This Health Care Dividend Aristocrat Will Profit From Old Age a Globally

- By Ben Reynolds

The world is aging. The average global population age is increasing.

Source: The Economist

Warning! GuruFocus has detected 5 Warning Signs with ABT. Click here to check it out.

The Wisdom Years

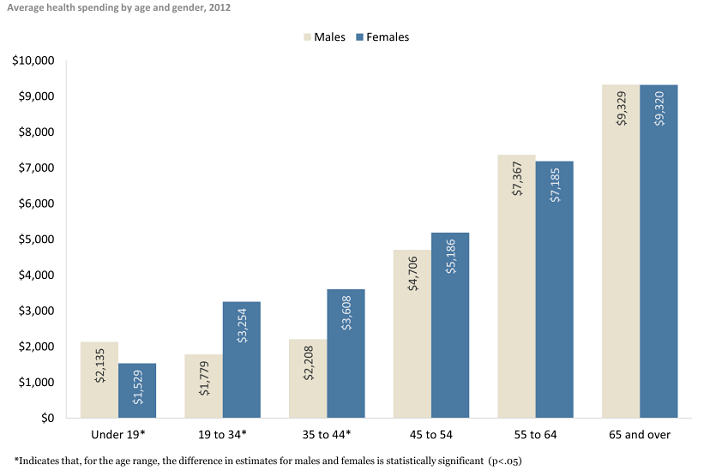

The older someone is, the more they spend on health care (on average).

Source: From Peterson-Kaiser Health System Tracker

Note: Data for the United States, in 2012.

Demographic changes create opportunity. What if you could benefit from these changes?

The business analyzed in this article will benefit from the coming demographic changes. Better yet, it already has a long history of successa

a As evidenced by its 44 consecutive dividend increases.

It also is a timely buy. It is ranked in the top 10 using The 8 Rules of Dividend Investing.

The business I am talking about will benefit from both:

Aging global populations.

Births and baby population growth in emerging markets.

This article examines the investment opportunity at Abbott Labs (ABT).

Note: I am personally long Abbott Labs.

Get to know Abbott Labs

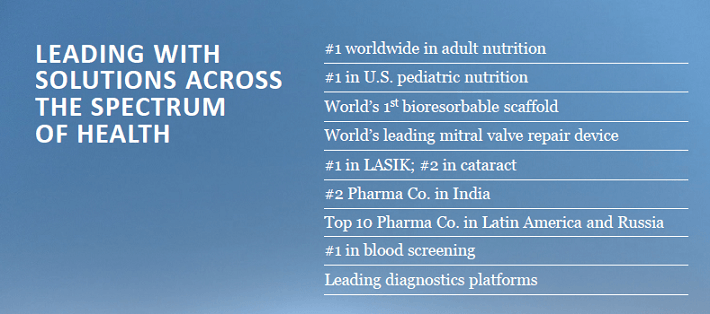

Abbott Labs was founded in 1888. Today the company is a leader in several key categories.

Source: Abbott Labs JP Morgan Conference Presentation, slide 4

Abbott is the global leader in adult nutrition. The companyas adult nutrition leadership is a result of its Ensure brand.

The company grew adult nutrition sales year-over-year by 5.2% in the U.S. and 3.6% internationally (constant-currency) in its most recent quarter.

The companyas adult nutrition category will continue to be boosted by favorable demographic trends going forward.

Abbott Labs is much more than adult nutrition and baby formula. The company operates in four segments.

Each segment is shown below along with the percentage of total revenue generated for Abbott Laboratories in fiscal 2015:

Nutrition generated 34% of total revenue.

Diagnostics generated 23% of total revenue.

Established Pharmaceuticals generated 18% of total revenue.

Medical Devices generated 25% of total revenue.

The Nutrition segmentas primary brands are Ensure, Pedialyte and Similac.

The established pharmaceutical segment is noteworthy for its geographical distribution. It sells generic pharmaceuticals only outside the U.S. A full 75% of the segmentas revenue comes from key emerging markets.

But itas not just the established pharmaceutical segment that has a large emerging market presence.

Abbott Labs is an emerging market business

Abbott Labs sales by country type (developed, emerging) are shown below:

50% of Abbott Labas sales come from emerging markets.

31% come from the U.S. (developed).

19% come from developed international markets.

The company generates half of its revenue in emerging markets.

It also generates half of its revenue in direct to consumer sales. This means Abbott Labs health care products are popular with consumers, not just health care providers.

Demographic changes will be most impactful in emerging markets.

They have the fastest population growth. More babies means more formula sales for Abbott.

Emerging markets will also make the biggest gains in life expectancy increases. Emerging market populationas dwarf developed populations. This means more sales for Abbottas:

Medical devices segment.

Adult nutrition division.

Diagnostics segment.

Generic pharmaceuticals segment.

The company has positioned itself extremely well. It is primed to take advantage of emerging market growth.

With Abbott Labs you get expert management and developed world regulation and transparency combined with emerging market exposure and growth.

Total returns and EPS growth

What type of growth should Abbott Labs investors expect going forward?

I believe Abbott Labs investors should expect EPS growth of around 10% a year going forward. The companyas growth will come from a mix of acquisitions, organic revenue growth, small margin improvements, and share repurchases.

This growth combined with the companyas current dividend yield of 2.7% gives Abbott Labs investors expected returns of 12% to 13% a year.

Recent acquisitions are a potential growth catalyst

One of Abbott Labas growth strategies is acquisitions.

The company has recently engaged in two large acquisitions:

Alere (ALR) for $5.8 billion.

Jude Medical (STJ) for $25 billion.

The Alere acquisition will boost Abbott Labas diagnostics segment.

The St. Jude Medical acquisition will bolster Abbott Labas medical devices segment.

Both acquisitions are expected to be accretive to earnings within the first full fiscal year after closing, which is good news for shareholders.

Abbott Labs will benefit from these acquisitions far into the future. The company can integrate and roll out products from the respective acquired companies throughout the globe a this is the power of Abbott Labas international approach.

The St. Jude Medical acquisition is funded by a mix of cash and new share issuance.

I would have preferred Abbott Labs to take on additional debt rather than issue new shares to take advantage of historically low interest rates. Still, both acquisitions will likely be beneficial for long-term shareholders.

Abbott Labs scores high marks for safety and stability

The health care sector has historically performed better than average during recessions.

You simply cannot cut back on baby formula or pharmaceuticals when times get tough. This makes Abbott Labs recession resistant.

History has proven Abbott Labs handles recessions very well. Abbott Labs is one of the 10 most recession proof Dividend Aristocrats. Its stock fell 5% in 2008, while the S&P 500 declined 38%.

The company grew EPS and dividends each year through the Great Recession of 2007 to 2009.

2007 EPS of $2.84

2008 EPS of $3.03

2009 EPS of $3.72

Recession performance is only one aspect of the companyas safety.

Abbott Labas excellent dividend history speaks to its strength and safety:

Paid dividends every year since 1924.

44 years of consecutive dividend increases.

Abbott is one of only 50 Dividend Aristocrats.

It is highly likely the companyas dividend streak continues far into the future. The company has a reasonable payout ratio of 50% (using adjusted earnings).

Abbott Labas balance sheet is also in good shape. Through the first quarter of 2016, the company had about $4 billion in cash and $8 billion in debt on its books. To put that in perspective, the company generates about $3 billion a year in cash from operations.

Abbottas compelling price to value proposition

Abbott Labs has historically traded for around the same PE multiple as the S&P 500 since the AbbVie spin-off in 2012.

Abbott Labs average price-to-earnings ratio of 19.1 (2013 through 2015).

S&P 500 average price-to-earnings ratio of 19.3 (2013 through 2015).

I donat believe Abbott Labs should trade for the same price-to-earnings multiple as the S&P 500.

The company is of a higher quality than the average S&P 500 stock. It also has better total return prospects than the average S&P 500 stock.

The market disagrees at this time. Abbott Labsas price-to-earnings ratio has not followed suite with the S&P 500as.

Abbott Labs current price-to-earnings ratio of 18.7.

S&P 500 current price-to-earnings ratio of 24.2.

I believe Abbott Labs should trade at least in line with the S&P 500. Relative to the market, Abbott Labs is significantly undervalued today.

Relative to its historical average price-to-earnings ratio, the company is likely trading around fair value. Taken as a whole, I expect an investment in Abbott Labs to beat the S&P 500 Index over the next five to 10-year period.

Abbott Labs is a buy at current prices

Investors in Abbott Laboratories should expect total returns of around 12% to 13% a year going forward from dividends and EPS growth.

An investment that grows at 12% a year doubles in value about every six years.

The company scores high marks for safety and will very likely continue increasing dividend payments far into the future.

Additionally, Abbott Labs gives investors lower risk exposure to emerging markets.

The company currently ranks as a top 10 dividend stock using The 8 Rule of Dividend Investing.

Abbott Labs ranks highly using the eight rules because it has:

An above average dividend yield of 2.7%.

Above average expected earnings-per-share growth of 10% per year.

Reasonable payout ratio of 50%.

Lower than average stock price standard deviation of 20.1%.

I believe Abbott Labs is an excellent example of a high quality, shareholder friendly business trading at fair or better prices now.

Investors looking for exposure to the health care sector and/or emerging markets should look no further than Abbott Labs.

Want more high quality health care stocks? Click here to download a data-filled spreadsheet of all 13 health care sector stocks with 25+ years of dividend payments a ranked in order using The 8 Rules of Dividend Investing.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 5 Warning Signs with ABT. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years