Japan Currency-Hedged ETFs Gain on Fed Speculation

Japan currency-hedged exchange traded funds are rebounding as rising speculation of a Federal Reserve interest rate hike sometime this year fueled a strengthening U.S. dollar and depressed the yen currency.

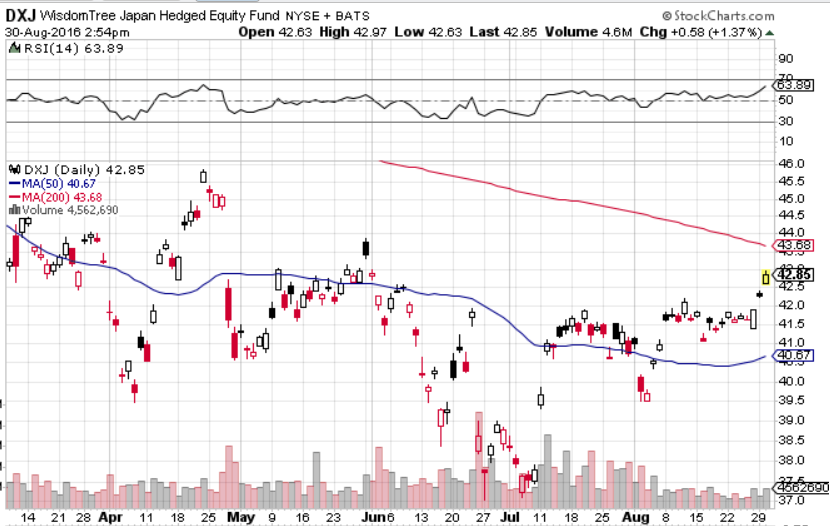

On Tuesday, the WisdomTree Japan Hedged Equity Fund (DXJ) gained 1.4%, iShares Currency Hedged MSCI Japan ETF (HEWJ) rose 1.2% and Deutsche X-trackers MSCI Japan Hedged Equity ETF (DBJP) advanced 1.1%. The currency-hedged ETFs are outperforming non-hedged funds as the local currency depreciates against the U.S. dollar.

The non-hedged iShares MSCI Japan ETF (EWJ) was relatively flat Tuesday while the CurrencyShares Japanese Yen Trust (FXY) fell 1.0% and dipped below its short-term, 50-day simple moving average. Meanwhile, the JPY depreciated against the USD, with the dollar now trading at ¥102.96.

A depreciating yen is supporting Japanese markets as a weaker currency bolsters the country’s large export industry.

SEE MORE: Currency-Hedged ETFs to Capitalize on Increased Japanese Stimulus

The U.S. dollar advanced for the fifth day against the yen, its longest winning streak since March, on speculation of a more hawkish Fed. USD gains were further supported by Vice Chairman Stanley Fischer, whom reiterate that the central bank could even hike rates next month.

“All of the concerns and worries were addressed in [Ms. Yellen’s] speech,” Alex Wijaya, a senior sales trader at CMC Markets, told the Wall Street Journal.

Trending on ETF Trends

Dollar ETFs may Finally get Their Day

Please Don’t Hire Donald Trump to Manage Your 401(k)

Government Stimulus Can Only Do So Much for Japan ETFs

Worse, not Better, for Sterling ETF

How Brexit Kicked Currency-Hedged U.K. ETFs into High Gear

Meanwhile, Bank of Japan Governor Haruhiko Kuroda also commented on hits readiness to ease monetary policy even further at Jackson Hole, Bloomberg reports.

Looking ahead, traders will be watching for the September 2 Labor Department report on employment, which will require a strong showing to maintain hawkish Fed speculation and to keep the dollar’s rally on track.

SEE MORE: Dollar ETFs may Finally get Their Day

“The dollar is likely to stay on a firm footing into the Friday payrolls report, but we’ll need to see a solid set of numbers for gains to be sustained beyond that,” Ned Rumpeltin, the European head of currency strategy at TD, told Bloomberg.

For more information on the Japanese markets, visit our Japan category.

WisdomTree Japan Hedged Equity Fund