An "Ideal" EUR/GBP Short Set-up

Talking Points:

EUR/GBP Nears Rising Trend Line

A Much Larger Pattern in the Making

The "Ideal" EUR/GBP Set-up

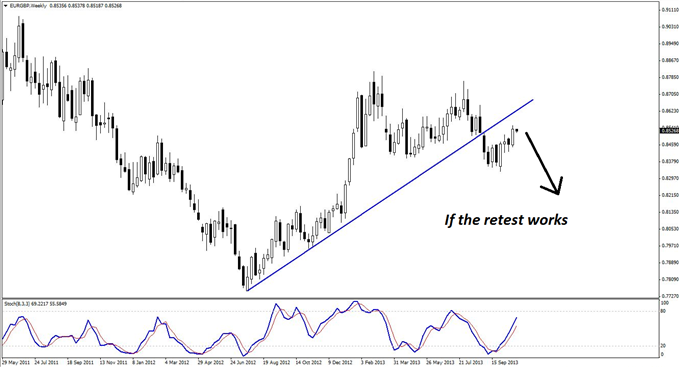

EURGBP is widely seen as a slow-moving currency pair, but nonetheless, it is creeping back to retest the underside of a rising trend line on the weekly chart, as shown below.

Guest Commentary: EUR/GBP Nears Weekly Trend Line

Admittedly, now may be a little early to form a longer-term short, as the primary momentum on the weekly chart has merely turned sideways, and not down. However, it should provide at least a near-to-mid-term short opportunity that could turn out to be a much larger trade.

The daily chart of EURGBP has a rising wedge forming rather beautifully below the trend line, which is another case for a short. The zone between the upper wedge resistance and the underside of the longer-term trend line has been estimated as 0.8550-0.8620.

Guest Commentary: Rising Wedge Pattern in EUR/GBP

Some traders would already be short on the pin bar from October 24, but given how close the rising wedge support is on the daily chart, a sharper entry would be preferable.

Going down to lower time frames is always useful for reducing risk and getting better entries, so we’ll turn to the four-hour chart for guidance.

Although there are several patterns in play on the four-hour time frame, not of least of which is the sideways/symmetrical triangle, there are no new factors here that would significantly change the analysis.

Guest Commentary: Be Very Picky with EUR/GBP Shorts

As a result, the ideal trade set-up would be another push into the projected resistance zone accompanied by reversal divergence. That should be quite easily fulfilled, as there has already been one divergence. This trade is one to be picky about entries, as the reward-for-risk would be poor otherwise.

By Kaye Lee, private fund trader and head trader consultant, StraightTalkTrading.com

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.