week low.

GATX has a market cap of $2.32 billion and operates, manages and remarkets long-lived used assets in the rail and marine market. It also provides leasing, shipping, asset remarketing and asset management services.

The company's largest shareholder among the gurus is Gabelli with 7.29% of outstanding shares followed by Jones with 0.04%.

Disclosure: I do not own any shares of any stocks mentioned in this article.

Start a free seven-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Signs with RGR. Click here to check it out.

The intrinsic value of RGR