iShares’ Frontier ETF A Potential Blockbuster

On Thursday, iShares launched its highly anticipated MSCI Frontier 100 Index Fund (FM), and I think this fund will be a game-changer in the frontier markets investing landscape.

The cap-weighted fund holds 100 of the largest companies from frontier markets, as classified by indexing giant MSCI.

Frontier markets are increasingly sought by investors for a number of reasons. For one, frontier markets are still underdeveloped compared to emerging markets, meaning there’s potential for high growth in an ever-interconnected global economy.

Some frontier markets, such as Nigeria and Kazakhstan, are rich in natural resources, and are riding the current commodities boom. Others—such as Vietnam, Bangladesh and Pakistan—have favorable demographics.

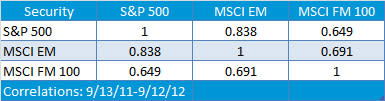

Then there’s the correlation factor, which appeals to investors seeking diversification.

Since many frontier markets are still relatively untapped by investors—mainly due to accessibility and liquidity issues related to the fact that they are nascent financial markets, their returns are less correlated with the broad equity markets.

Just look how much correlations have spiked in the past 10 years between the S'P 500 Index and the MSCI Emerging Markets Index, the underlying index of the other blockbuster, iShares MSCI Emerging Markets Index Fund (EEM).

Source:Bloomberg

From 2002-2003, the MSCI EM had a correlation of 0.57 with the S'P 500. Over the past year, its correlation has spiked to 0.838. Meanwhile, over the past year, the MSCI Frontier 100 Index had a correlation of 0.649 with the S'P 500.

Game-Changer?

FM separates itself from Guggenheim’s Frontier Markets ETF (FRN) in some important ways. FRN is only eligible to hold depositary receipts (DR), which significantly reduces its ability to access local companies that don’t have DR listings.

Meanwhile, with FM, for the first time, investors have access to a globally focused frontier fund with the capacity to hold local shares.

The “frontier” classification of Guggenheim’s FRN can also be somewhat questionable, depending on whose classification you’re looking at.

FRN follows BNY Mellon’s classification framework, which includes Chile, Colombia, Egypt and Peru as frontier—those countries make up over 70 percent of FRN’s weighting—even though MSCI, FTSE and S'P have them all classified as emerging.

While FM looks to be the first “pure” global frontier fund, country concentration risks aren’t exclusive to FRN. Roughly half of FM is currently weighted in Kuwait, Qatar and UAE. More specifically, FM is heavily weighted in financials, mainly from these three Gulf States.

I use the word “currently,” because there may be some changes to country exposure in FM in the coming years that are worth keeping in mind.

MSCI has been reviewing Qatar and UAE’s frontier status for some time now. While MSCI recently decided to keep them both classified as “frontier” markets for now, they will be up for review again next June for a potential upgrade to emerging status.

Then there’s Morocco, which is now being reviewed for a potential downgrade to frontier status from its current emerging status.

Still, even with its heavy focus on these three Gulf States, over time I think FM has blockbuster potential. I wouldn’t be surprised to see FM surpass FRN’s current $146 million in assets rather quickly.

Even though iShares didn’t take my advice to give the fund the ticker “FFM,” I think that FM will eventually be thought of as the frontier markets version of EEM.

Simply put, FM is the first of its kind, providing direct access to local shares of countries like Nigeria, Pakistan, Bangladesh, Kenya, Sri Lanka and Romania under one ETF wrapper.

I fully expect FM to become the standard by which investors will access the global frontier markets space using ETFs.

At the time this article was written, the author had no positions in the securities mentioned. Contact Dennis Hudachek at dhudachek@indexuniverse.com.

Permalink | ' Copyright 2012 IndexUniverse LLC. All rights reserved

More From IndexUniverse.com